The Inner Income Provider (IRS) has but to lend steerage at the dealing with of climate stimulus assessments, a lengthen that has thrown tax season into disarray. The deficit of course has left states and tax execs scrambling to deal with the problem, with many opting to lengthen submitting till the IRS problems its steerage. The lengthen additionally impacts those that obtain stimulus bills as a part of their tax go back, as they’ll have to attend till the IRS clarifies the foundations sooner than they may be able to document. In the meantime, the IRS has warned taxpayers to be cautious of scams similar to the stimulus bills.

It’s been a negligible over two weeks for the reason that tax returns, and lots of tax pundits have been virtually able to get this day’s season again to standard.

However steerage anticipated this generation from the Inner Income Provider on taxing govt stimulus assessments threatens that early overview. The company advisable that taxpayers who gained those bills within the while day wait till the steerage is finalized sooner than submitting their tax returns.

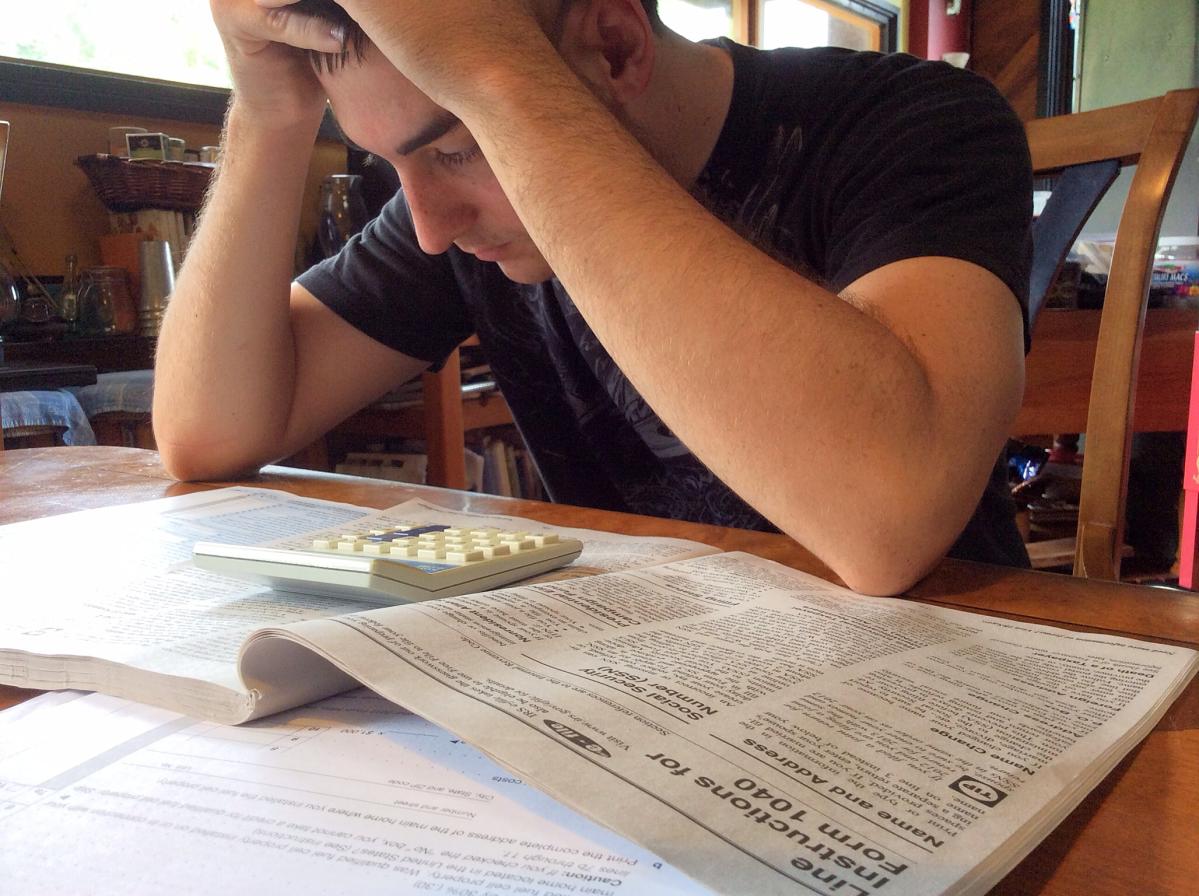

That suggests tens of millions of taxpayers are as soon as once more faced with a probably difficult and irritating tax season that, given the occasions of latest years, turns out to have turn into regimen.

“The IRS only publicly commented on this after the start of tax filing season, after nearly 17 million returns had already been filed. This delay creates unnecessary burden and confusion for taxpayers and tax preparers,” Jared Walczak, the Tax Bedrock’s vice chairman of climate tasks, informed Yahoo Finance. “This throws tax season into chaos. That was avoidable.”

(Photograph: Getty Editorial)

Extra of the similar?

The overdue alternate in steerage by way of the IRS is paying homage to contemporary years of disruption and alter.

The while day noticed primary adjustments from the American Rescue Plan (ARP), which presented a number of advanced tax breaks that benefited tens of millions of American citizens. In 2021, the IRS driven again the beginning of tax submitting season to February to behavior a 2d spherical of stimulus assessments. A final-minute stipulation within the ARP additionally implemented to those returns even supposing submitting season had already begun. And in 2020, the pandemic and next closures not on time the tax closing date by way of months and strained the company’s operations.

“The pandemic has been a major concern as staff have been called in sick and hiring efforts have derailed. Then all these extra stimulus checks added a significant burden to them,” mentioned Eric Bronnenkant, head of tax at Betterment, a monetary advisory company that claims this stuff and being in what’s arguably a ceaselessly underfunded climate used to be the easiest typhoon.”

Even 2019, sooner than the pandemic, used to be no longer standard.

That day, the IRS needed to put in force the immense tax regulation enacted below the Trump management. Some of the many adjustments have been a doubling of the usual deduction and kid tax credit score, a $10,000 cap at the climate and native deduction, the removing of a couple of miscellaneous particular person deductions, the next property tax exemption, and a 20 % passport-through-income deduction . The untouched regulation often known as for an absolutely restructured tax mode.

Moreover, the season started in a while nearest the federal government’s longest-running federal shutdown, all the way through which the company’s operations have been significantly curtailed.

“The IRS is trying”

Tax auditors paintings on the Inner Income Provider facility in Ogden, Utah on March 31, 2022. (Photograph by way of Alex Goodlett for the Washington Put up by way of Getty Photographs)

This day seemed adore it might be quieter.

Most of the advanced credit and deductions from the pandemic that experience difficult federal tax returns for the while two years have expired. And the few untouched tax breaks this day will follow to a way smaller circle of taxpayers.

The IRS, plagued by way of backlogs for the closing two years, has taken heavy strides to reduce its immense paper jam within the utmost months of 2022, because of its hiring efforts and a few technological healings. The company’s watchdog, the Taxpayer Recommend, even mentioned in its annual report back to Congress that the IRS used to be on higher base to start out this day’s submitting season, even though extra journey had to be made.

“I know the IRS is trying to work harder right now to improve the taxpayer experience,” Bronnenkant mentioned. “They’ve gotten a lot of money and they’re trying to figure out how to hire more people and what they can be more efficient at by expanding their technology.”

The largest doable hiccup tax professionals concern this day can be less-than-expected refunds for plenty of taxpayers nearest quickly enhanced tax breaks lapsed all the way through the pandemic.

“I’ve noticed this year that a lot of people are seeing lower refunds because of the decline in the child tax credit, dependent care credit and earned income credit,” Lend Dougherty, a registered agent and founding father of Dougherty Tax Answers, informed alternative tax execs polled Yahoo Finance.

“Unfair to taxpayers”

As for the pending steerage on govt stimulus assessments, there may be combined recommendation on tips on how to progress.

Generation the IRS has steered taxpayers to lengthen submitting their returns till a last resolution is made, two of the most important tax advisors — H&R Restrain and TurboTax — are reportedly proceeding to document returns for citizens of California, probably the most 19 states that just lately filed tax refunds have granted day. H&R Restrain informed the Wall Boulevard Magazine that the IRS will rule that the bills don’t seem to be taxable.

However alternative tax professionals mentioned it’s no longer so sunlit scale down.

It’s imaginable that the IRS may make a decision that one climate’s bills are taxable and some other climate’s bills don’t seem to be, relying at the “purpose and parameters” of each and every climate’s backup bundle, Walczak mentioned. Some tax refunds, as an example, got here from profusion govt earnings, era others have been meant to lend vacation from runaway inflation.

“This will be a real state-by-state analysis,” Walczak mentioned, noting that the investigation might be difficult. “The general rule is that state rebates are taxable income for federal purposes, but there are a variety of exclusions.”

(Symbol credit score: Forbes advisor)

Dwight Nakata, an authorized monetary planner and CPA at YNCPAs who practices in California, mentioned it “may be best to wait until additional guidance from the Internal Revenue Service (IRS) is available.” He most often advises his shoppers to attend till mid-February anyway “to have time for slow or misdirected mail.”

However that lengthen might be expensive for plenty of taxpayers who follow early, as they depend at the urged supply in their tax refunds, which can be continuously earmarked for explicit pieces like debt bills and even unsophisticated residing bills.

And for individuals who have already filed and are impacted by way of the IRS’s ultimate findings, it should cruel going again and adjusting their returns, Walczak mentioned.

“This process is unfair to taxpayers,” he added. “The reality is that some, maybe many, of these rebates will be taxable federally and that will be consistent with federal law. But the IRS should have been way ahead of that.”

Rebecca is a reporter for Yahoo Finance. Apply her on Twitter at @RebeccaChenP. Gabriella is a private finance reporter at Yahoo Finance. Apply her on Twitter @__gabriellacruz. Ronda is a Senior Reporter for Private Finance at Yahoo Finance and an legal professional with enjoy within the felony, insurance coverage, schooling and govt sectors. Apply her on Twitter @writeronda.

For the fresh reserve marketplace information and in-depth research, together with occasions shifting shares, click on right here

Learn the fresh monetary and industry information from Yahoo Finance

Obtain the Yahoo Finance App for Apple or Android

Apply Yahoo Finance on Twitter, Fb, Instagram, flipboard, LinkedInAnd youtube

Don’t miss interesting posts on Famousbio