Zone, an African blockchain firm, has launched the continent’s first regulated blockchain community for cost processing. The community facilitates native funds in fiat, with plans to help cross-border funds and allow acceptance of digital currencies on conventional cost channels. Zone’s blockchain community offers a extra environment-friendly various for transaction situations that at present undergo an advanced system of intermediaries, which typically results in errors and failed transactions. Blockchain expertise offers a decentralized “ledger” of transactions, permitting transactions to be settled immediately and immediately retaining monitor of them higher than current protocols or techniques. The expansion of digital banking and the following enhance in cost disputes have put a big pressure on conventional banking techniques in Africa. Blockchain expertise, with its decentralized nature and clear ledger capabilities, provides a viable resolution to those challenges.

Blockchain Technology: The Answer to Payment Disputes in Africa’s Financial Industry

While traditional banks have made strides in adopting digital options, there remains a significant disparity between legacy techniques and newer, innovative technologies. Many legacy banking structures have been in operation for over 30 years, and changing them is understandably risky and complicated. As a result, many banks have taken a risk-averse approach, hindering the adoption of newer, faster technologies in African markets.

Legacy systems pose issues for both banks and their customers, particularly in terms of maintainability and flexibility. The longer legacy systems go without updates, the more expensive they become to maintain as the technologies they were developed with are no longer well-supported, and there are fewer experts available to manage them. Additionally, legacy systems are difficult to change, which can make it challenging to keep up with industry changes and technological advances. This inflexibility can significantly inhibit the customer experience, as modern customers expect to be able to set up an account instantly without having to wait days or weeks for approval.

One of the most significant challenges of legacy banking today is cost disputes. These arise when a cardholder notices an invalid transaction on their account and contacts their card issuing bank to demand a refund. Card networks introduced dispute resolution processes to protect cardholders from fraudulent activities and payment errors, but disputes can still arise for various reasons. For example, a cardholder may claim to have been debited without receiving value or have no recollection of what the payment on their bank statement relates to.

Blockchain technology can offer a solution to payment disputes. The technology provides a secure, decentralized platform for transactions, removing the need for intermediaries like banks. Transactions on a blockchain are recorded on a shared ledger that cannot be tampered with, providing an immutable record of all transactions. This eliminates the possibility of disputes arising from incorrect or fraudulent transactions, as all transactions can be traced back to their source.

Blockchain technology is particularly useful for cross-border transactions in Africa, where traditional banking structures are not well-developed. Blockchain technology can facilitate faster, cheaper transactions across borders, providing access to financial services for those who are currently unbanked. Additionally, blockchain technology can enable microtransactions, allowing people to send and receive very small amounts of money that would otherwise be uneconomical to process.

In conclusion, legacy banking structures in Africa can be a hindrance to the adoption of newer, faster technologies. One of the most significant issues with legacy banking is payment disputes, which can be resolved through the use of blockchain technology. Blockchain provides a secure, decentralized platform for transactions, eliminating the need for intermediaries and enabling faster, cheaper transactions across borders. Blockchain technology can facilitate financial inclusion in Africa, providing access to financial services for those who are currently unbanked.

Understanding the Causes and Impact of Payment Disputes in Africa’s Banking Industry

In an Africa-wide survey on banking relationships, excellent customer service ranked second only to financial stability as the reason for maintaining a banking relationship, with 19.7% of respondents choosing it as their reason. This highlights the value of trust in banking relationships, especially when disputes arise.

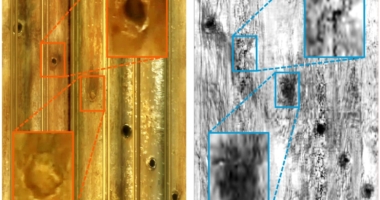

Transaction disputes can occur due to failures in current traditional systems, which only handle failures that occur at the bank and payment processor level. When there is a failure at these points, it can be detected and corrected. However, unstable network conditions can affect the flow of information from a bank back to the terminal during a transaction, resulting in a discrepancy where the bank assumes one thing, and the terminal assumes another. This discrepancy can take days or weeks to reconcile as it is done manually.

Payment disputes can be a source of frustration and inconvenience for customers, leading to skepticism around payment channels and limiting the adoption of financial services. Additionally, fraudulent claims can result in financial loss for terminal owners, as customers are sometimes refunded even after submitting false claims. This impacts the cost of transactions, as these losses are factored back into the fees charged to customers.

The Need for an Immediate Solution

Payment disputes are costly for banks, merchants, and individuals, making the need for a solution more urgent. The current system can take days or weeks to reconcile a dispute, which is unacceptable in today’s fast-paced world. To improve customer trust and loyalty, it is crucial to have a system that can detect and correct payment errors in real-time, thus preventing disputes from occurring in the first place.

Blockchain technology provides a solution to payment disputes by creating a secure and decentralized platform for transactions. It eliminates intermediaries like banks, ensuring that transactions are recorded on a shared ledger that cannot be tampered with. This provides an immutable record of all transactions, making it impossible for disputes to arise from incorrect or fraudulent transactions.

Moreover, blockchain technology enables faster and cheaper transactions across borders, providing access to financial services for those who are currently unbanked. It also enables microtransactions, allowing people to send and receive small amounts of money that would otherwise be uneconomical to process. In conclusion, blockchain technology can facilitate financial inclusion in Africa and provide access to financial services for those who are currently unbanked.

Blockchain Technology: The Future of Payment Disputes in Africa’s Financial Industry

As digital payments continue to gain popularity globally, creating economies like Nigeria are not being left behind. The Central Bank of Nigeria introduced a cashless policy in 2012 to reduce physical cash and cut down on cash handling expenses of banks while also getting more of the money in circulation into the formal financial system. This has led to a significant increase in electronic payment transactions.

While this development is positive for banks and card issuers, it has also led to an increase in disputable transactions and fraud, putting pressure on already overextended dispute processes and leading to increased operating costs. However, if banks view disputes as opportunities to strengthen relationships with customers and improve service adoption, they can turn this challenge into a silver lining.

Blockchain Technology: A Solution to Payment Disputes

Blockchain technology has been disrupting the financial services industry since the emergence of Bitcoin as a cryptocurrency. Its unique capabilities and applications promise to address major issues impacting the financial services industry, including cyber-theft, fraud, and reliability. In particular, blockchain technology has the potential to eliminate payment disputes and improve the dispute resolution process.

Blockchain enables the use of smart contracts and digital tokens to facilitate real-time settlement and currency conversion activities required for fast cross-border payments. Transactions on a blockchain are recorded on a shared ledger that cannot be tampered with, providing an immutable record of all transactions. This eliminates the possibility of disputes arising from incorrect or fraudulent transactions, as all transactions can be traced back to their source.

Blockchain’s Potential in Africa

While blockchain technology is still in its early stages of development in Africa, it has enormous potential for the continent’s economy, commodities, and connectivity. A survey of 69 active projects or completed pilots that apply blockchain technology reveals that 57% have their headquarters in Africa, with the highest number of projects headquartered in Kenya, South Africa, and Nigeria.

Blockchain technology can facilitate faster, cheaper transactions across borders, providing access to financial services for those who are currently unbanked. It can also enable microtransactions, allowing people to send and receive very small amounts of money that would otherwise be uneconomical to process. Blockchain technology can also improve the transparency and security of supply chains, particularly in the agriculture and mining industries, which are critical sectors for the African economy.

Conclusion

In conclusion, blockchain technology has the potential to revolutionize the financial services industry and eliminate payment disputes. It can facilitate faster, cheaper transactions across borders, providing access to financial services for those who are currently unbanked. While blockchain technology is still in its early stages of development in Africa, it has enormous potential for the continent’s economy, commodities, and connectivity. Banks and financial institutions that embrace this technology can not only reduce costs but also improve customer trust and loyalty, making it a win-win for everyone.

Zone’s Blockchain Network: A Solution to Payment Disputes in Africa

Zone, a company that launched Africa’s first regulated blockchain network for payment processing in November 2022, aims to facilitate local payments in fiat and has plans to support cross-border payments and the acceptance of digital currencies on traditional payment channels.

The conventional banking system in Africa has been challenged by digital banking and an increase in payment disputes. As a case study, Zone’s blockchain network provides a solution to payment disputes and settlements, enabling transactions to be settled immediately and keeping track of them better than existing protocols or systems. Zone’s blockchain network serves as a decentralized “ledger” of transactions that disrupts the current state of play. It transparently keeps track of all transactions and records, eliminating the need for reconciliation of each financial institution’s ledger as it currently works with legacy systems.

Zone’s blockchain network has the potential to streamline transactions and reduce operational costs while also providing a better customer experience. By allowing counter-parties in a transaction to access transaction information, Zone’s blockchain network provides a more efficient, transparent, and direct transaction settlement process.

Blockchain Technology’s Advantages

The lack of stakeholder visibility in completing a transaction has led to the inefficiency of failed transactions. Zone’s blockchain network disrupts this by transparently keeping track of all transactions and records. With blockchain technology’s decentralized nature and transparent ledger capabilities, it provides a viable solution to the challenges faced by the traditional banking system in Africa.

Legacy systems in Africa have led to an absence of transparency, increased costs, and poor customer experience. As a result, blockchain technology has been disrupting the financial services industry, driving efficiency and ease by establishing new financial instruments, processes, and services. It enables the use of smart contracts and digital tokens to facilitate real-time settlement and currency conversion activities required for fast cross-border payments.

The Benefits of Zone’s Blockchain Network

Zone’s blockchain network provides a more efficient alternative for transactions such as a simple in-store PoS or cross-border payment, where the transaction would need to go through an extensive system of intermediaries before it reaches its destination. This process often results in errors and failed transactions.

With Zone’s blockchain network, transactions can be settled immediately, and all parties involved in a transaction can see the final status of the transaction right after it is completed. This saves time and eliminates the need to wait for days or even weeks for disputed transactions to be resolved.

Zone’s blockchain network also eliminates the cost of maintaining a network of intermediaries while bypassing unnecessary points of failure associated with legacy payment systems. Access to transaction information is subject to stringent permission requirements and limited to counter-parties in a transaction who are contributors on the network.

Conclusion

In conclusion, Zone’s regulated blockchain network provides a solution to payment disputes by offering a more efficient, transparent, and direct transaction settlement process. With its potential to streamline transactions, reduce operational costs, and eliminate the reliance on multiple intermediaries, Zone is positioned to lay the foundation for the next generation of payment solutions in Africa. As the use of digital payments continues to grow, blockchain technology offers the promise of a more efficient and secure financial system in Africa.

The adoption of blockchain technology in the financial services industry in Africa is expected to not only help in resolving payment disputes but also contribute to modernization and efficiency. This will lead to increased trust between banks and their customers, ultimately promoting greater financial inclusion and economic growth in the continent.

Don’t miss interesting posts on Famousbio