[ad_1]

Ukraine’s Crop Deal Stalls as Russia Delays Ship Inspections

(Bloomberg) – From his post at the mouth of the Black Sea, Ukrainian ship inspector Ruslan Sakhautdinov has watched his Russian counterparts repeatedly slow his country’s flow of grain abroad – from checking fuel gauges to crews’ personal belongings.

Most read by Bloomberg

Last year’s landmark agreement to reopen some Ukrainian ports for essential food exports included a requirement that joint teams from Ukraine, Russia, the United Nations and Turkey inspect each vessel. The idea is to prevent unauthorized cargo or passengers from boarding and disembarking.

But Ukrainian traders and authorities say Russia is deliberately slowing the pace by exceeding the limits of that mandate and cutting personnel. Sakhautdinov said Russian team members finish work at 3:30 p.m., halting the day’s inspections. The number of ships laden with grain that had to evacuate the corridor in January fell to its lowest level since August’s launch.

The US has also blamed Russia for the slowdown, while Moscow says the backlog was artificially created by Ukrainian companies.

Exports from Ukraine are vital to feeding the world’s hungry and relieving pressure on cost inflation. The Grain Corridor has already played an important role in shipping significant volumes and helping bring global food prices down from records set after the Russian invasion. But the delays are hurting farmers’ incomes and increasing costs for traders, making it increasingly difficult to grow and ship Ukrainian crops.

“There are daily delays in inspecting ships as the Russian side exceeds its powers on inspections, which is outside the scope of the Grains Initiative,” Sakhautdinov said.

The volume of harvests handled on ships from Ukraine fell to 3.1 million tons in January, just below the target of 5 million tons. Bad weather has also blocked work at the Joint Coordination Center in Istanbul, which facilitates grain trade, for a few days.

Three inspection teams have been deployed since November, up from four or five in previous periods, according to the United Nations. They cleared an average of 2.7 ships loaded with grain daily in January, compared to 3.4 in December.

JCC procedures require ships and inspectors to review a variety of details, from cargo manifests to crew lists to fuel oil consumption reporting.

The number of outbound ships handled in a day peaked at 46 on October 31, when Russia briefly withdrew from the deal and ships without its involvement were inspected.

Nibulon Ltd., a major Ukrainian grain trader, has shipped more than 400,000 tonnes through the corridor but said the restrictions mean exporters and producers are suffering significant losses.

In his experience, inspections can be canceled due to Russian inspectors’ dissatisfaction with the ship’s equipment, including the nationality of the crews. Discrepancies between fuel levels reported on documents and the actual amount on board — which are difficult to predict in advance — can hold ships back, it said.

International dealer Archer-Daniels-Midland Co. also said ship inspections have become a major bottleneck recently while it conducts the process.

“Russians use various administrative pretexts to refuse to issue a permit to transit the Bosphorus,” Andriy Vadaturskyy, chief executive of Nibulon, said via email. “Customers around the world are having to wait much longer while consumers face shortages and higher prices.”

A queue of 114 ships awaited inspection or joining the initiative as of February 1, according to the JCC. That compares to 96 at the end of December.

The UN on January 18 called on all parties to “improve operational efficiency” and reduce the backlog. Russia’s Foreign Ministry said the buildup was due to Ukrainian companies chartering ships that violate agreed rules and times for registration and participation.

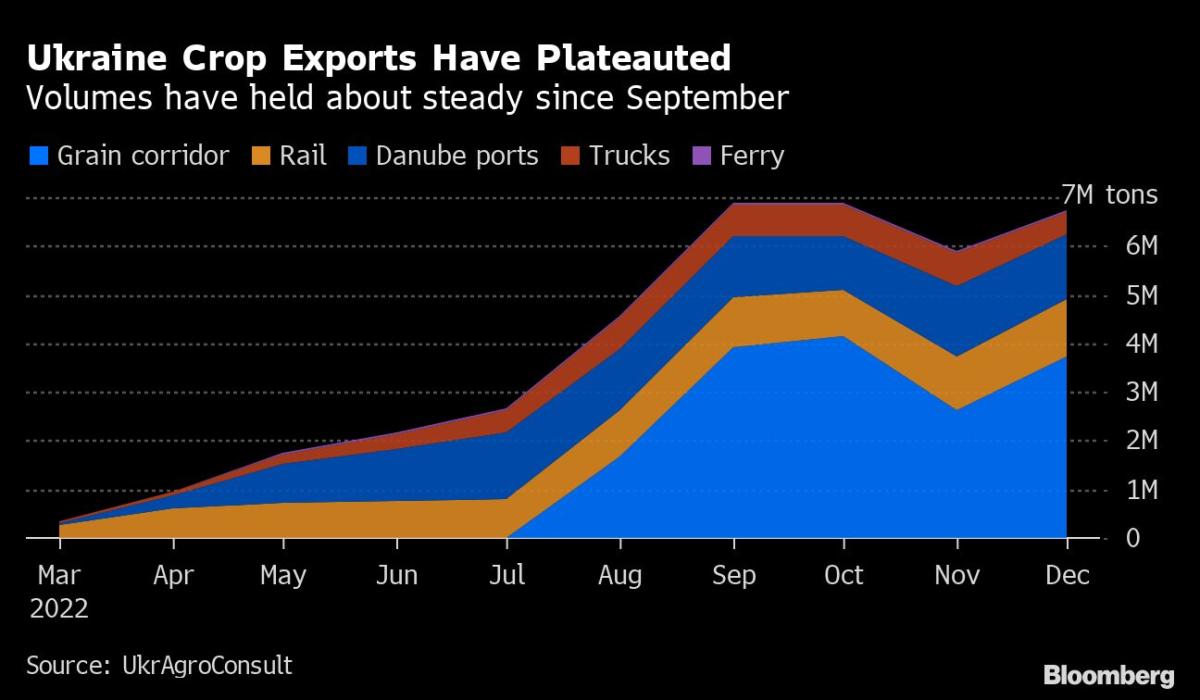

Ukraine has tried to increase volume in other ways, such as prioritizing larger ships. It is also still shipped via rail and road routes, although these are lengthy and the influx of grain has provoked the wrath of Eastern European farmers.

Its Black Sea crop exports peaked in October at about 4 million tons, data from UkrAgroConsult shows. The initiative is set to be renewed in March, and uncertainties about its longevity could also impact flows.

Dmitry Timotin from the agency Inzernoexport GmbH in Odessa arranges the calls of ships in ports. One he worked on – the Akson Sara – waited nearly six weeks for embarkation and another after disembarkation before sailing to Egypt in December with Ukrainian corn. The delays meant the trader had to pay the shipowner an additional $1 million for a cargo worth about $9 million, he estimates.

Trade challenges raise hurdles for farmers, who traditionally ship two-thirds of their grain abroad. Growers are already struggling with power outages and mined land, and exports are 29% behind last season. The Ukrainian Grain Association forecasts half of the pre-war level for this year’s harvest.

“The initiative should work as planned, transporting 5 million tons of food per month,” US Ambassador Linda Thomas-Greenfield said in a January speech to the UN Security Council. “The starving of the world deserve nothing less.”

–With the support of Tarso Veloso and Olesia Safronova.

(Adds the latest export dates in the penultimate paragraph.)

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

[ad_2]

Don’t miss interesting posts on Famousbio