[ad_1]

“Investor Confidence in BlackRock’s US ESG Flows Takes a Hit Amid Tech Rout and Anti-Green Backlash”

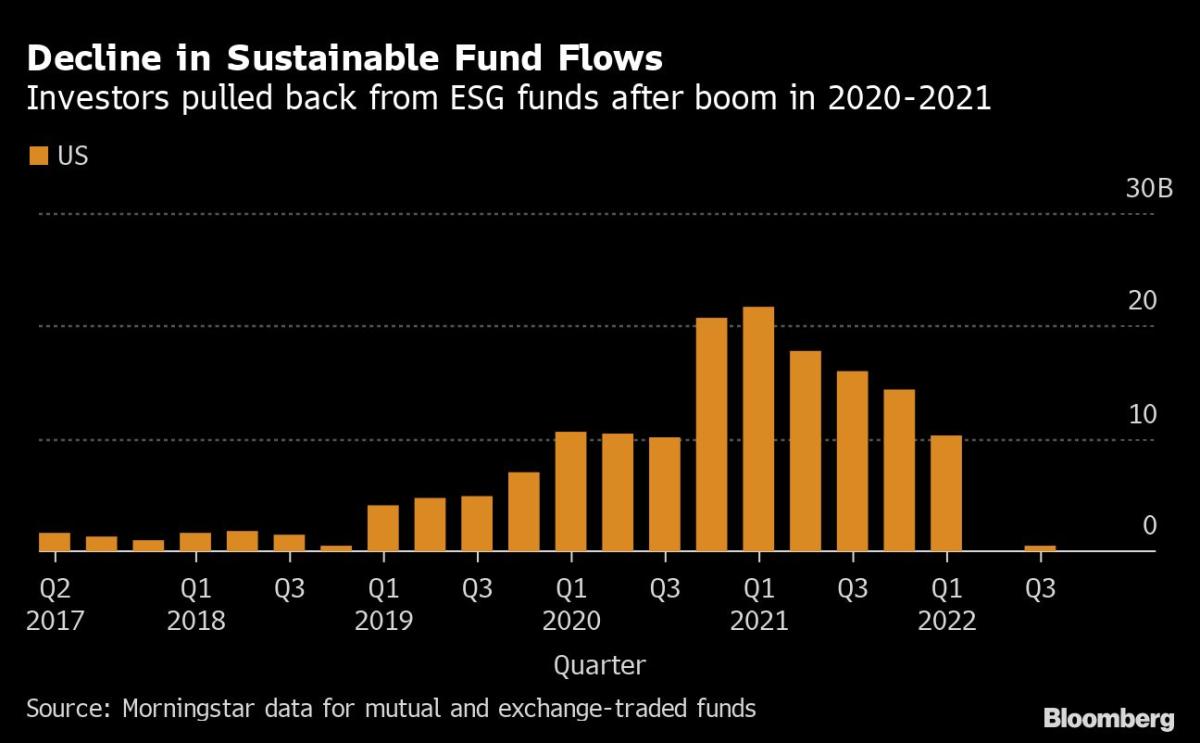

(Bloomberg) – Cash flows into US sustainable funds plummeted last year as the broader market took a hit and anti-ESG crusaders targeted money managers like BlackRock Inc. over “awakened capitalism”.

Most read by Bloomberg

ESG exchange-traded funds in the US aren’t doing any better in 2023.

ETFs in the US with environmental, social and governance objectives saw net outflows of $772 million in January, compared with $953 million in inflows in the first month of 2022, according to data compiled by Bloomberg. Some of the biggest withdrawals over the past month have come from funds managed by BlackRock, Invesco Ltd. and Vanguard Group were managed.

According to a person familiar with the matter, BlackRock had no net inflows into its sustainable products in the US last year. The company declined to comment.

“Last year there was a tremendous, well-coordinated backlash on this issue that changed the mood,” said Aniket Shah, global head of ESG strategy at Jefferies Financial Group Inc., in an interview. “Sentiment came right down to financial advisors and individuals deciding where to put their investments.”

The ESG industry in the US faced a reckoning last year as sustainable mutual funds and ETFs netted $3 billion in client money, compared to $70 billion in 2021 — a 96% plunge, according to data from Morningstar Inc.

The political setback in the US came on top of the worst year for equity and bond investing since the 2008 financial crisis. ESG funds, particularly those linked to indexes, were often heavily invested in technology and growth stocks, and many had limited exposure to the energy sector, the best-performing part of the S&P 500 index in 2022.

Anti-ESG sentiment was not global, and ESG investing outside the US did better last year.

BlackRock, the world’s largest wealth manager and prominent advocate for sustainable investing, had $65 billion in inflows into sustainable funds globally in 2022, according to the person familiar with the matter. The company has seen positive flows into its sustainable long-dated products every quarter of the year. Its sustainable platform accounts for about $500 billion of the company’s assets under management, the company said in a recent memo.

“Probably overbought”

In 2022, Republican state officials in the US, including treasurers, attorneys general and Florida Gov. Ron DeSantis, campaigned against ESG investing, claiming that the strategy promotes social or ideological interests at the expense of investment performance.

Anti-ESG officials targeted BlackRock and Chief Executive Officer Larry Fink, who warned other CEOs in 2020 that “climate risk is an investment risk.” At least six states said they plan to divest more than $3 billion from BlackRock as House Republicans roll back efforts by the Biden administration to bolster ESG investing.

Read more: BlackRock Struggles to Escape ESG Crossfire: Timeline

The anti-ESG push is likely just one factor that has kept money out of sustainable funds. ESG funds saw large inflows in 2020 and 2021 as investors embraced the Biden administration’s green agenda and followed the lead of the European Union in funding green businesses.

“Is it true that we were probably overbought in 2022? Absolutely,” said Peter Krull, partner and director of sustainable investing at Earth Equity Advisors, a Prime Capital Investment Advisors company, in an interview. “Valuations on the growth side were certainly above what they should have been.”

Sustainable ETFs have also been used in model portfolios, broad-based asset allocation strategies that investment advisors recommend to clients. Changes to these models can result in significant cash inflows and outflows.

BlackRock’s iShares ESG Aware MSCI USA ETF — one of the country’s largest ESG ETFs — had withdrawn $1.2 billion in October, spurring market speculation of a shift in the wealth management giant’s model portfolios. As of Jan. 11, the fund had a net withdrawal of $666 million, according to data compiled by Bloomberg.

Skepticism about broader equity investing was also a major contributor to the ESG decline in the second half of last year, said Joe Sinha, chief marketing officer at Parnassus Investments, which integrates ESG analysis into its funds.

“I haven’t seen any new ESG mandates, models or recommendation lists for a while,” Sinha said. “I would definitely say some of the business was softer.”

Even if tech and growth stocks rebound this year, it could still be some time before investors allocate new money to sustainable funds, Sinha said.

“It’s clear that people are waiting for several observations – that the market seems safe – and then jumping in,” he said. “You get moderation in the beginning and then, ironically, people wait for stocks to go up.”

–With support from Margot Wentzel.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

[ad_2]

Don’t miss interesting posts on Famousbio