The Impact of Kuroda’s Departure from Japan’s Bond Market: What to Expect from the Next BOJ Governor

(Bloomberg) – Bank of Japan Governor Haruhiko Kuroda is coming to the end of his 10-year term. His successor inherits a bond market that’s bigger than ever but riddled with wild distortions. The ongoing question for Japan is how the central bank can normalize monetary policy.

Most read by Bloomberg

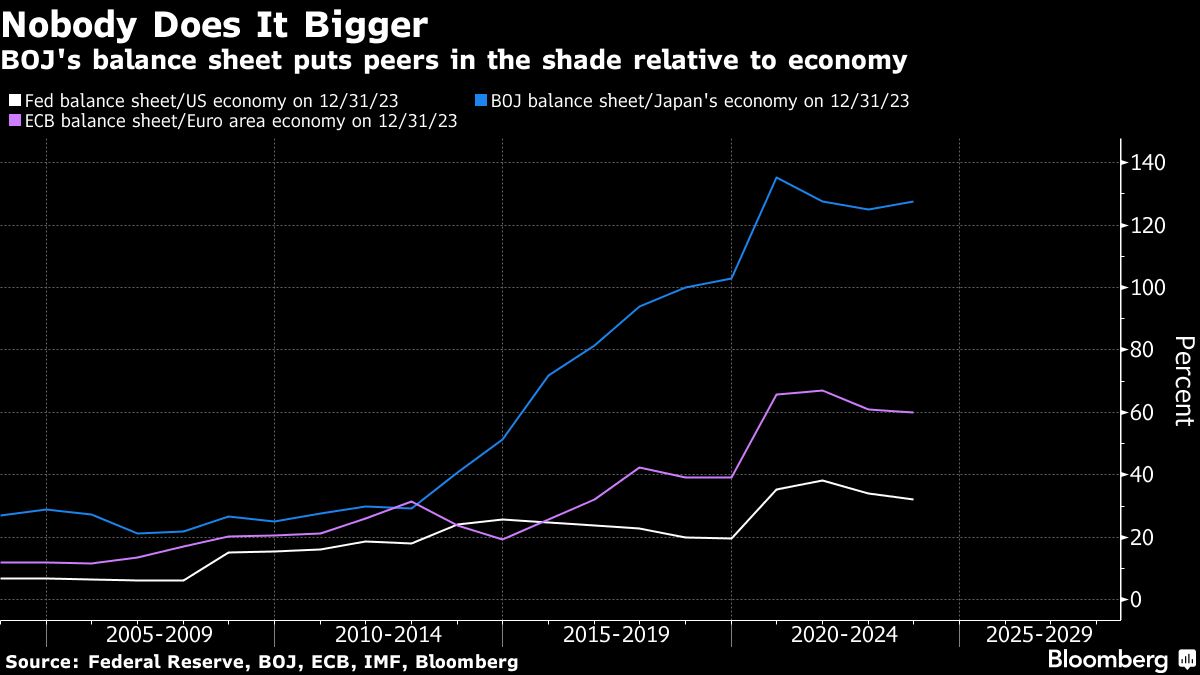

The BOJ’s balance sheet, relative to the economy, was once about the same size as that of the Federal Reserve and the European Central Bank. Now its assets are worth well over 100% of Japan’s gross domestic product.

Japan’s bonds, valued at more than 1,000 trillion yen ($7.6 trillion), represent the world’s largest developed bond market, excluding US Treasuries. The BOJ’s holdings of long-term government securities (excluding T-bills) rose to 535.6 trillion yen at the end of the third quarter, accounting for nearly 80% of its assets at the time.

How the BOJ is getting a new governor and why it matters: QuickTake

The central bank also owns more than half of the bond market. Foreigners increased theirs as the BOJ’s negative interest rates made the yen cheap, prompting the Japanese to pay a premium to get their hands on US dollars.

The bottom line is that trading conditions are a mess, particularly for the 10-year notes aligned under curve control. The BOJ now officially owns more than 100% of the last three benchmark 10-year bonds, resulting in significant gaps between the yields of these securities. At the same time, swap rates rose sharply to underscore market expectations that yield caps are about to end.

Wild yield gaps are another sign of bond distortion caused by BOJ

The yield curve itself – Japanese government bond rates across a range of maturities – is striving to retrace towards its pre-Kuroda levels. Right now, BOJ policy is creating a highly unusual kink where 10-year yields are below those of the seven-to-nine-year range.

The curve is also in sharp contrast to those in the US and Germany, two of the traditional magnets for global rates markets. Looking at the gap between 5 and 30 year yields (to escape the tightly controlled 10 year space), the JGB curve was smoother and often flatter for most of the period. Now that Kuroda’s ten-year tenure is coming to an end, it’s getting steeper as the US and German gauges reverse.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio