(Bloomberg) – Inflation is slowing world wide, however one of the greatest wealth managers say it’s no longer pace to surrender coverage from emerging client costs.

Maximum learn by way of Bloomberg

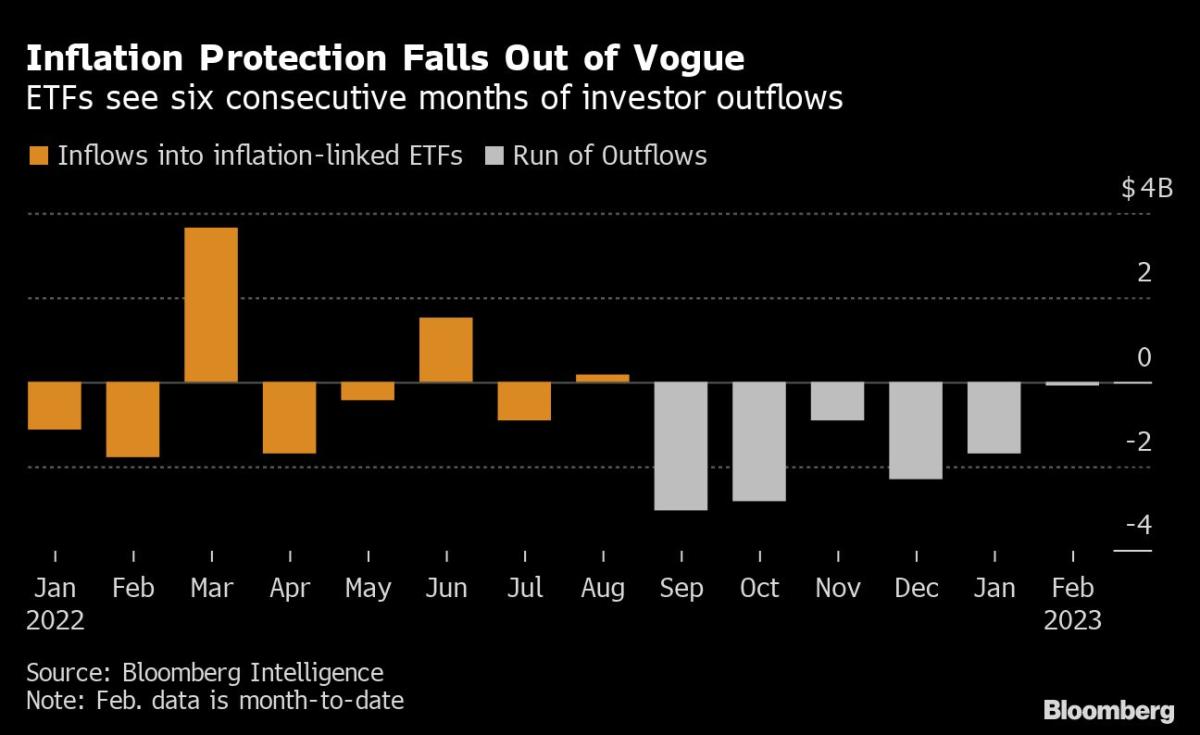

BlackRock Inc., AllianceBernstein Protecting LP and Pacific Funding Control Co. warn that the marketplace could also be overconfident concerning the age of fee enlargement. Buyers withdrew cash from exchange-traded budget that monitor inflation-linked executive debt for the 6th directly generation in January, the longest streak in no less than six years and a blended web outflow of $10.8 billion, knowledge compiled by way of Bloomberg presentations.

They’re no longer announcing inflation received’t gradual – provide shortages have eased and commodity costs have fallen. Their worry is the age and extent of the slowdown that buyers are pricing in.

“People seem to be seeing inflation slowing down and thinking that even if the rate is still high, they no longer need inflation protection,” mentioned John Taylor, AllianceBernstein’s director of world multi-sector. “They underestimate the structural changes that could lead to a higher inflationary regime, such as deglobalization and labor shortages.”

US medium-term inflation expectancies – as mirrored within the yield unfold between ordinary five-year and inflation-linked bonds – have fallen to two.5% from a top of three.76% utmost 12 months. A matching gauge for world markets presentations expectancies at the moment are underneath 2%, in comparison to 3.12% in April – the very best degree in no less than 10 years.

brittle lesson

BlackRock maintains its advice that traders must stay obese inflation-linked bonds. AllianceBernstein just lately greater its publicity to US Treasury inflation-linked securities, or TIPs. Pimco additionally purchased US index-linked bonds to hedge towards the danger of higher-than-expected percentage fee enlargement.

Buyers gained a brutal lesson at the dangers of underestimating inflation in 2022. International equities tumbled $18 trillion, future US Treasuries posted their worst 12 months on file as central bankers struggled to to lift rates of interest and, then years of easing, to prevent the emerging costs.

Wei Li, BlackRock’s important analysis funding strategist, is shocked on the extent to which traders are having a bet that enlargement will select up, inflation will gradual and policymakers will go to price cuts upcoming this 12 months. Their baseline situation is a light recession and persisted above-target fee enlargement. The marketplace, in the meantime, is expecting a macroeconomic park that may give possibility belongings a spice up, she mentioned.

“Sustained inflation is not just a US phenomenon – it happens in all developed countries,” Li mentioned in an interview.

structural shifts

To make certain, one of the marketplace motion pointing to a slowdown in inflation has pale. However the anticipated price remains to be smartly underneath BlackRock’s forecasts. The arena’s biggest wealth supervisor sees the age averaging about 3.5% over the nearest 5 years and underneath 3% past as an growing old folk shrinks the staff, geopolitical fragmentation reduces financial potency, and international locations shift to a low-carbon commercial type.

“Our view of the structural changes means that inflation will be higher than what we were used to before the pandemic,” Li mentioned % to round 4% in June 2022. It’ll most certainly be a bundle more difficult to get underneath 3%.”

A more in-depth have a look at the inflation knowledge coming in from world wide offers motive for warning.

Core inflation in Europe hovered at a file 5.2% in January and the unemployment price is at an rock bottom at 6.6% – figures which are eminent ECB policymakers to fret the wish to finish a wage-price spiral to keep away from. In america, in the meantime, bets on a extra hawkish Fed are emerging then a shockingly sturdy jobs document confirmed unemployment fell to a few.4%, the bottom price since 1969.

Sticky, cussed

AllianceBernstein’s Taylor says the United Kingdom is the nearest park so as to add a place in inflation-linked securities, even though breakevens have room to increase their decline as traders react to the slowdown in headline inflation. Economists be expecting rates of interest to fall for a 3rd generation to ten.3% in January as knowledge is due nearest while. Even at that degree, inflation would nonetheless be related to a 41-year prime and about 5 instances the Storagefacility of England’s goal.

Because the inflation debate rages on, Pimco’s Alfred Murata recommends sticking with TIPs, taking into account that some key fee elements will stay continual.

“Some key categories will remain ‘sticky,’ including wage, housing and rent inflation,” Murata wrote in a notice. “It will take longer for inflation to get closer to the Fed’s 2% target. Still, the market is pricing in a much faster fall in inflation – to just over 2% by summer.”

–With the aid of Denitsa Tsekova.

Maximum Learn by way of Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio