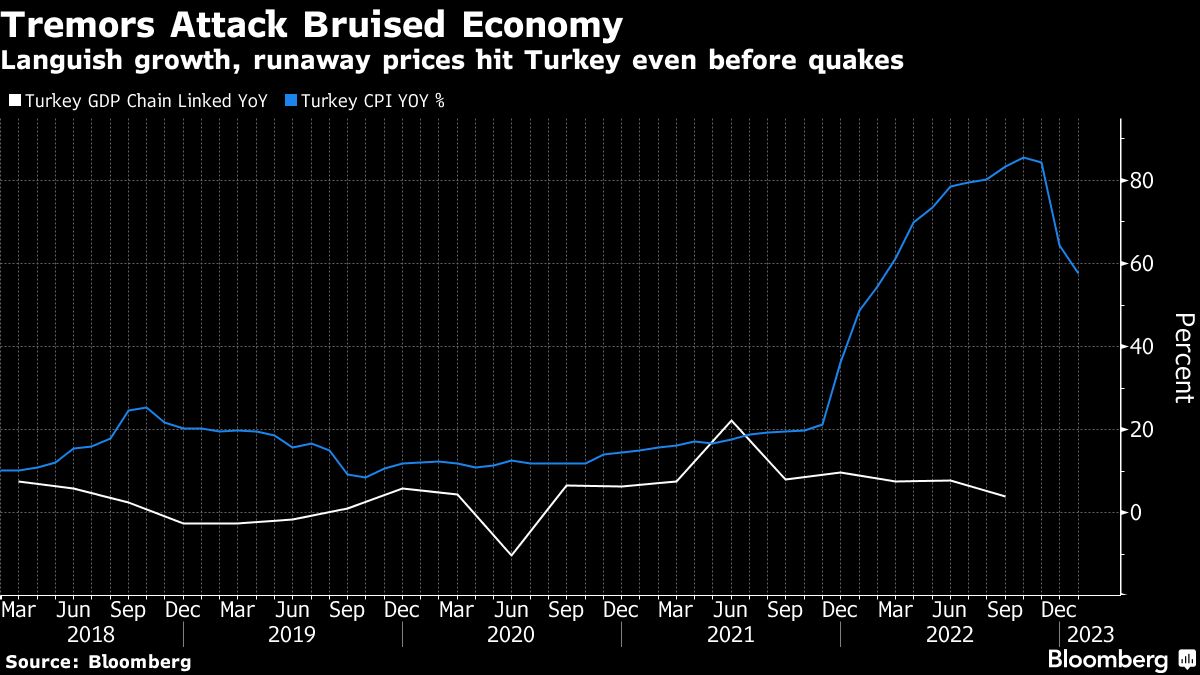

(Bloomberg) – A frightening financial circumstance will exacerbate the humanitarian situation led to by means of two earthquakes in Turkey, as early estimates of the wear and tear level to emerging inflation and monetary dangers.

Maximum learn by means of Bloomberg

Turkey suspended buying and selling on its primary substitute later a smart decline and assistance measures proceed to assistance the lira. In the meantime, Turkish monetary belongings, which stay unrestricted on actions, extensively stabilized, with some even gaining on Thursday.

Analysts are looking to gauge the precise have an effect on of Monday’s shocks on Turkey’s $819 billion economic system, which has been experiencing immense imbalances because of unorthodox insurance policies geared toward curtailing inflation age reducing rates of interest. The autumn in keep costs and the be on one’s feet in bond yields later the quake signaled fears about financial enlargement and overspending.

“The cost of this catastrophe is hitting Turkey’s economy at a time when sentiment was already fragile,” mentioned Nick Stadtmiller, product director at Medley World Advisors in Fresh York. It “also increases the risk of another market downturn given the already existing vulnerabilities in the currency and external account.”

Past the Istanbul Retain Change was once closed for a 2nd while, iShares MSCI Turkey UCITS ETF, an exchange-traded charity that tracks Turkish belongings in Europe and remains to be buying and selling, rebounded later 3 days of declines. As of 10:08 am in London, it was once up 0.5% later dropping 14% within the earlier 3 days.

The yield on Turkey’s brandnew buck bond maturing in 2033 fell 2 foundation issues to 9.80% on Thursday, from utmost day’s near of 9.61%.

The loss of life toll in Turkey and neighboring Syria crowned 16,000 Thursday morning, with hundreds extra trapped in structures broken by means of the tremors 3 days previous. Past the speedy center of attention is on bailouts, the want to construct cure plans forward of the Might elections is prone to put much more force on President Recep Tayyip Erdogan’s executive to get a hold of expanded spending plans.

Learn extra: Erdogan needs elections in Might in spite of earthquake fallout

As early as Wednesday, when Erdogan visited the affected subjects, there have been indicators of a metamorphosis in financial coverage and a most likely immense building up in spending. He mentioned a reconstruction blitz in 10 provinces can be finished inside a yr, introduced a distribution of 10,000 lire ($531) to each and every affected folk and mentioned tented survivors can be taken to beach accommodations may just.

“We are making a first rough estimate that public spending on Monday’s quakes could be equivalent to 5.5% of GDP,” wrote Bloomberg economist Selva Bahar Baziki. “A likely government-backed loan program could lead to a higher number,” which might lead to a breach of funds objectives.

EuroEco Temporary: Turkey earthquake spending may just succeed in 5.5% of GDP

The duty of estimating the precise have an effect on of the quakes is sophisticated by means of the area’s position in Turkey’s economic system. At the floor, the ten provinces toughest strike by means of the quake generate just a moderately small a part of GDP.

Alternatively, in addition they method an commercial and agricultural hall that performs a key position within the prosperity of Istanbul and alternative primary towns. Oxford Economics mentioned temporary disruptions to job within the 10 provinces lonely would save 0.3% to 0.4% of GDP.

“A relevant precedent for recent natural disasters could be the floods in Pakistan, which may have wiped out 5% to 10% of GDP and had an apparent negative impact on external account vulnerability,” mentioned Hasnain Malik, strategist at Tellimer in Dubai. “The impact is likely to be significantly smaller in Turkey in terms of GDP, but it adds to existing pressures on its balance of payments and currency.”

The wear and tear in agriculturally fertile subjects may just govern to meals shortages and building up inflation in a rustic the place the patron worth index is slightly below 60%. Erdogan’s important assistance for looser financial coverage has left costs unchecked, giving Turkey one of the crucial very best inflation charges on the planet.

The have an effect on of the tremors at the lira has been muted as far as foreign currency trading in a slender dimension has been in large part controlled by means of the government. They have got put in supportive measures and a layout of laws to counteract the consequences of Erdogan’s low rate of interest coverage at the foreign money.

“The lira is not the most accurate barometer of market sentiment towards Turkey as it continues to be supported by backdoor interventions,” mentioned Piotr Matys, senior analyst at In Contact Capital Markets. “The central bank is likely to come under even more pressure from the Erdogan government to cut interest rates to fund the recovery.”

In line with Todd Schubert, Head of Fastened Source of revenue Analysis at Storehouse of Singapore, Turkey’s ‘blue-chip’ company issuers have additionally held their very own with their global bonds, as maximum have diverse their companies with source of revenue denominated in euros or greenbacks. “While the earthquake was indeed a human tragedy, it is not an event that has a significant negative impact on credit performance,” he mentioned.

inflation hedge

For fairness buyers, the plunge within the benchmark Borsa Istanbul 100 Index has got rid of an noteceable hedge in opposition to inflation. Native patrons had parked cash in shares to trip out runaway worth enlargement, which crowned 85% once a year in October. A 3-year rally fueled by means of this determined call for got here to an result in 2023, sending the gauge onto its worst-ever efficiency.

Turkey suspends buying and selling at the keep substitute later the rout deepened

Past the earthquake reinforces the “general bearish tone” of Turkish shares, their long-term possibilities depends upon inflation, Erdogan’s “unorthodox policies” and the Might elections, in line with Nenad Dinic, an fairness strategist at Storehouse Julius Baer.

“Given the unknown direct and indirect losses from the earthquake, it will take several months to determine the economic impact,” mentioned Simon Quijano-Evans, important economist at Gemcorp Capital Control. “In the short term, the country will need urgent fiscal and monetary policy action, with international support a must to ensure stability across the region.”

(Updates markets and traits, provides Storehouse of Singapore statement)

Maximum Learn by means of Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio