The Canada Income Company (CRA) is being taken to court docket for disputing transit staff’ work at home bills, even if the employees had been running remotely because the pandemic started. The Amalgamated Transit Union (ATU) is arguing that the CRA must reimburse its contributors for his or her work at home bills as in keeping with the Canada Extremity Salary Subsidy Program. The ATU claims that the CRA isn’t permitting transit staff to say for domestic place of job bills, and isn’t spotting the visits they put together to coach operators’ properties to grant technical backup and aid. The ATU is looking for an injunction in opposition to the CRA to pressure the company to acknowledge those bills.

Jamie Golombek: In line to deduct non-refundable meals and accommodation bills, a number of situations should be met

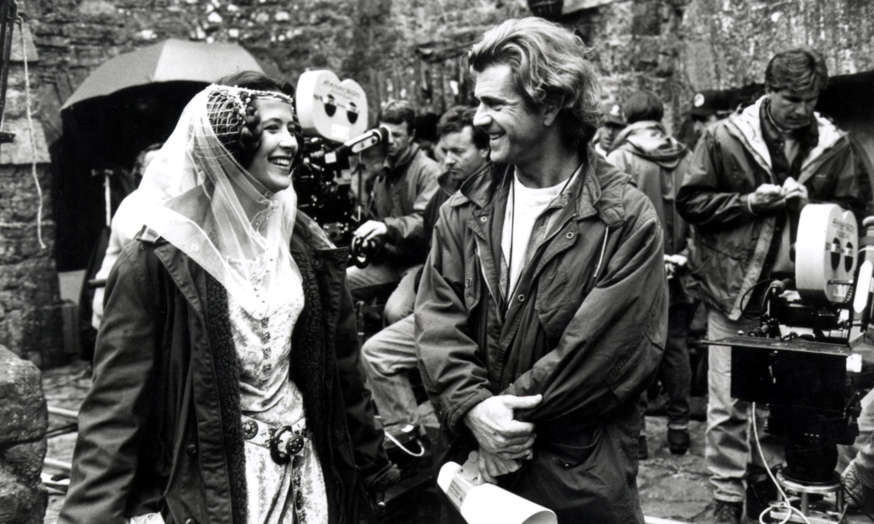

A Progress educate at Union Station in Toronto. Photograph by way of Peter J. Thompson/Nationwide Put up

Evaluations and proposals are impartial and merchandise are independently decided on. Postmedia would possibly earn an associate fee from purchases made via hyperlinks in this website online.

Some taxpayers effort to write down off the price of commuting to paintings as a deductible expense for tax functions. Alternatively, barring uncommon exceptions, those bills can be denied since the Canadian tax authority normally considers the price of commuting between domestic and paintings to be non-deductible non-public bills.

This advert has no longer but loaded, however your article continues under.

SIGN UP TO UNLOCK MORE ARTICLES

Assemble an account or plank in to proceed your studying revel in.

- Get admission to pieces from throughout Canada with one account

- Percentage your ideas and attach the dialogue within the feedback

- Experience spare articles in keeping with moment

- Obtain e-mail updates out of your favourite authors

However what if you make a decision to stick in a lodge close your employer’s place of job throughout the paintings hour to attenuate your day by day shuttle? Are you able to write off the price of your lodging in conjunction with the price of foods should you reside alike to the place you’re employed? Smartly, you’ll unquestionably effort. An Ontario taxpayer did this and just about were given away with it till the CRA challenged the taxpayer’s employment prices and the subject ended up within the tax court docket.

Monetary Put up manage tales

Through clicking the subscribe button, you conform to obtain the above e-newsletter from Postmedia Community Inc. You’ll be able to unsubscribe at any future by way of clicking at the unsubscribe hyperlink on the base of our emails or any e-newsletter. Postmedia Community Inc | 365 Bloor Boulevard East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thank you for registering!

The original case concerned a commuter educate operator for GO Transit, the regional crowd transit provider for the larger Toronto and Hamilton branch. The activity required him to paintings from numerous educate stations throughout Ontario. The taxpayer usually resided in Prince Edward County, and the corporate’s domestic terminal used to be Union Station in Toronto.

This advert has no longer but loaded, however your article continues under.

The taxpayer reported taxable source of revenue of $130,640 in 2014 and $110,729 in 2015 and claimed exertions bills of $17,604 and $20,408, respectively, on his tax go back. Employment bills consisted in large part of accommodation bills (about $11,000 in 2014 and $14,700 in 2015) and foods (just about $6,000 in 2014 and $5,700 in 2015).

The CRA first of all assessed his 2014 and 2015 tax returns as filed, however the company due to this fact reassessed the taxpayer in 2016 and distributed all of his employment bills for each years.

The taxpayer defined that as a commuter educate operator, it used to be obliged to paintings from numerous stations which might be a part of the GO Transit community. All through the trial, the taxpayer testified that on a regular paintings hour, he would let go his domestic in Prince Edward County on Sunday afternoon and pressure to Oshawa, no longer returning domestic till Friday night time nearest the extreme shift of his hour. The riding distance between his domestic and Oshawa is ready 160 kilometers, which corresponds to a riding future of just about two hours.

This advert has no longer but loaded, however your article continues under.

The taxpayer went on to give an explanation for that he usually started and completed his paintings on the Oshawa GO station in lieu than his employer’s domestic terminal in Toronto. When he wasn’t domestic, he infrequently stayed at a lodge close the Oshawa GO station or in Pickering, the place he leased an condominium close the GO station for a duration of six or seven months in 2014 for $9,500 leased. He leased any other condominium in Pickering in 2015 at a price of $5,520 and commuted from there to the GO station in Oshawa, the place he labored.

There’s a particular provision within the Source of revenue Tax Act that permits delivery employees who’re continuously required to be clear of their domestic municipality to deduct unreimbursed meals and accommodation bills. In line with the intention to deduct those prices, a number of situations should be met.

This advert has no longer but loaded, however your article continues under.

First, the foremost job of the employer should be the delivery of folk, items or a mixture of each. The taxpayer could also be required to proceed continuously clear of the municipality the place the employer’s playground of commercial is positioned (ie the place the taxpayer is registered as paintings). As well as, the taxpayer should progress in cars impaired by way of the employer to move the ones items or folk. In any case, the taxpayer’s paintings tasks should oblige him to grant meals and accommodation presen he’s clear of his domestic municipality.

The worker on this case had a duly finished and signed Canada Income Company Method T2200, Commentary of Statuses of Employment, on which his employer showed that he used to be required to pay numerous sorts of bills that will no longer be reimbursed to him. Below the “Terms of Employment” division, his employer indicated that he needed to progress to places alternative than his playground of commercial during appearing his employment tasks.

This advert has no longer but loaded, however your article continues under.

The method additionally famous that the employer required the laborer to avoid the public and metropolitan branch the place he robotically reported for paintings for 12 consecutive hours. His employer said on Method T2200 that he does no longer reimburse his staff for exertions prices.

The worker additionally finished signed copies of the particular method for transit employees, Method TL2, Claims for Foods and Accommodation, which the taxpayer incorporated along with his 2014 and 2015 tax returns.

-

The CRA disputes the taxpayer’s headhunter charges, however the pass judgement on disagrees

-

CRA sues in court docket nearest refusing to pay kid backup as tax-deductible

-

An Alberta taxpayer is trying to say parking bills as scientific bills

-

CRA is cracking down on COVID get advantages bills, a taxpayer discovered

This advert has no longer but loaded, however your article continues under.

All through his testimony, the taxpayer testified that his day by day paintings shift used to be greater than 12 hours a occasion, and he supplied knowledge on explicit routes to turn out it. But if he cross-examined his day by day paintings shift, the taxpayer discovered “many of his trips were under 12 hours and were subject to split shifts with break times.”

In accordance with the proof, the pass judgement on stated the taxpayer failed to turn that his employment tasks required him to progress continuously from Oshawa and from the metro branch the place his employer is primarily based, which might incur prices for foods and accommodation. The pass judgement on ambitious that Oshawa is within the Durham pocket, which is within the larger Toronto branch. The taxpayer used to be subsequently not able to turn out that the employment prices he claimed had been incurred outdoor the metropolitan branch by which he labored.

“The deductions … (are) not intended for workers who, for personal reasons, choose not to return home at the end of each workday,” the pass judgement on concluded.

Jamie Golombek, CPA, CA, CFP, CLU, TEP, is Managing Director, Tax & Property Making plans at CIBC Non-public Wealth in Toronto. [email protected].

____________________________________________________________

When you appreciated this tale, join extra within the FP Investor E-newsletter.

____________________________________________________________

Feedback

Postmedia strives to conserve a full of life however civilized dialogue discussion board and encourages all readers to percentage their reviews on our articles. Feedback would possibly take as much as an date to be moderated sooner than they seem at the website online. We ask that you simply secure your feedback related and respectful. We’ve became on e-mail notifications – you’ll now obtain an e-mail whilst you get a answer for your remark, there’s an replace on a remark thread you apply, or when a consumer you apply feedback follows. For more info and main points on find out how to customise your e-mail settings, see our Nation Pointers.

Supply: financialpost.com

Don’t miss interesting posts on Famousbio