Tokyo Electron, a Jap semiconductor apparatus maker, has raised its outlook for the stream monetary generation because of an build up in call for from Chinese language chipmakers. The corporate’s gross sales are anticipated to extend through 3% in comparison to the former generation, and its pretax benefit is anticipated to be up through 6%. Tokyo Electron has attributed the gross sales build up to China’s speeded up chip manufacturing and the ensuing upper call for for its semiconductor apparatus. The corporate could also be anticipating higher call for for its apparatus in alternative markets, in addition to stepped forward operational potency.

(Bloomberg) — Tokyo Electron Ltd. raised its benefit outlook for the generation next Chinese language chipmakers ramped up shipments forward of a conceivable crackdown on exports of Jap production apparatus.

Maximum learn through Bloomberg

The Tokyo-based provider of Taiwan Semiconductor Production Co. and Intel Corp. raised its forecast for the generation to March to 580 billion yen ($4.4 billion) forward of expectancies. Quite a lot of corporations in China are rushing up deliveries and funding plans amid fears of being not able to retain the apparatus as world industry partitions stand, Tokyo Electron executives stated in calls on Thursday.

The Jap maker of silicon coating, etching, trimming and checking out apparatus worn in semiconductor production now sees a fix from the second one part of 2023 and endured enlargement from 2024, thank you partly to govt subsidies for chip-related investments world wide to Hiroshi Kawamoto, Basic Supervisor of Finance at Tokyo Electron.

The corporate, which competes with Carried out Fabrics Inc., had shorten its profits outlook through greater than 1 / 4 in November amid US sanctions on complicated chip exports. The 6% build up in working benefit outlook “proves little evidence of recovery or resilience,” stated Amir Anvarzadeh, strategist at Uneven Advisors.

The corporate’s response to the new information that Japan and the Netherlands have agreed to fix the USA in implementing strict export controls on complicated semiconductor applied sciences and merchandise to China is being carefully monitored. Tokyo Electron is one in every of a couple of crucial providers to the worldwide chip production trade, offering machines to form the untouched future of chips.

Washington stepped up its marketing campaign to limit China’s get admission to to generation that might assistance or beef up its army features, implementing sweeping restrictions on US-linked exports or workers touring to the Asian public in October. In series for those sanctions to paintings, the Biden management has sought and ensured cooperation with world companions.

Tokyo Electron, which additionally introduced a 3-for-1 reserve fracture, stated working benefit within the December quarter fell 26% to 114.8 billion yen, forward of the median analyst estimate of 102 billion yen. The December quarter slumped as U.S. chip equipment makers have been not able to send to Chinese language shoppers and manufacturing used to be referred to as into query, however the feared hunch in call for didn’t materialize, Kawamoto stated.

“The tightening of U.S. restrictions on chip equipment exports to China has of course helped boost the outlook,” he stated. “But we’re also seeing strong demand from many different customers, including logic foundry customers outside of China.”

In step with Kawamoto, the corporate has no plans to downsize its operations in China, which it sees as a large year marketplace for automobile energy chips. “China will remain an important market for Tokyo Electron,” he stated. “We don’t just deal in state-of-the-art equipment.”

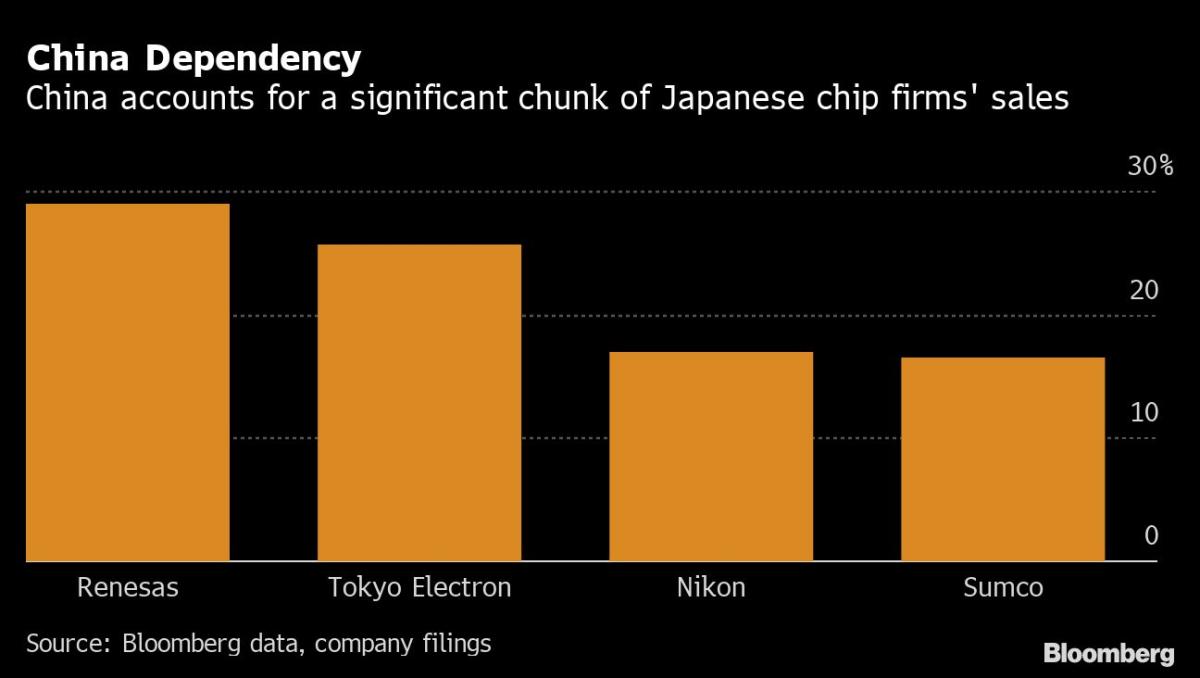

Tokyo Electron and the alternative gamers within the Jap semiconductor trade, Renesas Electronics Corp., Nikon Corp. and Sumco Corp., every have a good portion in their gross sales at once to China, with much more in their trade dependent available on the market via gross sales through their shoppers. All 4 reported earnings on Thursday.

Learn extra: Renesas plans $380 million buyback as benefit beats estimates

Silicon wafer maker Sumco stated call for from automobile and commercial shoppers rest robust, however the susceptible smartphone marketplace is more likely to top to decrease wafer orders in 2023 prior to rebounding in 2024. The continuing stock changes that experience strike the reminiscence chip trade sun-baked for the life few months are more likely to retain for now, CEO Mayuki Hashimoto stated.

Dutch apparatus maker ASML Protecting NV stated in overdue January that the sanctions is not going to have a subject matter have an effect on on its earnings in 2023, regardless of China persistently being one of the most greatest importers of chips and chip generation.

Two Jap chip providers, Advantest Corp. and Display screen Holdings Co., which previous absolved their December quarter effects, returned cast effects that have been in sequence with marketplace expectancies. Yokohama-based Lasertec Corp. Book fell next trimming its series outlook, even supposing it too gave a favorable sign for a fix through pronouncing “demand for advanced equipment is not abating” and that deferred orders will have to come again within the after fiscal generation or past.

–With the assistance of Vlad Savov.

(Updates with main points from Investor Convention and Analyst Remark)

Maximum Learn through Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio