William F. Sharpe - Intellectuals & Academics, Family and Childhood

William F. Sharpe's Personal Details

William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’

| Information | Detail |

|---|---|

| Birthday | June 16, 1934 |

| Nationality | American |

| Famous | Intellectuals & Academics, Economists |

| Spouses | Kathryn |

| Known as | William Forsyth Sharpe |

| Childrens | Deborah, Jonathan |

| Birth Place | Boston, Massachusetts, U.S. |

| Gender | Male |

| Sun Sign | Gemini |

| Born in | Boston, Massachusetts, U.S. |

| Famous as | Economist |

// Famous Economists

Bertil Gotthard Ohlin

Bertil Gotthard Ohlin was a famous Swedish economist. This biography profiles his childhood, family life & achievements.

Emily Greene Balch

Emily Greene Balch was an American economist, sociologist and pacifist who won the 1946 Nobel Peace Prize. This biography of Emily Greene Balch provides detailed information about her childhood, life, achievements, works & timeline.

Paul Samuelson

Nobel laureate Paul Anthony Samuelson is referred to as the ‘Father of Modern Economics’. This biography profiles his childhood, life, career, achievements and interesting facts about him.

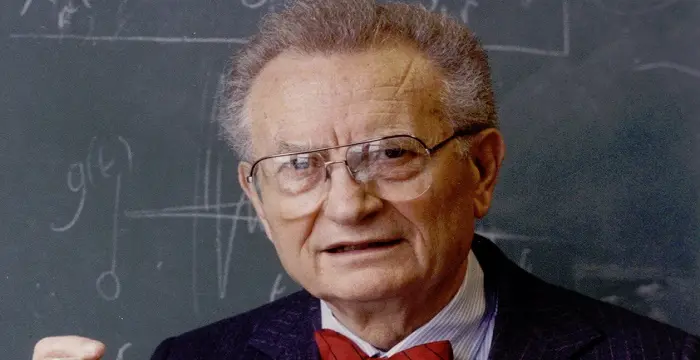

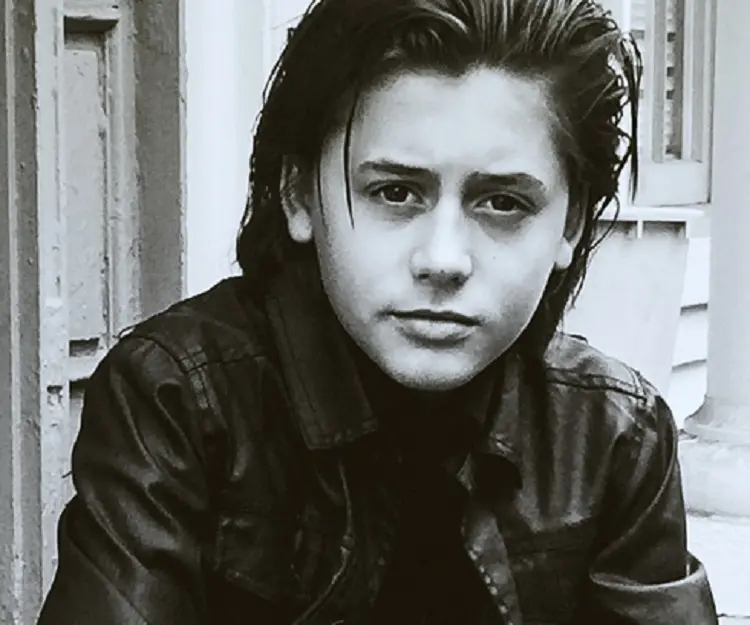

William F. Sharpe's photo

Who is William F. Sharpe?

William Forsyth Sharpe is an American economist who received the Nobel Memorial Prize for Economic Sciences for developing the ‘Capital Asset Pricing Model’. He created a measure for the performance analysis of investments known as the ‘Sharpe Ratio’. He also developed a ‘binomial method’ for evaluating options, a method for the optimization of asset allocation and a method for evaluating the performance of investments based on returns. He started with Harry Markowitz’s ‘portfolio theory’ and developed the ‘Capital Asset Pricing Model’ or CAPM. This model could be followed by all types of investors irrespective of whether the portfolio contained a large number of risky assets or it was weighed down by riskless assets such as insured bank deposits. He suggested the value ‘beta’ as the measure of risk that cannot be mitigated in a portfolio. This meant that if the ‘beta’ value of the portfolio was 1.5, then the value of the portfolio could rise by 15 percent if the stock market rose by 10 percent. Conversely the value could go down by 15 percent if there was a reduction of 10 percent in the stock market. This became a standard of evaluating the accumulated return of all the shares in the portfolio.

// Famous Intellectuals & Academics

Bertil Gotthard Ohlin

Bertil Gotthard Ohlin was a famous Swedish economist. This biography profiles his childhood, family life & achievements.

Emily Greene Balch

Emily Greene Balch was an American economist, sociologist and pacifist who won the 1946 Nobel Peace Prize. This biography of Emily Greene Balch provides detailed information about her childhood, life, achievements, works & timeline.

Martin Buber

One of the greatest philosophers to have ever walked on earth, Martin Buber contributions to philosophy is a long-standing one. Explore all about his profile, childhood, life and timeline here.

Childhood & Early Life

William Sharpe was born in Boston, Massachusetts, USA on June 16, 1934.

William had his schooling at the ‘Riverside Polytechnic High School’ and graduated in 1951.

He joined the ‘University of California at Berkeley’ in 1951 in order to study medicine.

Before the first year was over he decided to study Business Administration instead and joined the ‘University of California at Los Angeles’.

Out of the two main subjects of accountancy and economics he decided to major in economics as he found accountancy to be too plain.

He earned his B.A. in economics from UCLA in 1955 and his M.A. degree in 1956 from UCLA.

He joined the Army for a short period after which he joined the RAND Corporation in 1956 to pursue research and also started work on his PhD thesis with the help of Harry Markowitz.

He earned his PhD from the UCLA in 1961 while working at Rand Corporation.

Career

In 1961 William Sharpe moved to Seattle and joined the ‘University of Washington’ as professor of finance in the ‘School of Business’.

While teaching at this university, he started his research on asset pricing and came up with the ‘Capital Asset Pricing Model’ or CAPM.

He remained with the University of Washington up to 1968 except for a year when he took leave to work for the Rand Corporation.

He moved to the ‘University of California at Irvine’ in 1968. He remained at this university for only a couple of years.

He moved to the ‘Stanford University’ in 1970 and joined the ‘Graduate School of Business’ where, other than teaching, he continued his research.

In 1973 he was named the ‘Timken Professor of Finance’ at Stanford.

In 1974 he took up a study on the role of investment policy on funds dealing with providing pensions. At this time he also became a consultant for ‘Merrill Lynch’, ‘Pierce’, Fenner and Smith’, and ‘Wells Fargo’ where he could apply his financial theories to practical solutions.

He spent the academic year from 1976 to 1977 at the ‘National Bureau of Economic Research’ studying the effects of the adequacy of bank capital.

He was elected the president of the ‘American Finance Association’ in 1980.

From 1975 to 1983 he served as a ‘Trustee of the College Retirement Equities Fund’ and ‘Research Foundation of the Institute of Chartered Financial Analysts’. He served as a committee member in the ‘Institute of Quantitative Research in Finance’ and the ‘Council on Education and Research of the Institute of Chartered Financial Analysts’.

He also served as a ‘Strategic Advisor’ for Nikko Securities’ Institute of Investment Technology’ and in the department of ‘Portfolio Management’ for the ‘Union Bank of Switzerland’.

In 1986 he collaborated with Frank Russell to form the ‘Sharpe-Russell Research’ company which provided consultations to various foundations and pension funds companies on asset allocation.

He retired from teaching in 1989 but remained a ‘Timken Professor Emeritus of Finance’ at the ‘Stanford University’.

After retirement he became deeply involved with his consultation firm named ‘William Sharpe Associates’.

He founded the company ‘Financial Engines’ or FNGN which started to use modern technologies for the implementation of his financial theories of portfolio management into real life scenarios.

He became the president of the ‘American Finance Association’ and also a trustee for the ‘Economists for Peace and Security’.

He has been advocating ‘adaptive asset allocation strategies’ for optimizing asset allocation for maximum returns and little volatility with the help of latest market behaviors.

Major Works

William Sharpe published the papers ‘A Simplified Model for Portfolio Analysis’ in 1963 and ‘Capital Asset Prices – A Theory of Market Equilibrium Under Conditions of Risk’ in 1964.

His book ‘Portfolio Theory and Capital Markets’ was published in 1970 and 2000 while his second book ‘Asset Allocation Tools’ was published in 1987.

His next two books ‘Investments’ and ‘Fundamentals of Investments’ in collaboration with Jeffrey Bailey and Gordon J. Alexander were published in 1999 and 2000 respectively. The ‘William F Sharpe: Selected Works’ was published in 2012.

Awards & Achievements

William Sharpe received the ‘Doctor of Humane Letters, Honoris Causa’ from the ‘DePaul University’ and a ‘Doctor Honoris Causa each from the Spanish university of Alicante and the Vienna University.

He also won the ‘UCLA Medal’ which is the highest honor given by UCLA.

He won the Nobel Prize in Economics in 1990.

Personal Life & Legacy

William Sharpe got married to Kathryn, a well-known painter, in 1986.

They have a daughter named Deborah and a son named Jonathan from the marriage.

Trivia

William Sharpe loves sailing, football, basketball and the opera.

// Famous American peoples

Wentworth Miller

Wentworth Miller is an American actor and screenwriter who achieved recognition for his role in the TV series ‘Prison Break’.

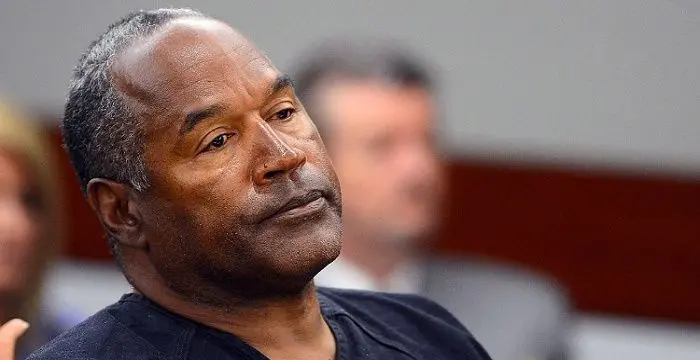

Jason Simpson

Jason Simpson is the son of former NFL running back, broadcaster and actor O. J. Simpson. Check out this biography to know about his childhood, family, life, and little known facts about him.

Melissa Brim

Melissa Brim is the ex-girlfriend of former professional boxer Floyd Mayweather Jr. Check out this biography to know about her birthday, childhood, family life, achievements and fun facts about her.

William F. Sharpe's awards

| Year | Name | Award |

|---|---|---|

Other | ||

| 0 | Nobel Memorial Prize in Economic Sciences (1990) | |

William F. Sharpe biography timelines

- // 16th Jun 1934William Sharpe was born in Boston, Massachusetts, USA on June 16, 1934.

- // 1951William had his schooling at the ‘Riverside Polytechnic High School’ and graduated in 1951.

- // 1951He joined the ‘University of California at Berkeley’ in 1951 in order to study medicine.

- // 1955 To 1956He earned his B.A. in economics from UCLA in 1955 and his M.A. degree in 1956 from UCLA.

- // 1956He joined the Army for a short period after which he joined the RAND Corporation in 1956 to pursue research and also started work on his PhD thesis with the help of Harry Markowitz.

- // 1961He earned his PhD from the UCLA in 1961 while working at Rand Corporation.

- // 1961In 1961 William Sharpe moved to Seattle and joined the ‘University of Washington’ as professor of finance in the ‘School of Business’.

- // 1963 To 1964William Sharpe published the papers ‘A Simplified Model for Portfolio Analysis’ in 1963 and ‘Capital Asset Prices – A Theory of Market Equilibrium Under Conditions of Risk’ in 1964.

- // 1968He remained with the University of Washington up to 1968 except for a year when he took leave to work for the Rand Corporation.

- // 1968He moved to the ‘University of California at Irvine’ in 1968. He remained at this university for only a couple of years.

- // 1970He moved to the ‘Stanford University’ in 1970 and joined the ‘Graduate School of Business’ where, other than teaching, he continued his research.

- // 1973In 1973 he was named the ‘Timken Professor of Finance’ at Stanford.

- // 1974In 1974 he took up a study on the role of investment policy on funds dealing with providing pensions. At this time he also became a consultant for ‘Merrill Lynch’, ‘Pierce’, Fenner and Smith’, and ‘Wells Fargo’ where he could apply his financial theories to practical solutions.

- // 1975 To 1983From 1975 to 1983 he served as a ‘Trustee of the College Retirement Equities Fund’ and ‘Research Foundation of the Institute of Chartered Financial Analysts’. He served as a committee member in the ‘Institute of Quantitative Research in Finance’ and the ‘Council on Education and Research of the Institute of Chartered Financial Analysts’.

- // 1976 To 1977He spent the academic year from 1976 to 1977 at the ‘National Bureau of Economic Research’ studying the effects of the adequacy of bank capital.

- // 1980He was elected the president of the ‘American Finance Association’ in 1980.

- // 1986In 1986 he collaborated with Frank Russell to form the ‘Sharpe-Russell Research’ company which provided consultations to various foundations and pension funds companies on asset allocation.

- // 1986William Sharpe got married to Kathryn, a well-known painter, in 1986.

- // 1989He retired from teaching in 1989 but remained a ‘Timken Professor Emeritus of Finance’ at the ‘Stanford University’.

- // 1990He won the Nobel Prize in Economics in 1990.

// Famous Gemini Celebrities peoples

Wentworth Miller

Wentworth Miller is an American actor and screenwriter who achieved recognition for his role in the TV series ‘Prison Break’.

Joyce Meyer

Joyce Meyer is a Christian author and speaker. This biography provides detailed information about her childhood, life, achievements, works & timeline

Zoe LaVerne

Zoe LaVerne is an American musical.ly star. Check out this biography to know more about her family, personal life, including her age, birthday, etc.

WolfieRaps

Check out all that you wanted to know about WolfieRaps, the famous YouTube Personality; his birthday, his family and personal life, his girlfriends, fun trivia facts and more.

Adam Saleh

Check out all that you wanted to know about Adam Saleh, the famous YouTube Personality; his birthday, his family and personal life, his girlfriends, fun trivia facts and more.

Isaak Presley

All about American actor and singer Isaak Presley including his age, birthday, family life, girlfriends, net worth, and some fun facts.

William F. Sharpe's FAQ

What is William F. Sharpe birthday?

William F. Sharpe was born at 1934-06-16

Where is William F. Sharpe's birth place?

William F. Sharpe was born in Boston, Massachusetts, U.S.

What is William F. Sharpe nationalities?

William F. Sharpe's nationalities is American

Who is William F. Sharpe spouses?

William F. Sharpe's spouses is Kathryn

Who is William F. Sharpe childrens?

William F. Sharpe's childrens is Deborah, Jonathan

What is William F. Sharpe's sun sign?

William F. Sharpe is Gemini

How famous is William F. Sharpe?

William F. Sharpe is famouse as Economist