(Bloomberg) — Vanguard Group Inc. is accelerating its foray into Australia’s A$3.3 trillion (US$2.3 trillion) fixed income market just months after launching its debut fund in the highly competitive sector.

Most read by Bloomberg

The US giant plans to offer a retirement product in the country by mid-year at the earliest, Australian boss Daniel Shrimski said in an interview. Vanguard unveiled its first Australian pension fund in November after years of preparation, and the new offering is aimed at retirees siphoning off those savings.

The project progresses, even if the manager of the pension insurance unexpectedly leaves. Michael Lovett, who led the founding of the Australian pension fund, will leave the company at the end of February and plans for his succession are “well advanced,” according to a separate statement from the firm on Tuesday.

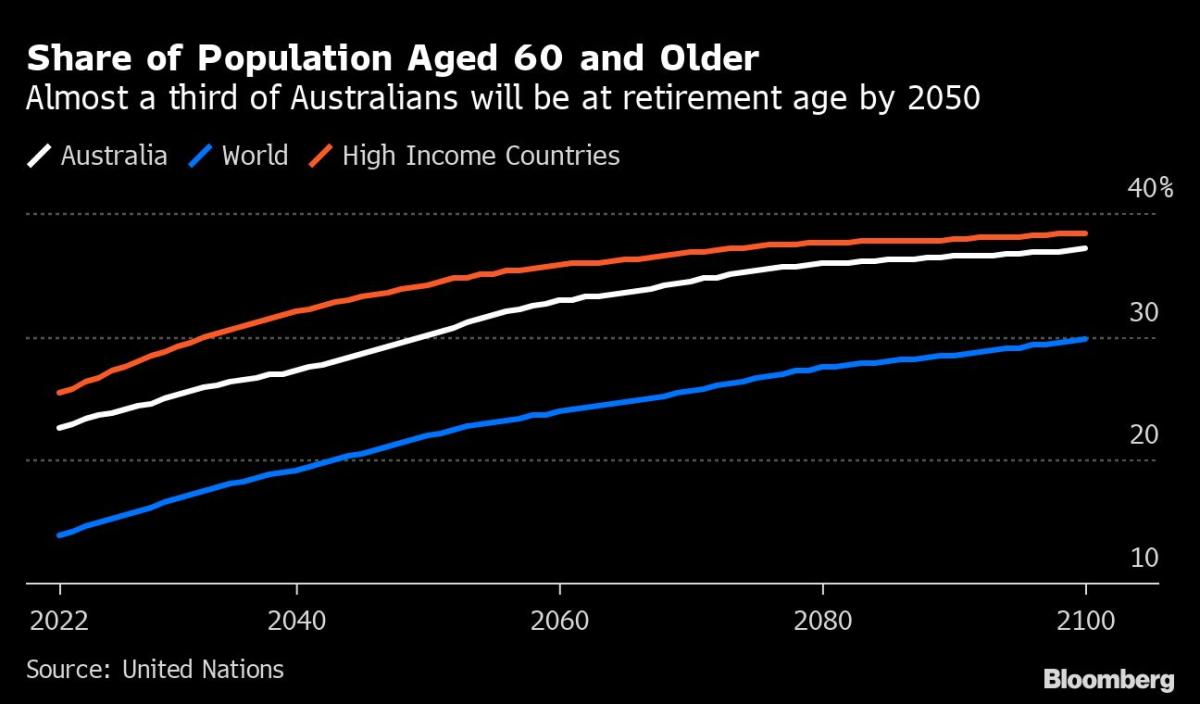

Vanguard is the latest offshore wealth manager to appeal to Australia’s aging savers beyond the workforce as more of them exit the labor market. The industry is under increasing pressure to ensure retirees can manage their savings and live comfortably, with new regulations over the past year forcing pension funds to strategize to achieve this.

Shrimski said a retirement product would help retain Vanguard’s annuity customers for the long term and complements its similar U.S. offerings. “This will work for members who are in this decumulation phase and are earning an income based on their pension,” he said.

Australia’s pension system is the fourth largest pension pool in the world and is projected to nearly triple to A$9 trillion by 2040. Employers must pay employees an additional 10.5% of their salary, which will gradually increase to 12% by 2025. Vanguard didn’t disclose how many customers had signed up for its recently launched retirement fund, but said demand was strong.

Read more: Global Managers Circle as Boomers Retire Billions

Since the introduction of Australia’s pension system in 1992, funds have mainly focused on increasing a pensioner’s nest egg rather than on how to spend it, Australia’s Finance Services Minister Stephen Jones said, adding that work in the region had increased .

“There has been almost no focus on how to convert that retirement savings account into something that will spread enough income over the life of retirement,” Jones said in an interview last month.

Vanguard plans to use its network of financial advisors to advance its retirement offering. It will be the industry’s third new retirement product in a year, according to KPMG Actuarial and Financial Risk and Super Advisory Partner Melinda Howes. Allianz SE on Tuesday announced three new executive appointments for its Australian pension product Allianz Retire+.

“What we haven’t really had before is this regulatory push with the requirement to have a post-retirement strategy that is outlined to the members of each superfund,” Howes said.

“I expect to see more new products coming out over the next 12 months,” she added, as a number of large insurers are currently eyeing the market.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio