Nelson Peltz - Investors, Career and Life

Nelson Peltz's Personal Details

Nelson Peltz is an ace American investor and a businessman

| Information | Detail |

|---|---|

| Birthday | June 24, 1942 |

| Nationality | American |

| Famous | University Of Pennsylvania, Business People, Investors, Businessman, Investors |

| City/State | New Yorkers |

| Spouses | Claudia Heffner Peltz |

| Siblings | Robert B. Peltz |

| Childrens | Nicola Peltz |

| Universities |

|

| Notable Alumnis |

|

| Birth Place | Brooklyn, New York City, New York |

| Height | 165 |

| Gender | Male |

| Father | Maurice Herbert Peltz |

| Mother | Claire Peltz |

| Sun Sign | Cancer |

| Born in | Brooklyn, New York City, New York |

| Famous as | Businessman & Investor |

// Famous Businessman

Guccio Gucci

Guccio Gucci was a famous fashion designer from Florence, Italy, and the founder of the world-renowned fashion brand ‘Gucci.’ Check out this biography to know about his childhood, family, personal life, career, etc.

Santo Versace

Santo Domenico Versace is an Italian businessman and politician. Check out this biography to know about his birthday, childhood, family life, achievements, and fun facts about him.

Robie Uniacke

Robie Uniacke is a British businessman, who is best known as the long-time partner of English actress Rosamund Pike. Check out this biography to know about her birthday, childhood, family life, achievements and fun facts about her.

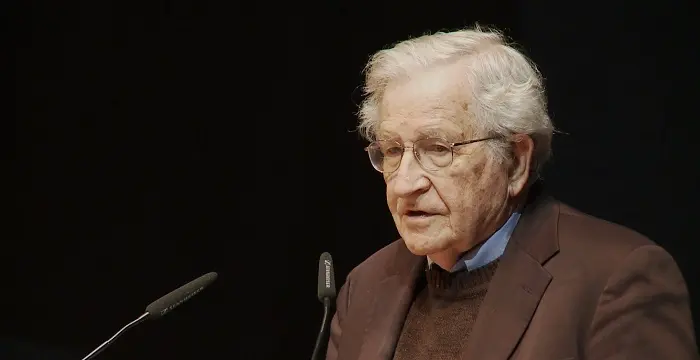

Nelson Peltz's photo

Who is Nelson Peltz?

Nelson Peltz is an ace American investor and a businessman, best known as one of the co-founders of ‘Trian Fund Management,’ an alternative investment company. Born and raised in New York, he dropped out of college in the early 60s and joined his family business ‘A. Peltz & Sons.’ In the next few years, Nelson and his brother took charge of the company and used their skills to gradually develop the firm from being a produce company to a frozen-food company. With time, as the business flourished, Nelson acquired many companies and emerged as one of the most powerful business minds in the country. Apart from being the CEO of ‘Trian,’ Nelson also happens to be the non-executive chairman of ‘The Wendy’s Company,’ and the director of the ‘The Madison Square Garden Company’ and ‘Sysco Corporation.’ Nelson, a devout Jew, has donated millions of dollars for the upliftment of the Jewish community in the US. The ‘National Association of Corporate Directors’ has repeatedly recognized him as one of the most powerful people in global corporate governance in 2010, 2011, and 2012.

// Famous Investors

Peter Schiff

Peter Schiff is a well-known American investment broker, author, economic forecaster and investment advisor. This biography profiles his childhood, life, career, achievements and gives some fun facts.

Childhood & Early Life

Nelson Peltz was born on June 24, 1942, in Brooklyn, New York, in a wealthy business family, to Claire and Maurice Peltz. His father worked for ‘A. Peltz & Sons,’ a company founded by Nelson’s grandfather, Adolph Peltz.

In the initial years of his life, Nelson remained a rebel and never showed any interest in joining the family business. In 1963, he dropped out of the ‘Wharton School’ of the ‘University of Pennsylvania,’ in order to focus on his dream of becoming a ski instructor. He moved to Oregon to fulfil his dreams of learning skiing. However, he soon came back and joined the family business as a driver. He worked for less than 100 dollars per week initially.

The company managed the transportation of food products to various restaurants and hotels in New York City. He worked in the company with his elder brother Robert. Claire Peltz soon handed over the charge of the company to the boys, and over the next few years, the company received a solid boost in gross profits.

Career

A few years after taking the charge of the company, the brothers shifted the core focus of the firm from fresh produce to institutionalized frozen-food products. Owing to this, the company grew rapidly, and in the 70s, the brothers took control of several smaller food companies in New York City. In the course of a decade, the company went from being a 2.5-million-dollar private company to a public company with an annual revenue of 150 million dollars.

In 1972, the brothers started a new food company, ‘Flagstaff Corp,’ and ten years later, after the company went bankrupt, Robert purchased back the assets of ‘Peltz Food’ from Flagstaff.’ This marked the end of the brothers’ partnership.

In the mid-80s, Nelson found a business acquaintance in Peter May, who worked as the chief financial officer with ‘Flagstaff’ and went in search of new acquisitions. In April 1983, stakes were bought by them in ‘Triangle Industries Inc.,’ a major wire and vending-machine company. Within a few years, the business expertise of Peter and Nelson made the company feature on the ‘Fortune 100’ list and transformed it into one of the top packaging companies in the world.

‘Triangle’ was more of a target practice for ‘Nelson’ and it was sold to a French company, ‘Pechiney.’ Nelson continued acquiring more companies such as ‘American Can’ and ‘National Can.’ His success throughout the 80s paved way for greater victories in the future, and by the arrival of the 90s, things improved furthermore.

In the mid-90s, Nelson used an investment vehicle ‘Triarc Cos’ to acquire ‘Snapple,’ from ‘Quaker Oats.’ Without any intention of keeping it around for a long time, Nelson and May started putting it out there, and in 2000, three years after acquiring ‘Snapple,’ they sold it to ‘Cadbury Schweppes.’ This major turnaround performed by Nelson and May featured as a case study at the prestigious ‘Harvard Business School.’

In 2005, May and Nelson started the activist investing company ‘Trian Fund Management’ along with a new partner, Ed Garden. The company successfully invested in some big companies such as ‘Cadbury,’ ‘Heinz,’ ‘Kraft Foods,’ ‘Family Dollar,’ and ‘Wendy’s.’

In 2007, ‘Trian’ bought some shares in ‘Cadbury Schweppes’ and ‘Kraft Foods,’ and in April 2008, Nelson merged ‘Triarc Corp’ with the globally famous burger chain ‘Wendy’s.’ The new company thus formed was named ‘Wendy’s Arby’s Group’ and its shares were traded on the ‘New York Stock Exchange.’ ‘Arby’s’ was later sold by the ‘Wendy’s Arby’s Group’ and was renamed as ‘The Wendy’s Company.’

In 2011, ‘Trian’ had a total of 8% stake in ‘Family Dollar’ and expressed its desire to participate in the private LBO of the company, but the management and board of directors of ‘Family Dollar’ rejected the offer. One of the founders of ‘Trian,’ Ed Garden then attained a place in the board of directors of ‘Family Dollar.’

In 2012, Peltz was appointed as a member of the board of directors for the company ‘Ingersoll Rand,’ and in 2013, he announced that he had about 1.25 billion worth of stakes in ‘DuPont.’ In 2014, after the public announcement that he had acquired more than 46 million shares in the company ‘Mondelez International,’ he was made a member of its board of directors.

In 2014, acting as a beneficial owner of ‘PepsiCo, Inc.,’ he wrote a letter to their board of directors stating that the company shall not be selling snacks and beverages under the same name. He further said that having independent companies for both operations would benefit the company and its shareholders in the long run.

In 2015, he failed to place four of his nominees on the board of directors of ‘DuPont,’ and shockingly, a few months later, the CEO of the company resigned. Later that year, Nelson bought a 2.5-million stake in ‘General Electric.’

Trian had a 1.5% stake in ‘Procter & Gamble.’ Thus, Peltz made an unsuccessful attempt to become one of the members of its board of directors in October 2017. However, it was later revealed that Nelson had won the proxy race for a seat on the board. In December 2017, he was finally named as one of the board members.

In 2014, Nelson earned a place for himself on the ‘Forbes’ list of the 25 highest-earning hedge-fund managers. With an annual earning of 430 million dollars, Nelson was placed at the 16th spot.

He was also named as one of the most influential people in corporate governance all over the world thrice, in a list formulated by the ‘National Association of Corporate Directors’ in 2010, 2011, and 2012.

Personal Life

Nelson Peltz has married thrice in his life. He is currently married to former model Claudia Heffner. He has two children from his first two marriages and eight children from his third marriage. Actors Will Peltz and Nicola Peltz are two of his children. Presently, Nelson stays with his wife in Bedford, New York.

Apart from contributing heavily to Jewish causes, Nelson is an ardent supporter of former US president George W. Bush and is said to have made a quarter-million-dollar contribution to his presidential campaign.

// Famous Investors

Ashton Kutcher

Ashton Kutcher is an American actor, model and a producer. This biography profiles his childhood, life, acting career, achievements and timeline.

Steve Eisman

Steve Eisman is an American businessman, money manager, and investor. Check out this biography to know about his childhood, family life, achievements and fun facts about him.

Bill Ackman

William Albert Ackman, better known as Bill Ackman, is an American hedge-fund manager, investor, and philanthropist. This biography profiles his childhood, family, personal life, career, etc.

Nelson Peltz biography timelines

- // 24th Jun 1942Nelson Peltz was born on June 24, 1942, in Brooklyn, New York, in a wealthy business family, to Claire and Maurice Peltz. His father worked for ‘A. Peltz & Sons,’ a company founded by Nelson’s grandfather, Adolph Peltz.

- // 1963In the initial years of his life, Nelson remained a rebel and never showed any interest in joining the family business. In 1963, he dropped out of the ‘Wharton School’ of the ‘University of Pennsylvania,’ in order to focus on his dream of becoming a ski instructor. He moved to Oregon to fulfil his dreams of learning skiing. However, he soon came back and joined the family business as a driver. He worked for less than 100 dollars per week initially.

- // 1972In 1972, the brothers started a new food company, ‘Flagstaff Corp,’ and ten years later, after the company went bankrupt, Robert purchased back the assets of ‘Peltz Food’ from Flagstaff.’ This marked the end of the brothers’ partnership.

- // Apr 1983In the mid-80s, Nelson found a business acquaintance in Peter May, who worked as the chief financial officer with ‘Flagstaff’ and went in search of new acquisitions. In April 1983, stakes were bought by them in ‘Triangle Industries Inc.,’ a major wire and vending-machine company. Within a few years, the business expertise of Peter and Nelson made the company feature on the ‘Fortune 100’ list and transformed it into one of the top packaging companies in the world.

- // 2000In the mid-90s, Nelson used an investment vehicle ‘Triarc Cos’ to acquire ‘Snapple,’ from ‘Quaker Oats.’ Without any intention of keeping it around for a long time, Nelson and May started putting it out there, and in 2000, three years after acquiring ‘Snapple,’ they sold it to ‘Cadbury Schweppes.’ This major turnaround performed by Nelson and May featured as a case study at the prestigious ‘Harvard Business School.’

- // 2005In 2005, May and Nelson started the activist investing company ‘Trian Fund Management’ along with a new partner, Ed Garden. The company successfully invested in some big companies such as ‘Cadbury,’ ‘Heinz,’ ‘Kraft Foods,’ ‘Family Dollar,’ and ‘Wendy’s.’

- // 2007 To Apr 2008In 2007, ‘Trian’ bought some shares in ‘Cadbury Schweppes’ and ‘Kraft Foods,’ and in April 2008, Nelson merged ‘Triarc Corp’ with the globally famous burger chain ‘Wendy’s.’ The new company thus formed was named ‘Wendy’s Arby’s Group’ and its shares were traded on the ‘New York Stock Exchange.’ ‘Arby’s’ was later sold by the ‘Wendy’s Arby’s Group’ and was renamed as ‘The Wendy’s Company.’

- // 2011In 2011, ‘Trian’ had a total of 8% stake in ‘Family Dollar’ and expressed its desire to participate in the private LBO of the company, but the management and board of directors of ‘Family Dollar’ rejected the offer. One of the founders of ‘Trian,’ Ed Garden then attained a place in the board of directors of ‘Family Dollar.’

- // 2014In 2014, acting as a beneficial owner of ‘PepsiCo, Inc.,’ he wrote a letter to their board of directors stating that the company shall not be selling snacks and beverages under the same name. He further said that having independent companies for both operations would benefit the company and its shareholders in the long run.

- // 2014In 2014, Nelson earned a place for himself on the ‘Forbes’ list of the 25 highest-earning hedge-fund managers. With an annual earning of 430 million dollars, Nelson was placed at the 16th spot.

- // 2015In 2015, he failed to place four of his nominees on the board of directors of ‘DuPont,’ and shockingly, a few months later, the CEO of the company resigned. Later that year, Nelson bought a 2.5-million stake in ‘General Electric.’

- // Oct 2017 To Dec 2017Trian had a 1.5% stake in ‘Procter & Gamble.’ Thus, Peltz made an unsuccessful attempt to become one of the members of its board of directors in October 2017. However, it was later revealed that Nelson had won the proxy race for a seat on the board. In December 2017, he was finally named as one of the board members.

// Famous University Of Pennsylvania

Sharon Stone

Sharon Stone is a Golden Globe Award winning American actress and former model. Read this biography to learn more about her childhood, profile, life and timeline.

Aaron Yoo

Aaron Yoo is a cinematographer and actor of Korean origin, who was born and raised in the United States of America. This biography of Aaron Yoo provides detailed information about his childhood, life, achievements, works & timeline.

Steve Eisman

Steve Eisman is an American businessman, money manager, and investor. Check out this biography to know about his childhood, family life, achievements and fun facts about him.

Noam Chomsky

Chomsky is an American linguist, political theorist, and activist, often referred to as "the father of modern linguistics”. Check out this biography to know about his childhood, family life, achievements and other facts related to his life.

Louis Kahn

Louis Kahn was one of the most reputed architects of the 20th century. This biography provides detailed information about his childhood, life, works, career, achievements and timeline.

Elizabeth Banks

Elizabeth Banks is a contemporary American actress, director, and producer. Explore the biography below to know about her childhood, life, career, achievements and timeline.

Nelson Peltz's FAQ

What is Nelson Peltz birthday?

Nelson Peltz was born at 1942-06-24

Where is Nelson Peltz's birth place?

Nelson Peltz was born in Brooklyn, New York City, New York

What is Nelson Peltz nationalities?

Nelson Peltz's nationalities is American

Who is Nelson Peltz spouses?

Nelson Peltz's spouses is Claudia Heffner Peltz

Who is Nelson Peltz siblings?

Nelson Peltz's siblings is Robert B. Peltz

Who is Nelson Peltz childrens?

Nelson Peltz's childrens is Nicola Peltz

What was Nelson Peltz universities?

Nelson Peltz studied at University Of Pennsylvania, University of Pennsylvania

What was Nelson Peltz notable alumnis?

Nelson Peltz's notable alumnis is University Of Pennsylvania

How tall is Nelson Peltz?

Nelson Peltz's height is 165

Who is Nelson Peltz's father?

Nelson Peltz's father is Maurice Herbert Peltz

Who is Nelson Peltz's mother?

Nelson Peltz's mother is Claire Peltz

What is Nelson Peltz's sun sign?

Nelson Peltz is Cancer

How famous is Nelson Peltz?

Nelson Peltz is famouse as Businessman & Investor