House consumers are after all gaining leverage within the housing marketplace, however the place to get the most efficient reductions on house costs varies from metro to metro.

One of the vital maximum widespread pandemic boomtowns like Phoenix and Seattle, in addition to widespread West Coast towns like San Jose and San Francisco, noticed house costs fall greater than 10% from their 2022 Cloudy peaks, in keeping with December information from Loan Era and Information Supplier Knight Inc., which beat the typical nationwide let go of five.3% from June 2022 highs.

That’s a welcome signal for some consumers, who’re benefiting from the newfound purchasing energy and vendor incentives in as of late’s marketplace. Nonetheless, affordability remainder a significant problem this 12 months as space costs and still-high loan charges proceed to hose down call for.

“We’re finally seeing real price corrections,” John Downs, senior vice chairman of Vellum Loan, instructed Yahoo Finance. “Housing prices remain high, but they are better now and falling.”

Puffed up markets will see the sharpest declines

Upcoming loan charges rose to almost 7% terminating 12 months, house worth enlargement national started to falter. Through December 2022, house costs had posted their 6th instantly per month decline — and Cloudy Knight predicts the ones declines will most likely lengthen into 2023.

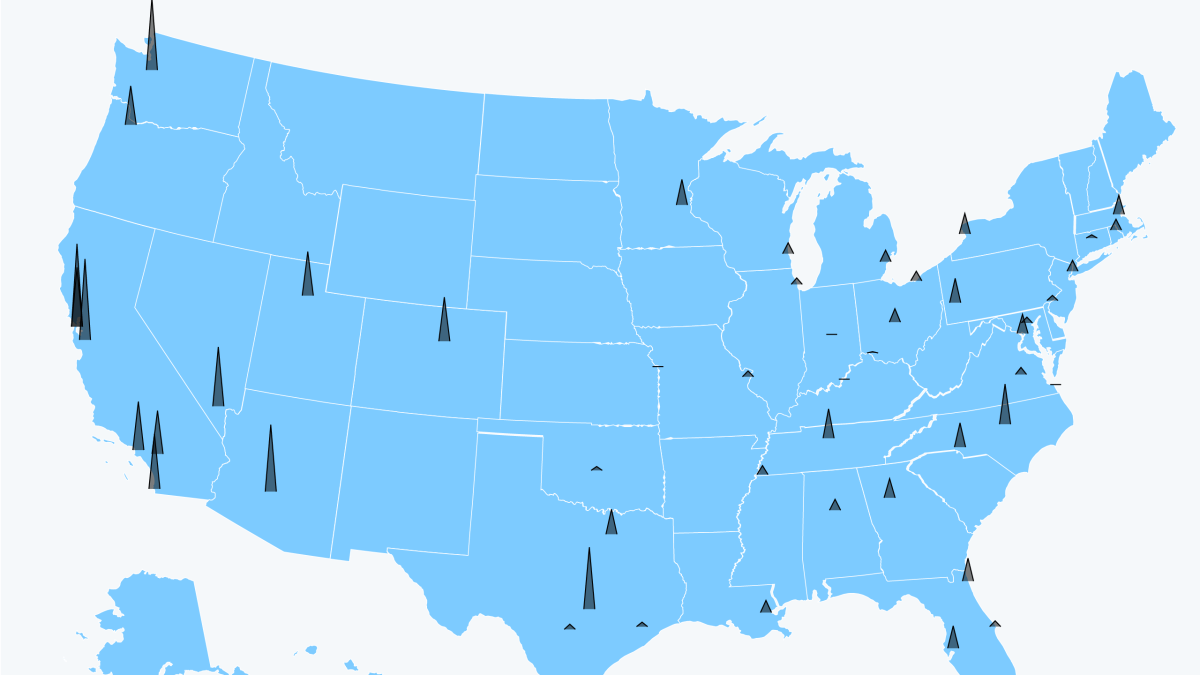

About 14 of the 50 biggest markets are already appearing indicators of a vital slowdown, the record says, with seasonally adjusted space costs falling a mean of 6% or extra from their 2022 peaks. A number of the metros assessed, costs fell extra within the West.

San Francisco took the top, with house costs there down 13% from their height in December 2022, information from Cloudy Knight confirmed. It used to be adopted by way of San Jose (down 12.7%), Seattle (down 11.3%) and Phoenix (down 10.5%).

An indication is posted in entrance of unused condos on the market on December 19, 2022 in Los Angeles, California. (Credit score: Mario Tama/Getty Photographs)

Nonetheless, house costs stay increased for lots of homebuyers. In keeping with Realtor.com, the typical checklist worth for a house in San Francisco on the finish of the 12 months used to be $1.3 million, nonetheless 3.7% upper than a 12 months in the past. Alternatively, the typical house offered for $1.25 million, or 3.8% beneath the median checklist worth.

“Buyers, particularly on the West Coast, know Seattle has been in a seller’s market for a decade, but they may get a short buying window where they can take advantage of buying incentives and stay ahead of the competition,” Jeff Reynolds, dealer at Compass and Founding father of UrbanCondoSpaces.com, to Yahoo Finance. “People would rather buy than wait until there’s multiple-supply competition again.”

Some markets could have a softer touchdown

Alternatively, some markets will see a extra slight decline in house costs.

In keeping with Cloudy Knight, best 4 of the lead 50 markets didn’t see worth declines, together with Kansas Town, Indianapolis, Virginia Seaside and Louisville, pace 20 markets noticed worth declines of as much as 2%. Twelve subways noticed declines of three% and 5% from their highs.

A detached record by way of Goldman Sachs discovered that gardens with upper affordability — the place the per month fee for a unused loan prices a few quarter of per month revenue, like in Philadelphia or Chicago — are more likely to see much less of a let go in house costs in comparison to costlier homes markets. Through comparability, loan bills account for three-quarters of per month revenue within the West, Goldman Sachs discovered.

“When you first buy in a market like Washington, DC, you know the last three years have been really crazy,” Downs stated. “But prices are finally easing.”

No “catastrophic drop” in space costs

A “Reduced” signal sits within the entrance backyard of a house on the market in northeast Washington, DC. (Credit score: Drew Angerer/Getty Photographs)

In keeping with Doug Duncan, Fannie Mae’s senior vice chairman and eminent economist, space costs will fall 6.7% over the later two years, however there gained’t be a “catastrophic drop” like right through the Admirable Recession.

Affordability remainder the principle worry of many economists and housing mavens.

The nationwide pay-to-income ratio is 34.8%, in keeping with Cloudy Knight estimates. Presen that’s down from 38.4% in October 2022, it remainder above the 2006 height earlier than the Admirable Recession.

That suggests it now takes $600, or 41% extra, to assemble the per month fee on a 30-year loan at the reasonable house — next paying 20% much less — in comparison to a 12 months in the past.

“The key question is what happens to household incomes now. Eventually, if they strengthen and employment remains reasonable, there will be an adjustment in the relative relationship between income, mortgage rates and home prices that will allow consumers to get back in the game,” Duncan instructed Yahoo Finance. “That’s our theme this year – it’s all about affordability.”

Gabriella is a non-public finance reporter at Yahoo Finance. Practice her on Twitter @__gabriellacruz.

Click on right here for the actual trade information and financial signs to support you together with your funding choices

Learn the actual monetary and trade information from Yahoo Finance

Obtain the Yahoo Finance App for Apple or Android

Practice Yahoo Finance on Twitter, Fb, Instagram, flipboard, LinkedInAnd youtube.

Don’t miss interesting posts on Famousbio