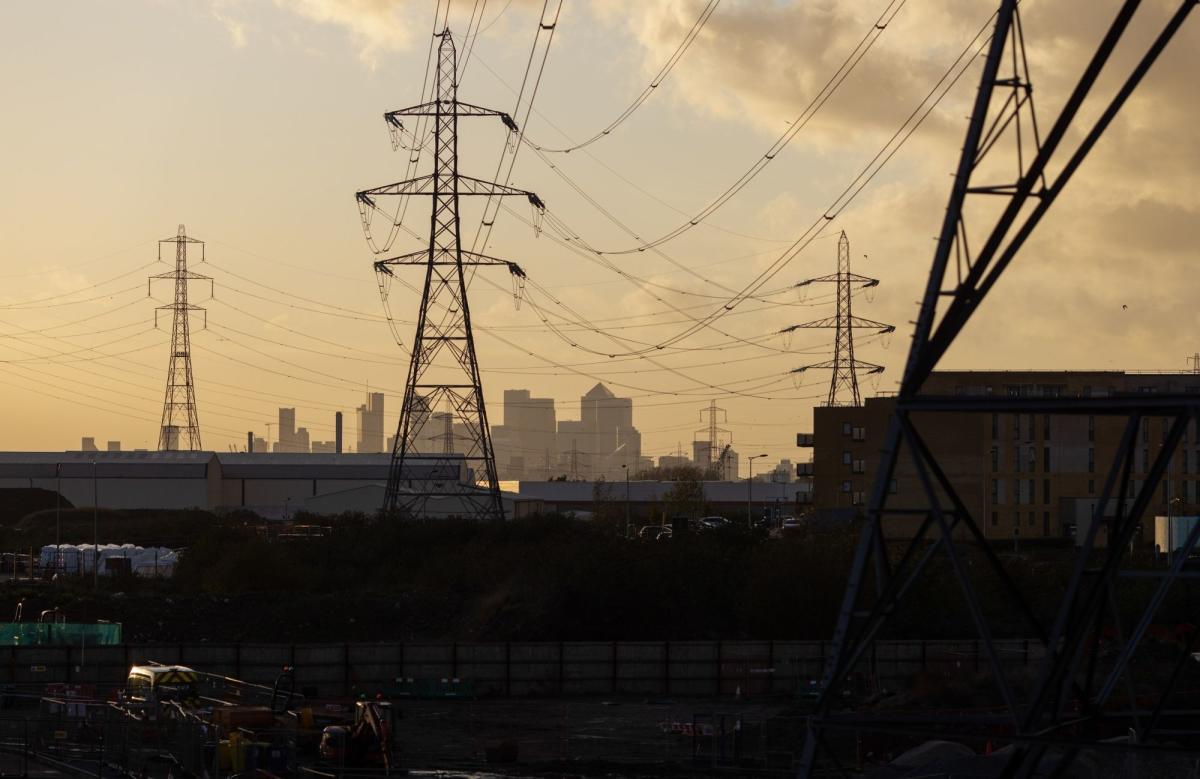

(Bloomberg) – British companies have averted the threat of “Armageddon” with defaults as the possible end of painfully high interest rates and the energy crisis looms large, according to the head of the government’s development bank.

Most read by Bloomberg

British Business Bank Chief Executive Officer Louis Taylor said the UK is escaping the significant spike in default rates many feared after last year’s market chaos caused by former Prime Minister Liz Truss’ budget.

The BBB – which managed the Covid-19 loan scheme – had warned last September that an economic downturn would likely lead to a spike in defaults as many companies ran into debt during the pandemic.

However, forecasters are expecting a shorter, flatter recession as wholesale energy prices fall to pre-war levels and there is a quiet return to UK markets. It raises the prospect of the UK avoiding a wave of defaults that would hurt both businesses and lenders.

“I wouldn’t say the picture is benign right now, but I don’t think it’s necessarily going to get much worse,” Taylor said in an interview. “The outlook is improving because people can see the peak in interest rates, the peak in inflation and the peak in energy prices, unlike three months ago. The default rates in our portfolio are not massively high.”

Taylor said he doesn’t see defaults picking up across the BBB portfolio and doesn’t expect a significant recovery despite recession warnings. He said the BBB is “certainly not experiencing the Armageddon” that people feared last fall when the Gilts crisis hit.

The Bank of England’s quarterly survey of credit conditions suggests banks expect default rates to rise in the first three months of 2023, particularly among smaller firms. However, despite the looming recession, lenders did not expect to drastically reduce the availability of credit for companies.

It came as the BBB’s venture capital arm said it had invested £1.3 billion ($1.6 billion) since it was founded five years ago to help boost the growth of young companies.

British Patient Capital said its investments helped create 5,000 additional jobs and three-quarters of companies said growth would not have been achieved or would have taken longer without the funding. BPC – which has pumped money into funds and co-investments – said it now manages just over £3 billion worth of assets.

Taylor said there was still a “major need” in the market for government-backed support and that the need for expanded intervention was “growingly recognised.”

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio