Technology has brought significant advancements to the insurance industry. Insurance companies use technology to analyze enormous amounts of data and prevent fraud. Insurers leverage AI technologies like machine learning for risk management purposes, and companies like Allstate have implemented a system that uses data gathered from third-party sources. Blockchain is also becoming an increasingly popular tool for these companies; it enables them to securely store and manage vast amounts of sensitive data, allowing them to identify and settle claims more quickly and accurately. Moreover, legacy system modernization is a primary way the Big Four leverage technology, helping them stay competitive within their respective regions and on an international scale. The insurance industry is following in the footsteps of the food and retail industries in offering self-service to their customers. They use technology to automate processes such as claims, customer service inquiries, and payments, to provide faster service and better customer engagement.

How Insurance Companies Use Technology

Insurance companies are using technology to improve their processes and services in various ways. Below are some of the most interesting ways they are doing so:

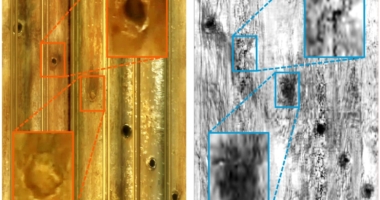

Classifying Claims Images

Insurance companies are using machine learning algorithms to identify and classify images related to the claims process, such as photographs of damaged property taken by claimants. This technique automates the analysis of large amounts of data, allowing insurance companies to quickly evaluate the images submitted and process the claim more efficiently.

Reducing a Substantial Amount of Paperwork

Thanks to new digital upgrades and the introduction of technologies such as virtual policies and forms to cloud storage, insurance companies have said goodbye to much of the paperwork involved in insurance processes. This has resulted in more forgiving processes for consumers and optimization of company resources.

Restructuring Car Insurance With Telematics

Telematics has allowed insurance companies to offer personalized pricing and policies by tracking a driver’s behavior on the road through a device installed in their car. This technology allows insurance companies to incentivize safe driving habits and reduce the risk of accidents, resulting in lower premiums for good drivers.

Improving Customer Service and Reducing Costs

Insurance companies are using chatbots, virtual assistants, and AI-powered customer service solutions to improve customer service and reduce costs. These technologies enable companies to provide instant responses to customer inquiries and automate routine tasks, freeing up customer service representatives to handle more complex issues.

Making the Process Fast and Friendly

Insurance companies are using technology to simplify and streamline the insurance process, making it faster and more user-friendly. For example, some companies are using mobile apps to allow customers to easily submit claims and track their progress in real-time.

Analyzing Data

Insurance companies are using data analytics to gain insights into customer behavior, claims trends, and risk assessment. By analyzing large amounts of data, insurance companies can make more informed decisions and offer more targeted products and services.

Settling Self-service Claims

Self-service claims technology allows customers to submit and track their claims online without the need for a customer service representative. This technology saves time and money for both the insurance company and the customer.

Streamlining With Robotic Process Automation (RPA)

Insurance companies are using robotic process automation (RPA) to automate routine tasks and reduce the risk of human error. RPA technology can be used for tasks such as data entry, claims processing, and underwriting.

Evaluating Risk With Machine Learning

Machine learning algorithms are being used to evaluate risk and predict future claims. This technology enables insurance companies to make more accurate risk assessments and offer more personalized policies.

Detecting Fraud

Insurance companies are using machine learning algorithms to detect fraudulent claims. By analyzing patterns and anomalies in claims data, insurance companies can identify potentially fraudulent claims and investigate them further.

Bettering the Underwriting Process

Insurance companies are using data analytics and machine learning algorithms to improve the underwriting process. This technology allows insurance companies to make more accurate risk assessments and offer more personalized policies.

Storing Info Safely on the Blockchain

Insurance companies are using blockchain technology to store customer data securely and transparently. By using a decentralized ledger, insurance companies can ensure that customer data is tamper-proof and easily accessible.

Modernizing Legacy Systems

Insurance companies are upgrading their legacy systems to modern technology to improve their processes and services. By modernizing their systems, insurance companies can reduce costs, improve efficiency, and offer better products and services to their customers.

Technology and Car Insurance

Car insurance companies are using telematics technology to offer customized coverage and premiums based on a customer’s driving profile. Usage-based insurance (UBI) involves using a tracking device that collects data on mileage, driving patterns, speed, acceleration, hard braking, and erratic driving. By analyzing this data, insurance companies can offer significant discounts to safe drivers, with some companies claiming savings of up to 40%.

Most insurance companies provide a UBI program, including Allstate’s Drivewise, American Family’s KnowYourDrive, and Progressive’s Snapshot. By using UBI, insurance companies can provide better rates and coverage to their customers, while also incentivizing safe driving habits.

Insurance companies are also using technology to improve customer service and reduce costs. Automation of processes such as claims, customer service inquiries, and payments can improve accuracy, reduce processing times, and eliminate errors. Digital marketing techniques such as chatbots and automated systems can also facilitate customer acquisition and engagement.

Technology is also being used to make the insurance process fast and user-friendly. Pet insurance companies like Spot Pet Insurance use online quote and enrollment processes to allow pet owners to easily get a quote and sign up for coverage without speaking with an agent or filling out lengthy paper forms. Claims can also be submitted and tracked online through the company’s portal, with most claims processed and paid within two days.

Finally, insurance companies are using data analytics to gain insights into customer behavior, claims trends, and risk assessment. By analyzing large amounts of data, insurance companies can make more informed decisions and offer more targeted products and services to their customers.

In conclusion, the use of technology in the insurance industry is revolutionizing the way insurance companies offer coverage and interact with their customers. By using telematics technology, automation, and data analytics, insurance companies can offer more personalized coverage and improve customer satisfaction while reducing costs.

Technology and Insurance Companies

Insurance companies use technology to collect and analyze vast amounts of data to better understand risk factors and price policies more accurately. Analyzing data can also help insurance companies process claims and detect fraudulent activities faster and more accurately.

Self-service technology is also being implemented in the insurance industry. With this technology, insurance companies can save time and costs while also offering responsive and personalized experiences to their customers. Robotic Process Automation (RPA) is another technology that insurance companies are using to automate routine and mundane tasks, freeing up staff time for other important tasks.

Machine learning is also being used to evaluate risk and price insurance premiums more accurately. Using predictive analytics, insurers can determine a customer’s risk profile and estimate expected losses from different events. Machine learning can also be used to identify fraudulent activity, reducing losses from fraudulent claims.

Insurance companies are also using technology to improve the customer experience. By using chatbots and automated systems, insurance companies can provide faster service and better customer engagement. Additionally, data analytics can help insurance companies better understand customer needs and preferences and better target their advertising campaigns.

In conclusion, technology is revolutionizing the insurance industry, enabling insurance companies to provide better service, reduce costs, and offer more personalized coverage to their customers. With the use of big data, machine learning, and automation, insurance companies are able to make more informed decisions, improve risk assessment, and detect fraudulent activity faster and more accurately, ultimately leading to a better experience for customers.

Insurance companies are harnessing the power of technology to prevent and detect fraud in the industry. Advanced automation and analytics have empowered insurance companies to track and detect fraud, saving them millions of dollars.

Digital Signature

Digital signatures are one of the most common ways insurance companies use technology to prevent fraud. They help to prevent fraud insurance purchases and lower the risk of fake account activations.

Lowering Underwriting Cost

Real-time information and data analysis are used to streamline underwriting and pricing, which helps to lower costs and prevent fraudulent applications.

Data Analytics

Data analytics, including predictive analysis and data mining, are used to detect fraud by identifying anomalies and patterns in claims data.

Bettering the Underwriting Process

Insurance companies leverage artificial intelligence (AI) technologies like machine learning and predictive analytics to predict customer behavior accurately. This enables them to better manage existing risks and avoid high-risk policies.

Storing Info Safely on the Blockchain

Insurance companies are using blockchain technology to securely store and manage vast amounts of sensitive data, such as customer behavior and claims data. Blockchain allows insurance providers to better track customer behavior, providing more tailored coverage for those who need it most, and enhances fraud detection capabilities.

Modernizing Legacy Systems

Legacy systems can be costly and difficult to maintain, so insurance companies are modernizing their frameworks into the digital age. By doing so, insurance companies can reduce costs and improve efficiency while staying up to date with modern technology.

Technology is changing the insurance industry and providing numerous benefits to both insurance providers and customers. With the help of technology, insurance companies can detect and prevent fraud, streamline their processes, and provide better customer service. These benefits make the insurance industry more efficient and accessible to consumers.

Large insurance carriers with extensive customer bases need to keep up with the demands of online interactions for customer service purposes. Legacy system modernization helps them stay competitive within their respective regions and on an international scale. This is particularly true for insurance companies, which are becoming increasingly reliant on web-based tools for access to policy information.

Don’t miss interesting posts on Famousbio