Benjamin Graham - Economists, Life Achievements and Facts

Benjamin Graham's Personal Details

Benjamin Graham, widely known as the ‘father of value investing’, was an American investor, economist and academic

| Information | Detail |

|---|---|

| Birthday | May 9, 1894 |

| Died on | September 21, 1976 |

| Nationality | American |

| Famous | Investors, Intellectuals & Academics, Economists |

| Spouses | Estey |

| Universities |

|

| Birth Place | London, United Kingdom |

| Gender | Male |

| Father | Isaac M. Grossbaum |

| Mother | Dora Grossbaum |

| Sun Sign | Taurus |

| Born in | London, United Kingdom |

| Famous as | Economist, Investor |

| Died at Age | 82 |

// Famous Intellectuals & Academics

Bertil Gotthard Ohlin

Bertil Gotthard Ohlin was a famous Swedish economist. This biography profiles his childhood, family life & achievements.

Emily Greene Balch

Emily Greene Balch was an American economist, sociologist and pacifist who won the 1946 Nobel Peace Prize. This biography of Emily Greene Balch provides detailed information about her childhood, life, achievements, works & timeline.

Martin Buber

One of the greatest philosophers to have ever walked on earth, Martin Buber contributions to philosophy is a long-standing one. Explore all about his profile, childhood, life and timeline here.

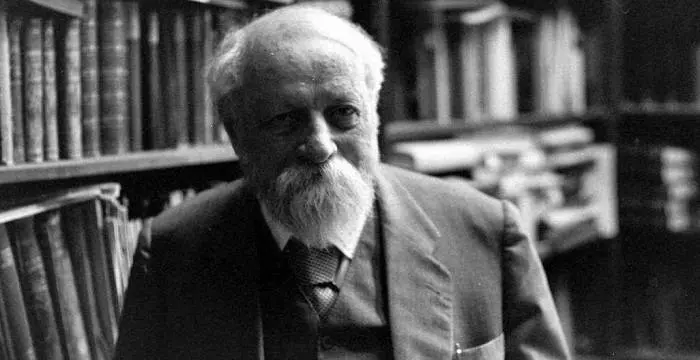

Benjamin Graham's photo

Who is Benjamin Graham?

Benjamin Graham, widely known as the ‘father of value investing’, was an American investor, economist and academic. Born in United Kingdom towards the end of the nineteenth century he moved with his parents to the USA at the age of one, losing his father at nine. Thereafter, he grew up under extreme poverty, which motivated him to earn enough money and make his family comfortable. Always a bright student, he earned his bachelor’s degree from Columbia University and then took up a job at the Wall Street as a chalker. Quickly climbing the ladder and earning enough, he formed his own partnership firm at the age of 32 and started teaching at Columbia University at 34. Although he lost substantial chunk of his asset in the stock market crash of 1929 it failed to dampen his enthusiasm and learning from his mistake, he wrote two widely acclaimed books on investment. His concepts in managerial economics have led to development of value investing within different investment vehicles like mutual funds, hedge funds, diversified holding companies. He had many disciples, among whom Warren Buffet is most notable.

// Famous Economists

Bertil Gotthard Ohlin

Bertil Gotthard Ohlin was a famous Swedish economist. This biography profiles his childhood, family life & achievements.

Emily Greene Balch

Emily Greene Balch was an American economist, sociologist and pacifist who won the 1946 Nobel Peace Prize. This biography of Emily Greene Balch provides detailed information about her childhood, life, achievements, works & timeline.

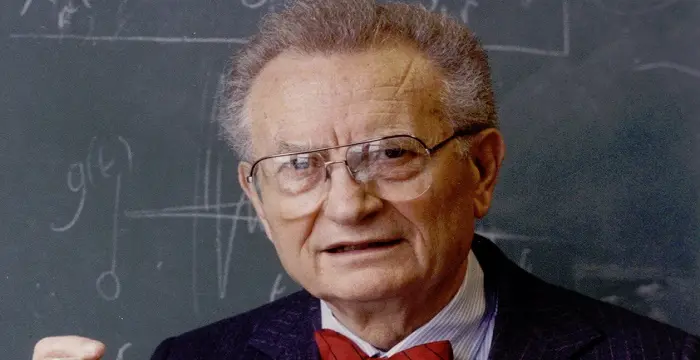

Paul Samuelson

Nobel laureate Paul Anthony Samuelson is referred to as the ‘Father of Modern Economics’. This biography profiles his childhood, life, career, achievements and interesting facts about him.

Childhood & Early Years

Benjamin Graham was born as Benjamin Grossbaum on May 9, 1894, in London, England into a Jewish family. His parents, Isaac M. and Dorothy Grossbaum, migrated to the USA when he was one year old, eventually settling down in New York, where Isaac started an export import business.

In 1903, Isaac Grossbaum passed away, leaving his wife to take care of nine year old Benjamin and his two younger siblings, Leon and Victor. While she could still manage, the Bank Panic of 1907 robbed her of her savings, forcing the family to move in with Dorothy’s brother, Maurice Gerad.

A brilliant student at school, Benjamin entered Columbia University on a scholarship, graduating in 1914 as salutatorian of his class. At that time, he was just 20 years old and ready to make his fortune, taking a bold and unorthodox step.

Few weeks before his graduation, the University offered him teaching positions in three different faculties: Greek and Latin philosophy, English, and mathematics. Although the job would have given him financial security he declined the offer and joined the Wall Street.

Early Career

In 1914, Benjamin Grossbaum began his career as a messenger at the Newburger, Henderson and Loeb, a brokerage firm at the Wall Street. In those days, it was deemed a revolutionary step because at that time university graduates did not consider stock broking as a career option.

Initially, his main job was to write scores on the blackboard; but with the passage of time, as he won the confidence of the proprietors with his natural intelligence he was given other responsibilities. Very soon, he was doing financial researches for the firm.

Rising through the ranks exceptionally quickly, he became a partner of Newburger, Henderson and Loeb in 1920. He was soon earning $50,000 per year. Sometime now, he changed his surname to suit the Wall Street ambience, becoming Benjamin Graham instead of Grossbaum.

Forming Partnership

In 1926, Benjamin Graham formed Graham Newman Co with Jerome Newman, another Wall Street broker. It was indeed a revolutionary partnership as they adopted some radical strategies, which not only safeguarded their clients’ investments, but also enabled them to provide a 670% return over a period of ten years. .

While putting a bet that a particular stock price was going to rise, they would place simultaneous bet that the price of another stock was going to fall. This way, they could fully use the available resources, without having to keep cash cushions, outperforming leading mutual funds by 40%.

Northern Pipeline Affair

Also in 1926, Graham made an astonishing discovery, which helped him to establish his position in the stock market. Back in 1911, Standard Oil, owned by the Rockefellers, was broken up into 34 independent entities. However, knowing little about their financial status, Wall Street paid hardly any attention to them.

In 1926, all pipeline companies were asked to file financial statements to the Interstate Commerce Commission, which they did very superfluously. While going through these reports, Benjamin Graham was instinctively drawn to one Northern Pipeline Company. Wanting to know more about its financial status, he immediately took a train to Washington.

To his astonishment he found that while the Northern Pipeline was trading at $65 per share, the company held railroad bonds at $95. He also realized that the nature of its holding, which included other liquid assets, was such that the company could distribute its assets without affecting the operators.

Graham now began to pick up the company’s stock, acquiring 5% of it within 1926. He now went to meet the top boss of Northern Pipeline, demanding that they distribute the excess asset to the shareholders because they were its rightful owners. But they refused to entertain the idea.

In 1927, during the shareholders’ meeting, Graham took his proposal directly to his shareholders. As required, he put his proposal in the form of a motion; but none of the present shareholders agreed to second it and therefore, it was discarded.

Undeterred, Benjamin Graham decided to take his battle to the next stage via proxies. Hiring a law firm, he now began to solicit proxies. He also visited Rockefeller’s Foundation; but did not receive much encouragement. However, by January 1928, he had acquired proxies for roughly 37.50% of the company’s shares.

The shareholder’s meeting in 1928 was a turning point in Graham’s career. In this meeting, he not only had 37.50% proxies with him, the Rockefeller Foundation, which gave their proxies to the company management, sent a directive that the company should distribute as much cash as the business can spare.

Northern Pipeline was now forced to accept Graham’s election to its board. Shortly, they distributed $70 per-share of excess liquid assets to its shareholders. Impressed, Rockefeller invited him for a meeting, eventually reaching out to other affiliates, who had excess liquid cash, urging them to distribute it among its rightful owners.

At the urging of Rockefeller, many other former associates began offloading their excess liquid cash, distributing them among the shareholders. Known as ‘Northern Pipeline Affair, the ripple effect established Benjamin Graham as a brilliant analyst and a shareholder activist.

After Stock Market Crash

Graham’s success in the Northern Pipeline Affair opened another avenue for him. In 1928, he joined Columbia Business School of Columbia University as a faculty member, a position he held until 1955.

In 1929, as the stock market experienced a major crash, setting in the Great Depression, Graham Newman Partnership lost major portion of their stock; but still managed to remain afloat. Eventually they regained their assets; never to lose again, enjoying an average annual return of 17% until 1956.

The stock market crash also set him thinking, resulting in the publication of his first book, ‘Security Analysis’ in 1934. Co-written with David Dodd, it was the first book to systematically deal with the study of investments.

In 1948, Graham Newman Co bought Government Employees Insurance Co. In spite of the world ‘Government’ in its name it was a private firm. Since an investment funds could not own an insurance company, they turned it into a public company, distributing shares among investors.

In 1949, he published his seminal work, ‘The Intelligent Investor’. Concurrently, he continued to play an important role in the stock market, buying shares that traded far below the companies' liquidation value and thus he continued to make profit in stocks while minimizing downside risk.

Noted Disciples

Over the years, Benjamin Graham’s performance in the stock market attracted the attention of many young would-be investors. One of them was Warren Edward Buffet. In1949, the nineteen year old would-be business magnet and investor enrolled at the Columbia University only to study with him.

Upon graduation in 1951, Buffet approached Graham for a job in his company, wishing to work in the stock market. He had such an enormous respect for Graham that he was willing to work without salary.

Although initially Graham discouraged him he later relented. Buffet joined the Graham Newman Corporation in 1954 at an annual salary of $12,000, remaining there until Graham retired in 1956. He later remembered Graham to be a tough, but accommodating boss.

It is not known when, but Graham also took classes at New York Stock Exchange Institute, where American investor and fund manager, Walter J. Schloss, was one of his students. Eventually, he also went to work for Graham, learning from him the tricks of the trade.

Graham also yielded enormous influence on Irving Kahn, his teaching assistant at the Columbia Business School at Columbia University. Few other noted investors, who considered themselves to be Graham’s disciples and employed his value investing techniques, were William J. Ruane, Seth Klarman, Bill Ackman and Charles H. Brandes.

Later Years

In 1956, Benjamin Graham dissolved his partnership with Newman and retired from stock market. Thereafter, he moved to California, teaching at the University of California, Los Angeles and also at Anderson School of Management, New Mexico. Concurrently, he also kept his home in New York and traveled frequently to France.

Although he dissolved the partnership, his interest in the stock market did not diminish. He spent a large part of his retired life devising simplified formulas, which would help average investors to invest in stocks. He also wrote extensively about monetary policies.

Over the time, he became disillusioned with average stockholders as they failed to demand their rights as the true owner of the company. However, he saw a light of hope in takeovers as that forced the companies to function properly.

During his later years, he also started taking Sunday classes for children not belonging to any church or temple. He told them about history of religion, discussing the topic in general. The children loved these classes.

Major Works

Benjamin Graham is best remembered for his two books, ‘Security Analysis’ and ‘The Intelligent Investor’. While in ‘Security Analysis’, he clearly distinguished between investment and speculation, in ‘The Intelligent Investor’, he mainly dealt in value investing.

He is also famous for devising, what we now call ‘Benjamin Graham formula’. Published in ‘The Intelligent Investor’, the formula helps the investors to quickly determine if their stocks were priced rationally. His two other popular concepts were ‘Mr. Market’ and ‘margin of safety’.

Personal Life & Legacy

Benjamin Graham married thrice; but little is known about his spouses or his children. His first wife, whose name remains unknown, was initially a dance teacher. Although she later gave up her career to look after her family she had to resume teaching after the 1929 stock market crash.

Graham divorced her first wife in 1937, marrying a young actress in the following year. But this marriage was also short lived. He shortly divorced her to marry his secretary, Estelle Messing Graham. Estelle, also called Estie, had been described as “a warm, giving and non-judgmental person”.

With Estelle, he had one son, Benjamin Graham Jr. From his previous two marriages, he had at least two more sons; Newton, who died of meningitis of the spine at the age of eight and Newton II, who served in the U.S. Army.

In 1954, his second son Newton II, while posted in France, committed suicide. On receiving the news, Graham traveled to France to make arrangement for his last rites. There, he met Marie Louise Amigues, who though twenty years senior to Newton, was in relationship with him.

Eventually Graham and Amigues developed a relationship and Graham began to spend more time with her. In 1965, he told Estelle that he would stay with her in California for six months and spend the other six months with Amigues in France. When Estelle rejected the offer he left home.

On September 21, 1976, Graham died in Aix-en-Provence, France, at the age of 82.

His concepts on investor psychology, minimal debt, buy-and-hold investing, fundamental analysis, concentrated diversification, buying within the margin of safety, activist investing, and contrarian mindsets are still being used by the serious investors all over the world.

Trivia

Legendary investor Warren Buffet named his eldest son Howard Graham Buffet as a tribute to his teacher, Benjamin Graham.

// Famous Investors

Ashton Kutcher

Ashton Kutcher is an American actor, model and a producer. This biography profiles his childhood, life, acting career, achievements and timeline.

Steve Eisman

Steve Eisman is an American businessman, money manager, and investor. Check out this biography to know about his childhood, family life, achievements and fun facts about him.

Bill Ackman

William Albert Ackman, better known as Bill Ackman, is an American hedge-fund manager, investor, and philanthropist. This biography profiles his childhood, family, personal life, career, etc.

Benjamin Graham biography timelines

- // 9th May 1894Benjamin Graham was born as Benjamin Grossbaum on May 9, 1894, in London, England into a Jewish family. His parents, Isaac M. and Dorothy Grossbaum, migrated to the USA when he was one year old, eventually settling down in New York, where Isaac started an export import business.

- // 1903 To 1907In 1903, Isaac Grossbaum passed away, leaving his wife to take care of nine year old Benjamin and his two younger siblings, Leon and Victor. While she could still manage, the Bank Panic of 1907 robbed her of her savings, forcing the family to move in with Dorothy’s brother, Maurice Gerad.

- // 1911 To 1926Also in 1926, Graham made an astonishing discovery, which helped him to establish his position in the stock market. Back in 1911, Standard Oil, owned by the Rockefellers, was broken up into 34 independent entities. However, knowing little about their financial status, Wall Street paid hardly any attention to them.

- // 1914A brilliant student at school, Benjamin entered Columbia University on a scholarship, graduating in 1914 as salutatorian of his class. At that time, he was just 20 years old and ready to make his fortune, taking a bold and unorthodox step.

- // 1914In 1914, Benjamin Grossbaum began his career as a messenger at the Newburger, Henderson and Loeb, a brokerage firm at the Wall Street. In those days, it was deemed a revolutionary step because at that time university graduates did not consider stock broking as a career option.

- // 1920Rising through the ranks exceptionally quickly, he became a partner of Newburger, Henderson and Loeb in 1920. He was soon earning $50,000 per year. Sometime now, he changed his surname to suit the Wall Street ambience, becoming Benjamin Graham instead of Grossbaum.

- // 1926In 1926, Benjamin Graham formed Graham Newman Co with Jerome Newman, another Wall Street broker. It was indeed a revolutionary partnership as they adopted some radical strategies, which not only safeguarded their clients’ investments, but also enabled them to provide a 670% return over a period of ten years. .

- // 1926In 1926, all pipeline companies were asked to file financial statements to the Interstate Commerce Commission, which they did very superfluously. While going through these reports, Benjamin Graham was instinctively drawn to one Northern Pipeline Company. Wanting to know more about its financial status, he immediately took a train to Washington.

- // 1926Graham now began to pick up the company’s stock, acquiring 5% of it within 1926. He now went to meet the top boss of Northern Pipeline, demanding that they distribute the excess asset to the shareholders because they were its rightful owners. But they refused to entertain the idea.

- // 1927In 1927, during the shareholders’ meeting, Graham took his proposal directly to his shareholders. As required, he put his proposal in the form of a motion; but none of the present shareholders agreed to second it and therefore, it was discarded.

- // 1928The shareholder’s meeting in 1928 was a turning point in Graham’s career. In this meeting, he not only had 37.50% proxies with him, the Rockefeller Foundation, which gave their proxies to the company management, sent a directive that the company should distribute as much cash as the business can spare.

- // 1928 To 1955Graham’s success in the Northern Pipeline Affair opened another avenue for him. In 1928, he joined Columbia Business School of Columbia University as a faculty member, a position he held until 1955.

- // Jan 1928Undeterred, Benjamin Graham decided to take his battle to the next stage via proxies. Hiring a law firm, he now began to solicit proxies. He also visited Rockefeller’s Foundation; but did not receive much encouragement. However, by January 1928, he had acquired proxies for roughly 37.50% of the company’s shares.

- // 1929 To 1956In 1929, as the stock market experienced a major crash, setting in the Great Depression, Graham Newman Partnership lost major portion of their stock; but still managed to remain afloat. Eventually they regained their assets; never to lose again, enjoying an average annual return of 17% until 1956.

- // 1929Benjamin Graham married thrice; but little is known about his spouses or his children. His first wife, whose name remains unknown, was initially a dance teacher. Although she later gave up her career to look after her family she had to resume teaching after the 1929 stock market crash.

- // 1934The stock market crash also set him thinking, resulting in the publication of his first book, ‘Security Analysis’ in 1934. Co-written with David Dodd, it was the first book to systematically deal with the study of investments.

- // 1937Graham divorced her first wife in 1937, marrying a young actress in the following year. But this marriage was also short lived. He shortly divorced her to marry his secretary, Estelle Messing Graham. Estelle, also called Estie, had been described as “a warm, giving and non-judgmental person”.

- // 1948In 1948, Graham Newman Co bought Government Employees Insurance Co. In spite of the world ‘Government’ in its name it was a private firm. Since an investment funds could not own an insurance company, they turned it into a public company, distributing shares among investors.

- // 1949In 1949, he published his seminal work, ‘The Intelligent Investor’. Concurrently, he continued to play an important role in the stock market, buying shares that traded far below the companies' liquidation value and thus he continued to make profit in stocks while minimizing downside risk.

- // 1949Over the years, Benjamin Graham’s performance in the stock market attracted the attention of many young would-be investors. One of them was Warren Edward Buffet. In1949, the nineteen year old would-be business magnet and investor enrolled at the Columbia University only to study with him.

- // 1951Upon graduation in 1951, Buffet approached Graham for a job in his company, wishing to work in the stock market. He had such an enormous respect for Graham that he was willing to work without salary.

- // 1954 To 1956Although initially Graham discouraged him he later relented. Buffet joined the Graham Newman Corporation in 1954 at an annual salary of $12,000, remaining there until Graham retired in 1956. He later remembered Graham to be a tough, but accommodating boss.

- // 1954In 1954, his second son Newton II, while posted in France, committed suicide. On receiving the news, Graham traveled to France to make arrangement for his last rites. There, he met Marie Louise Amigues, who though twenty years senior to Newton, was in relationship with him.

- // 1956In 1956, Benjamin Graham dissolved his partnership with Newman and retired from stock market. Thereafter, he moved to California, teaching at the University of California, Los Angeles and also at Anderson School of Management, New Mexico. Concurrently, he also kept his home in New York and traveled frequently to France.

- // 1965Eventually Graham and Amigues developed a relationship and Graham began to spend more time with her. In 1965, he told Estelle that he would stay with her in California for six months and spend the other six months with Amigues in France. When Estelle rejected the offer he left home.

- // 21st Sep 1976On September 21, 1976, Graham died in Aix-en-Provence, France, at the age of 82.

// Famous American peoples

Wentworth Miller

Wentworth Miller is an American actor and screenwriter who achieved recognition for his role in the TV series ‘Prison Break’.

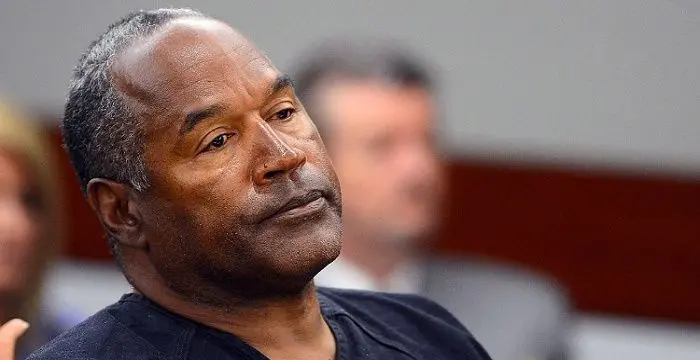

Jason Simpson

Jason Simpson is the son of former NFL running back, broadcaster and actor O. J. Simpson. Check out this biography to know about his childhood, family, life, and little known facts about him.

Melissa Brim

Melissa Brim is the ex-girlfriend of former professional boxer Floyd Mayweather Jr. Check out this biography to know about her birthday, childhood, family life, achievements and fun facts about her.

Skai Jackson

Skai Jackson is an American child actress with huge fan following. Find more about her family & personal life, relationships, facts and more.

Joyce Meyer

Joyce Meyer is a Christian author and speaker. This biography provides detailed information about her childhood, life, achievements, works & timeline

Zoe LaVerne

Zoe LaVerne is an American musical.ly star. Check out this biography to know more about her family, personal life, including her age, birthday, etc.

Benjamin Graham's FAQ

What is Benjamin Graham birthday?

Benjamin Graham was born at 1894-05-09

When was Benjamin Graham died?

Benjamin Graham was died at 1976-09-21

Where was Benjamin Graham died?

Benjamin Graham was died in Aix-en-Provence, France

Which age was Benjamin Graham died?

Benjamin Graham was died at age 82

Where is Benjamin Graham's birth place?

Benjamin Graham was born in London, United Kingdom

What is Benjamin Graham nationalities?

Benjamin Graham's nationalities is American

Who is Benjamin Graham spouses?

Benjamin Graham's spouses is Estey

What was Benjamin Graham universities?

Benjamin Graham studied at Columbia Business School, Graham-Newman Partnership

Who is Benjamin Graham's father?

Benjamin Graham's father is Isaac M. Grossbaum

Who is Benjamin Graham's mother?

Benjamin Graham's mother is Dora Grossbaum

What is Benjamin Graham's sun sign?

Benjamin Graham is Taurus

How famous is Benjamin Graham?

Benjamin Graham is famouse as Economist, Investor