[ad_1]

Asian Stocks Brace for Cautious Open Following US Market Plunge

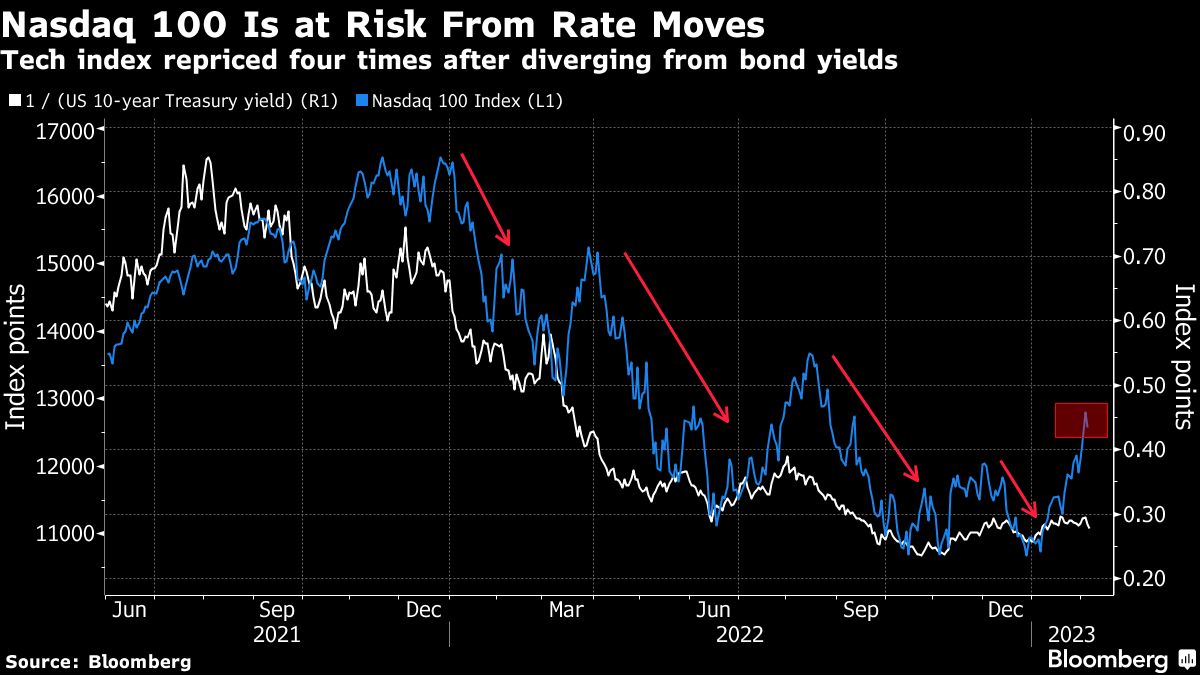

(Bloomberg) – Asian stocks appear poised for a cautious open after US stocks gave back part of their year-to-date gains amid bets on the Federal Reserve tightening its grip on monetary policy.

Most read by Bloomberg

Australian equities opened slightly lower, while futures for Japan and Hong Kong were little changed. US stocks came off overbought levels, with the S&P 500 and the tech-heavy Nasdaq 100 closing lower. Chinese companies listed in the US fell, with the Nasdaq Golden Dragon Index falling to its lowest level in more than two weeks.

Australian bonds fell in early trade on Tuesday after a slide in Treasuries pushed the policy two-year yield up 18 basis points on Monday. The Aussie and yen held losses from Monday after broad gains in the dollar pushed the greenback higher for a third day.

Investors are slipping into risk-aversion mode ahead of an interview later Tuesday by Fed Chair Jerome Powell, who could stress that optimism that the central bank will cut rates later in 2023 is likely misplaced. Atlanta Fed President Raphael Bostic said Monday that Friday’s strong payrolls data raises the possibility that the central bank will have to hike interest rates to a higher peak than policymakers had previously anticipated.

Treasuries extended their sell-off from Friday as traders increased their bets on future tightening after posting the best start to a year for cross-asset returns since 1987. Fed fund futures show another 25 basis point hike in March as a near-close deal while tied to a 75 percent chance of another in May. The odds of a June hike have also increased.

“Fed Chair Powell remains a huge joker every time he speaks,” said Chris Senyek of Wolfe Research. “Investors will be eager to see if he ‘undoes’ his very dovish tone from last Wednesday, particularly on the fiscal position and the ‘disinflationary process’ in the US. We still believe the Fed will be ‘higher for longer’.”

Read: Bond traders are quick to jump on the Fed’s view of peak interest rates

Traders in Asia will also be watching Australia’s rate decision on Tuesday for signs of how developed economies are tackling the global inflation spurt, with the central bank expected to tighten 25 basis points to 3.35%. Still, some economists are forecasting a rise of up to 50 basis points as policymakers struggle to contain price hikes.

There also doesn’t seem to be a quick fix to the stock flight raging Gautam Adani’s debt-ridden conglomerate. The meltdown since US short seller Hindenburg Research accused the Ports-to-Power group of fraud in a Jan. 24 report has wiped out $117 billion, or nearly half the market value of its businesses. Adani has repeatedly denied the claims.

Global markets caution is supported by geopolitical concerns. The US is preparing to impose a 200% tariff on Russian-made aluminum, while the US began recovering some parts of the Chinese balloon shot down by a warplane off the coast of South Carolina. Biden administration officials said the US was still trying to find out how much senior leaders in Beijing knew about the alleged spy mission.

JPMorgan Chase & Co. strategist Marko Kolanovic reiterated that equity investors should let out last week’s Fed-led rally, arguing that the US economy’s disinflationary process may be only “temporary”.

In late US trade, Pinterest Inc. tumbled on sales that missed estimates. Take-Two Interactive Software Inc., the video game publisher best known for the Grand Theft Auto franchise, lowered its guidance for fiscal 2023 bookings and provided disappointing guidance for the current quarter. Activision Blizzard Inc. reported bookings that beat forecasts due to a new release of Call of Duty as well as several other big titles.

Elsewhere, the yen fell Monday on a Nikkei report that the Japanese government had approached Bank of Japan deputy governor Masayoshi Amamiya to succeed Haruhiko Kuroda at the helm of the central bank. A sell-off in emerging markets deepened, with currencies posting their biggest two-day decline since March 2020.

Key Events:

-

US trade Tuesday

-

Fed Chair Jerome Powell interviewed by David Rubinstein Tuesday at the Economic Club of Washington

-

President Joe Biden delivers the State of the Union address before Congress on Tuesday

-

US Wholesale Inventories, Wednesday

-

New York Fed President John Williams will be interviewed at a live Wall Street Journal event on Wednesday

-

US initial jobless claims, Thursday

-

ECB President Christine Lagarde will attend the EU summit on Thursday

-

Bank of England Governor Andrew Bailey appears before the Finance Committee on Thursday

-

University of Michigan consumer sentiment, Friday

-

The Fed’s Christopher Waller and Patrick Harker speak on Friday

Some of the key market movements as of 8:29 am Tokyo time:

Shares

-

Hang Seng futures were little changed

-

Nikkei 225 futures were little changed

-

S&P/ASX 200 down 0.1%

-

The S&P 500 futures were little changed. The S&P 500 fell 0.6%

-

Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.9%

currencies

-

The Bloomberg Dollar Spot Index rose 0.6% on Monday

-

The euro was little changed at $1.0726

-

The yen was little changed at 132.71 per dollar

-

The offshore yuan was little changed at 6.8034 per dollar

cryptocurrencies

-

Bitcoin was little changed at $22,903.72

-

Ether fell 0.2% to $1,635.39

Bind

raw materials

This story was created with the support of Bloomberg Automation.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

[ad_2]

Don’t miss interesting posts on Famousbio