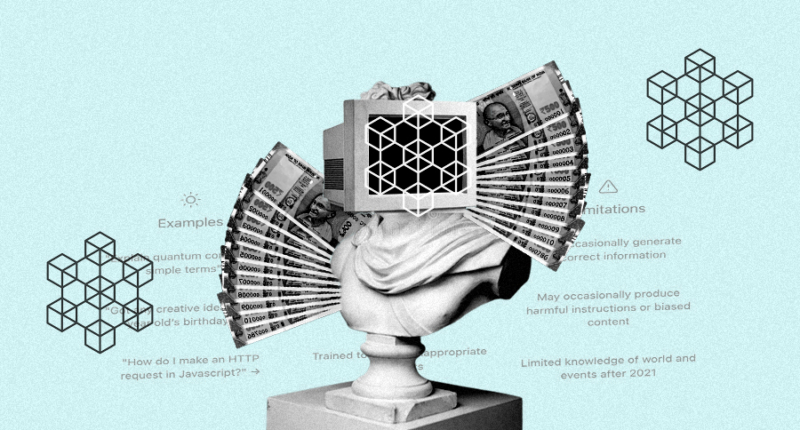

Blockchain technology is changing the financial sector in significant ways. This technology’s decentralized, distributed ledger technology can revolutionize the way financial transactions are conducted, recorded, and validated, and provide improved security and anonymity. Blockchain technology’s encryption guarantees that once a transaction is recorded, it can’t be altered or removed, making it ideal for applications such as digital currencies, where trust and security are vital. Blockchain technology also enables quicker and more efficient transactions, reducing the time and costs associated with conventional financial transactions. Although blockchain technology faces several concerns such as scalability, interoperability, regulatory compliance, and potential risks, it continues to be explored and implemented by financial institutions worldwide. In the coming years, we can expect blockchain-based solutions to become more widely used in the financial sector as technology continues to develop and mature.

The Immense Potential of Blockchain Technology in the Financial Sector

Blockchain technology is rapidly gaining traction in the financial sector due to its immense potential to streamline processes and enhance security. This innovative technology has the potential to revolutionize how financial transactions are conducted, recorded, and validated, and is already being implemented by financial institutions worldwide.

The use of blockchain technology in the financial sector provides improved security and anonymity for financial transactions, which is one of its main advantages. Transactions are recorded on a decentralized, distributed ledger that is secured by encryption, ensuring that once a transaction has been recorded, it cannot be changed or removed. This feature is particularly important in applications like digital currency, where trust and security are essential.

Another significant advantage of blockchain technology is its capacity to enable quicker and more efficient transactions. Blockchain transactions can save time and costs associated with conventional financial transactions, such as wire transfers or credit card payments, because they can be handled and validated in almost real-time. This feature is especially useful for cross-border transactions, where existing financial systems are slow and costly.

Despite these benefits, blockchain technology still faces several issues that need to be addressed before it can be widely adopted in the financial industry. Scalability, interoperability, and regulatory compliance are a few of these concerns that must be tackled. Additionally, it is important to carefully assess and manage potential risks or uncertainties related to blockchain technology, such as the risk of hacking or market volatility.

In conclusion, the potential of blockchain technology in the financial sector is immense and continues to be explored and implemented by financial institutions worldwide. As this technology evolves, it is essential to carefully consider its benefits, risks, and limitations to ensure that it is used in a responsible and effective manner.

The Potential Impact of Blockchain Technology on the Financial Industry

Blockchain technology has the potential to transform the financial industry by improving security, enabling quicker transactions, and providing greater transparency. Although there are still challenges that need to be addressed, such as scalability and regulatory compliance, blockchain technology is an exciting area of innovation for the financial sector. As technology continues to develop and mature, we can expect to see more widespread adoption of blockchain-based solutions in the financial industry in the coming years.

Don’t miss interesting posts on Famousbio