(Bloomberg) — Stock market investors craving guidance after a month of yo-yo action brace themselves for a week of economic data and Federal Reserve spokesmen that should help clarify the next step for U.S. stocks.

Most read by Bloomberg

This year began with a rapid rally, but that has given way to the S&P 500’s first two-week losing streak since December. The risk now is that increasing bets on steeper rate hikes will wear down market resilience. Investors fearful of a return to the dark days of 2022 could be near a breaking point where they will start making money faster.

The warning signs are everywhere. Fed officials speak of another jumbo rate hike. Inflation is more persistent than expected. And Wall Street’s most vocal bears see nothing but pain on the horizon. All of this has traders weighing the risk of their gains disappearing in 2023 against the potential for another rapid recovery.

“If we have a bigger downturn, investors could pull away quickly,” Frank Cappelleri, founder of research firm CappThesis, said by phone. “Stop losses could really be in play because the worst case scenario is already on everyone’s lips – and that’s testing new lows again.”

The spate of upcoming economic updates could reinforce investors’ view of the Fed’s policy stance. The holiday-shortened trading week brings readings on manufacturing, consumer health and US economic output. Add to that the minutes of the Fed’s most recent meeting and speeches from a number of officials, including Cleveland Fed Chair Loretta Mester, who said last week that she made a “strong economic case” for a half-point hike at the last central bank see collecting.

It’s a stretch that could help confirm whether this year’s stock rally is the start of a bull market or another bear trap. On the one hand, for example, Marko Kolanovic of JPMorgan Chase & Co. sees a “pervasive sense of exuberance and greed.” On the other hand, Wells Fargo & Co.’s Chris Harvey declared the bear market over.

The S&P 500 is essentially flat this month after rising 6.2% in January. That rally was likely fueled in part by short sellers covering bearish bets and buying by systematic investors who attracted momentum players, analysts say.

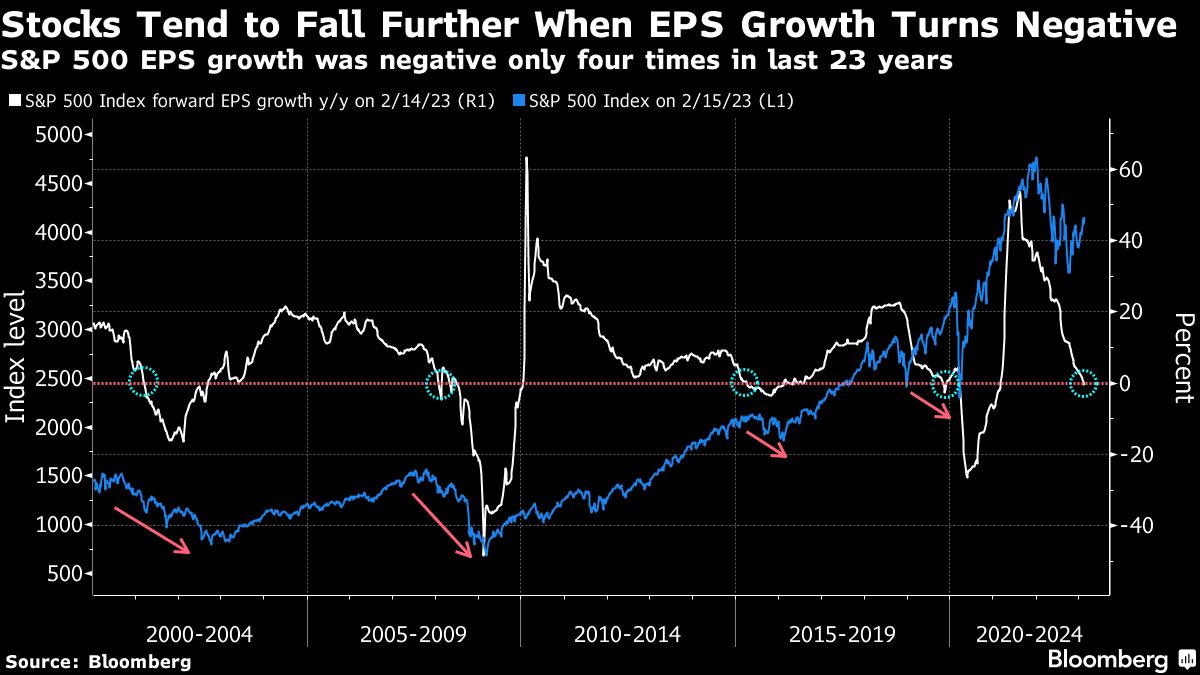

A red flag is surfacing in Corporate America during this earnings season. Earnings growth has turned negative year-over-year, which has only happened four other times in the past two decades and has never been an encouraging sign for stocks.

There is another big question mark in an uptrend when trading short-term options. This activity has increased the daily fluctuations, increased the noise and created another potential source of risk. This week, volume for contracts expiring the same day they are traded hit a record 50% share of all options transactions on the S&P 500, data from CBOE and Nomura show. According to JPMorgan’s Kolanovic, this is a background that creates a risk on the scale of the market’s volatility implosion in early 2018.

Yet some investors find solace in forecasts for a rebound in earnings in 2024 and optimism that a soft landing and a mild recession are not only achievable, but expected.

“The result is that fear of missing out (FOMO) has made a comeback,” said Ed Clissold, chief US strategist at Ned Davis Research Inc. “Even for some investors who doubt the Fed’s ability to pull off a soft landing , reluctantly boarded. ”

While sentiment and capital flows show a mix of skepticism and optimism, there could be room for further gains, he added. “Sentiment appears far from the overly optimistic levels often seen at major market tops.”

One group that buys tirelessly are retailers. Individual investors net bought $32 billion in U.S. stocks and exchange-traded funds in the 21 sessions ended Thursday, a record for such a length of time, data from Vanda Research shows. While this pace may be difficult to sustain, there is enough money for the group to take risky bets if institutional investors step in to fuel a stronger recovery, writes Vanda’s Marco Iachini.

Amid the overarching debate about the economy and Fed policy, chart watchers have their own opinions. They point to the market’s stability into late 2022 as a sign the recovery is finding support and are eyeing those levels as stocks stutter. The S&P 500 hit an intraday low of 3,764 on Dec. 22, almost 8% above the October bottom, creating a pattern of a higher low.

“The market can break out from here, but if that fails it will show that the ‘biggest patterns’ that are now bullish could be negated, says Cappelleri.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio