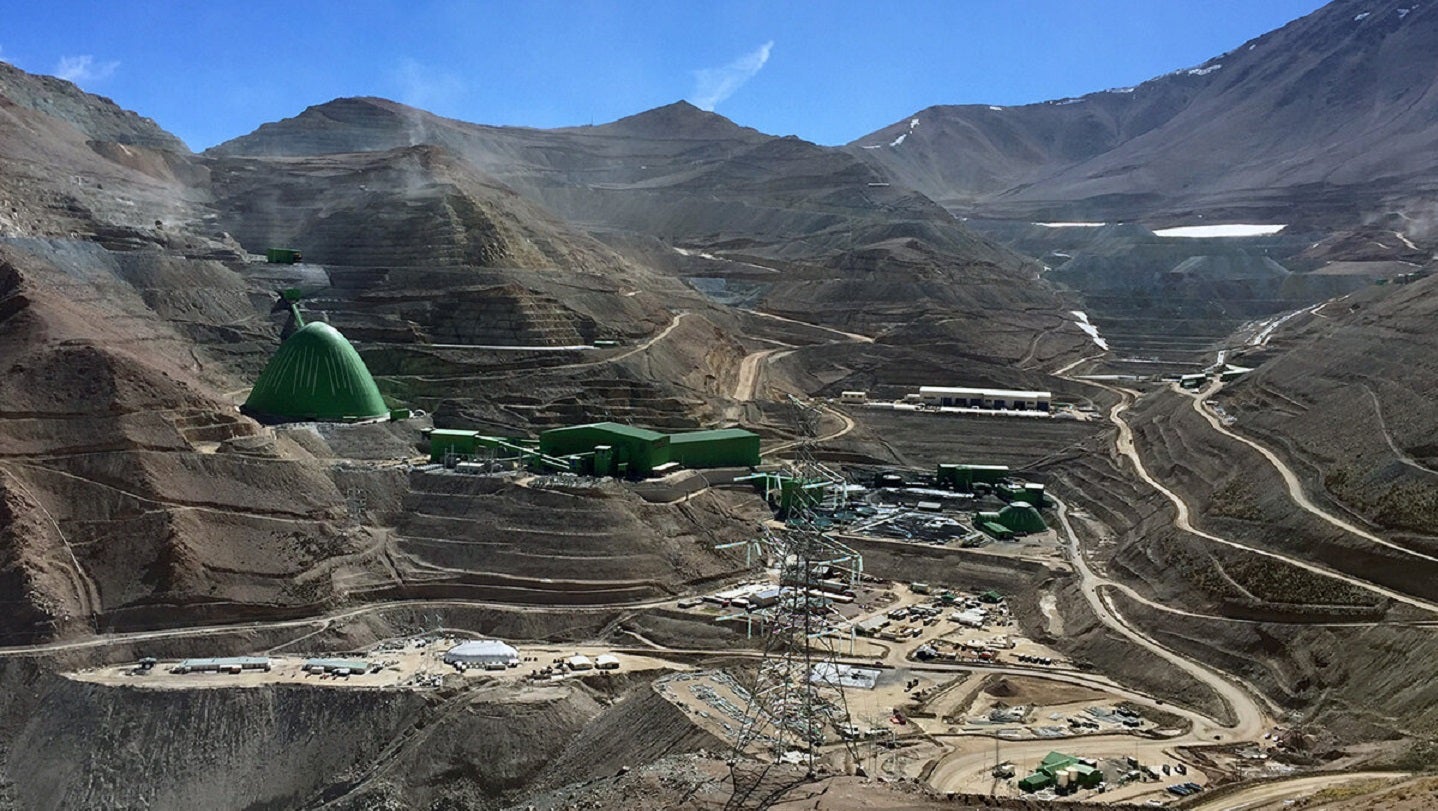

Canadian mining firm Lundin Mining has agreed to purchase a 51% stake in the Caserones copper-molybdenum mine in Chile from SCM Minera Lumina Copper Chile for $950m. The Caserones mine is located in the Atacama region of the northern Chilean Andean Cordillera and includes a traditional open pit mine, a conventional sulphide flotation plant, and a dump leach, solvent extraction and electrowinning plant. The acquisition gives Lundin Mining another long-life copper mine of significant size and with significant growth potential to its portfolio in a region where the company has extensive knowledge and experience. The deal also provides Lundin with an option to acquire an additional stake of up to 19% in the Caserones mine for $350m over five years. The purchase is part of JX Nippon Mining & Metals’ asset portfolio review as it seeks to transform into a technology-based entity.

Lundin Mining, a Canadian firm, has agreed to purchase a 51% stake in SCM Minera Lumina Copper Chile, the operator of the Caserones copper-molybdenum mine in Chile, for $950m. The stake will be acquired from JX Nippon Mining & Metals and several of its subsidiaries. The Caserones mine is located in the Atacama region of the northern Chilean Andean Cordillera and includes a traditional open pit mine, a conventional sulphide flotation plant, and a dump leach, solvent extraction and electrowinning plant. According to the deal, JX will receive an $800m upfront cash payment from Lundin Mining, as well as $150m deferred cash payment payable over six years.

Upon completion of the acquisition, Lundin Mining CEO Peter Rockandel stated that the company would add another long-life copper mine of significant size and with significant growth potential to its portfolio in a region where the company has extensive knowledge and experience. Additionally, Lundin will have the option to acquire an additional stake of up to 19% in the Caserones mine for $350m over five years, beginning on the first anniversary of the closing date.

Rockandel remarked that the initial controlling interest increases Lundin Mining’s exposure to a growing top-tier copper mining district, and the company retains the option to further increase its ownership at an attractive price over the next few years. The acquisition strengthens Lundin Mining’s position as a growing global producer of copper as the world transitions to a lower carbon future.

The sale is part of JX Nippon’s asset portfolio review, which aims to transform the company from an industry-based entity to a technology-based entity.

Don’t miss interesting posts on Famousbio