The Rise of Adani Group Stock: Evidence in the Options Market

(Bloomberg) – The sell-off in Adani Group shares drags into a third week despite efforts to contain the contagion, prompting a spate of bets in the options markets that could give traders clues as to how long the declines will last become.

Most read by Bloomberg

Six of the group’s 10 stocks slid on Monday, adding to losses to around $117 billion since US short seller Hindenburg Research launched fraud allegations against the conglomerate on Jan. 24. Billionaire Gautam Adani and his family have raised $1.11 billion in equity-backed loans

The following four charts show how the options market is positioned and depict some price levels that are likely to inform investors about the tactical outlook for the group’s shares:

1. Option ‘Walls’

The shares of the flagship Adani Enterprises Ltd. are down about 50% since Hindenburg released its short-selling report on Jan. 24, the steepest decline of the group’s four derivatives-backed stocks. Still, they have recovered from their intraday low of around 1,017 rupees set on Friday.

Friday’s low is notable as it lies between the 1,000 and 1,100 levels where there is the highest concentration of put options expiring in February based on data compiled by Bloomberg. If the stock falls below that, selling pressure could mount.

Similarly, the top of the current trading range appears to be between 2,500 and 3,000 where there is the largest accumulation of call options, suggesting investors will be able to buy around these levels if the stock trades above the strikes, according to data compiled by Bloomberg.

The puts and calls expire on February 23, setting the stage for a scramble in about two weeks.

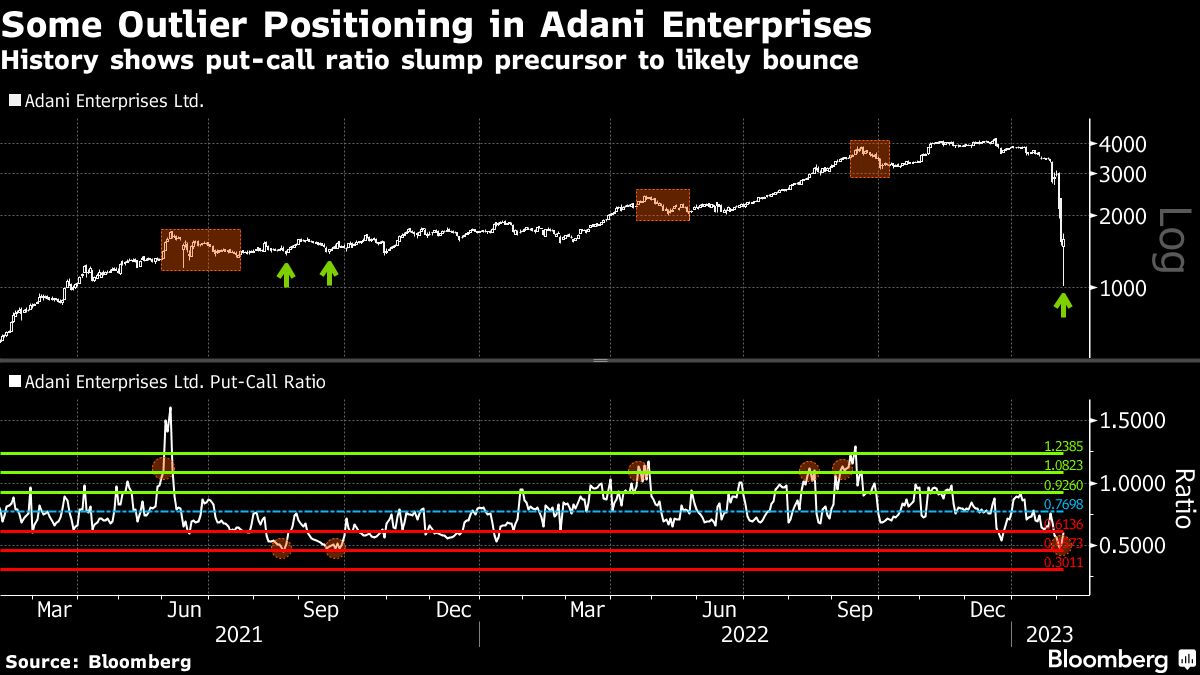

2. Put-call ratio

The ratio of put-to-call options on Adani Enterprises, as measured by open interest, slipped to a six-month low over the past week and briefly fell about two standard deviations below the 24-month moving average. Whenever the ratio has broken through this level in the past, stocks have reversed, according to data compiled by Bloomberg based on regression analysis.

The decline in the put-call ratio for the group’s flagship stock is due to more calls being created relative to puts, suggesting institutions selling calls are confident the stock will either move sideways or continue will fall. At the same time, however, history shows that when the market becomes too confident about favoring one direction, the opposite tends to take place.

3. Aggregate Positioning

The aggregate put-call ratio for the combination of the four Adani Group stocks linked to derivatives – Adani Enterprises, Adani Ports & Special Economic Zone Ltd., ACC Ltd. and Ambuja Cements Ltd. – has yet to reach the level where it could be considered extreme. Therefore, on a broader group basis, the recovery may still have room to run.

Adani Ports and ACC both rose for a second day on Monday.

The combined put-call ratio for the group, based on open interest, ended last week at 0.89, about two standard deviations above the two-year average. Another rise, pushing the ratio to three standard deviation levels, would mean that put option sellers have become overly confident of another rally, which could pave the way for a pullback.

4. Technical position

Last Friday’s Adani Enterprises low is also significant from a technical standpoint as it contains multiple levels of support. The area around the bottom includes the 78.6% Fibonacci retracement level of the stock’s 3,500% rally from early 2020 to the record high in December, and is also where the volume-weighted average price since the pandemic bottom lies.

On the upside, stocks are likely to face resistance between 1720 and 1920 where there are so called “polarity levels” of 2021 and 2022. If these barriers are not cleared, a break below the Fibonacci support level around 988 can further encourage bears. In that case, shares could slide to support at the 88.6% Fibonacci retracement line around 580, down more than 60% from Friday’s close.

“It’s important to remember that stocks hit by a crisis after skyrocketing valuations need time to consolidate, to defuse negative sentiment before the next bull market begins,” said Jai Bala, chief market engineer at Cashthechaos. com, an independent market consulting firm. The nature of the next tactical move will provide an indication of how much damage has been done on the longer-term frame charts, he said.

Most Read by Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio