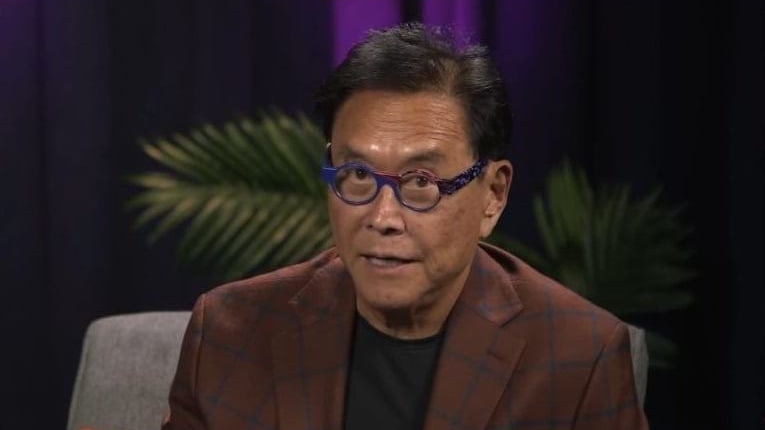

Renowned personal finance author Robert Kiyosaki is warning investors about a potential economic crash and advocating for investment in safe assets such as Bitcoin, gold, and silver. Kiyosaki’s perspective is centered on cautioning investors about systemic inflation, interest rate hikes, and the potential collapse of the US dollar. He believes that the Fed is a Marxist entity that requires an alternative to challenge it and has suggested that Bitcoin can serve as an “auditor” for the Fed, providing transparency and accountability to fight against central banks. Kiyosaki believes that blockchain technology underlying Bitcoin will be bigger than the gunpowder revolution, and the younger generation is particularly drawn to this technology. In summary, Kiyosaki’s warnings are centered on the potential economic crash, citing systemic inflation, interest rate hikes, and the potential collapse of the US dollar. He is advocating for investment in safe assets such as Bitcoin, gold, and silver in preparation for the imminent economic crash.

Renowned personal finance author Robert Kiyosaki has warned investors about the potential economic crash and offered advice on how to protect themselves. Kiyosaki’s warnings were centered on inflation, interest rate hikes, and the potential crash of the US dollar.

Kiyosaki has cautioned that inflation in the United States is now a systemic issue rather than a temporary situation. He has urged citizens to brace themselves for continuously increasing prices in the coming years. Kiyosaki also criticized the Fed Chair, Jerome Powell, stating that he had lied when he reassured the public about the temporary nature of inflation.

Kiyosaki also cites rising inflation as a possible trigger for an economic crash, blaming the Fed for worsening the situation through constant interest rate hikes and the increased printing of money as a catalyst. He warns that raising interest rates would result in the downfall of stocks, bonds, real estate, and the US dollar. According to Kiyosaki, the next financial crash will also stem from the derivatives market, and US financial sector leaders may not be acting in the best interests of Americans.

Kiyosaki maintains that the dollar is destined to collapse to zero and refers to the currency as ‘fake money.’ He further alleges that the Fed is a ‘Marxist’ organization that needs auditing.

In summary, Kiyosaki’s perspective is centered on cautioning investors about a potential economic crash, citing systemic inflation, interest rate hikes, and the potential collapse of the US dollar.

According to Robert Kiyosaki, the Fed is a Marxist entity that requires an alternative to challenge it. He has suggested that Bitcoin can serve as an “auditor” for the Fed, providing transparency and accountability to fight against central banks. Kiyosaki believes that blockchain technology underlying Bitcoin will be bigger than the gunpowder revolution, and the younger generation is particularly drawn to this technology. Kiyosaki is advocating for investment in safe assets like Bitcoin, gold, and silver in preparation for an imminent economic crash.

Don’t miss interesting posts on Famousbio