Adani to Prepay Over $1 Billion in Debt to Stabilize Stock Market Amid Meltdown

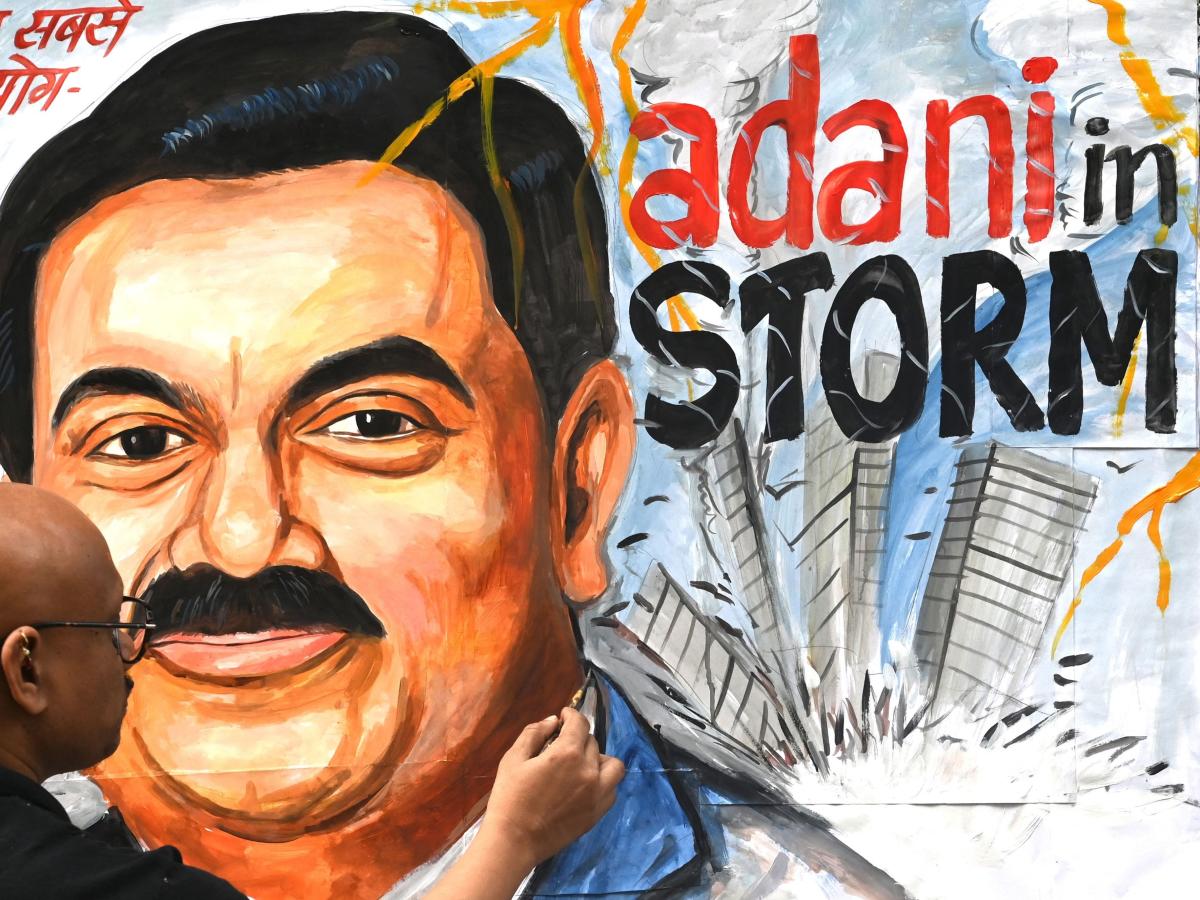

A painting of Indian businessman Gautam Adani.Indranil Mukherjee/Getty Images

-

Embattled Indian conglomerate Adani Group is repaying $1.1 billion in debt ahead of schedule.

-

It is scrambling to halt a stock market crisis that has wiped out over $110 billion in market value in the past two weeks.

-

The sell-off came after US short seller Hindenburg Research accused the group of market manipulation and fraud.

The Adani Group said on Monday it would prepay more than $1 billion in debt to boost investor confidence after its companies were hit by a two-week stock market crisis.

The Indian conglomerate said in a statement that it plans to repay just over $1.1 billion in loans ahead of their scheduled September 2024 maturity.

The bonds were backed by Adani Ports, Adani Green Energy and Adani Transmission – three of the group’s companies whose share prices have plummeted over the past two weeks.

The sell-off came after US-based short seller Hindenburg Research released a sizzling report accusing Adani of “pulling off the biggest fraud in the company’s history” through “brazen stock manipulation and accounting fraud.”

Adani has denied Hindenburg’s allegations – but the report nonetheless sparked a massive stock market crisis that wiped more than $110 billion in market value from the group’s 10 public companies in just two weeks.

The market turmoil has also wiped out chairman and founder Gautam Adani’s personal fortune of over $60 billion.

At the time of Hindenburg’s report, he was the third-richest person in the world, but in the two weeks that followed, he slipped to 21st, according to the Bloomberg Billionaires Index.

By repaying the loan early, he could be trying to demonstrate to investors that he still has significant financial muscle despite the ongoing sell-off.

Adani said it prepaid its debt “in light of recent market volatility and in continuation of the promoters’ commitment to reduce the promoters’ overall debt secured by Adani’s listed shares.”

Continue reading: Everything you need to know about Gautam Adani and Hindenburg after the short seller’s cheating allegations burned a $72 billion hole in the wealthiest Asian man’s empire

Read the original article on Business Insider

Don’t miss interesting posts on Famousbio