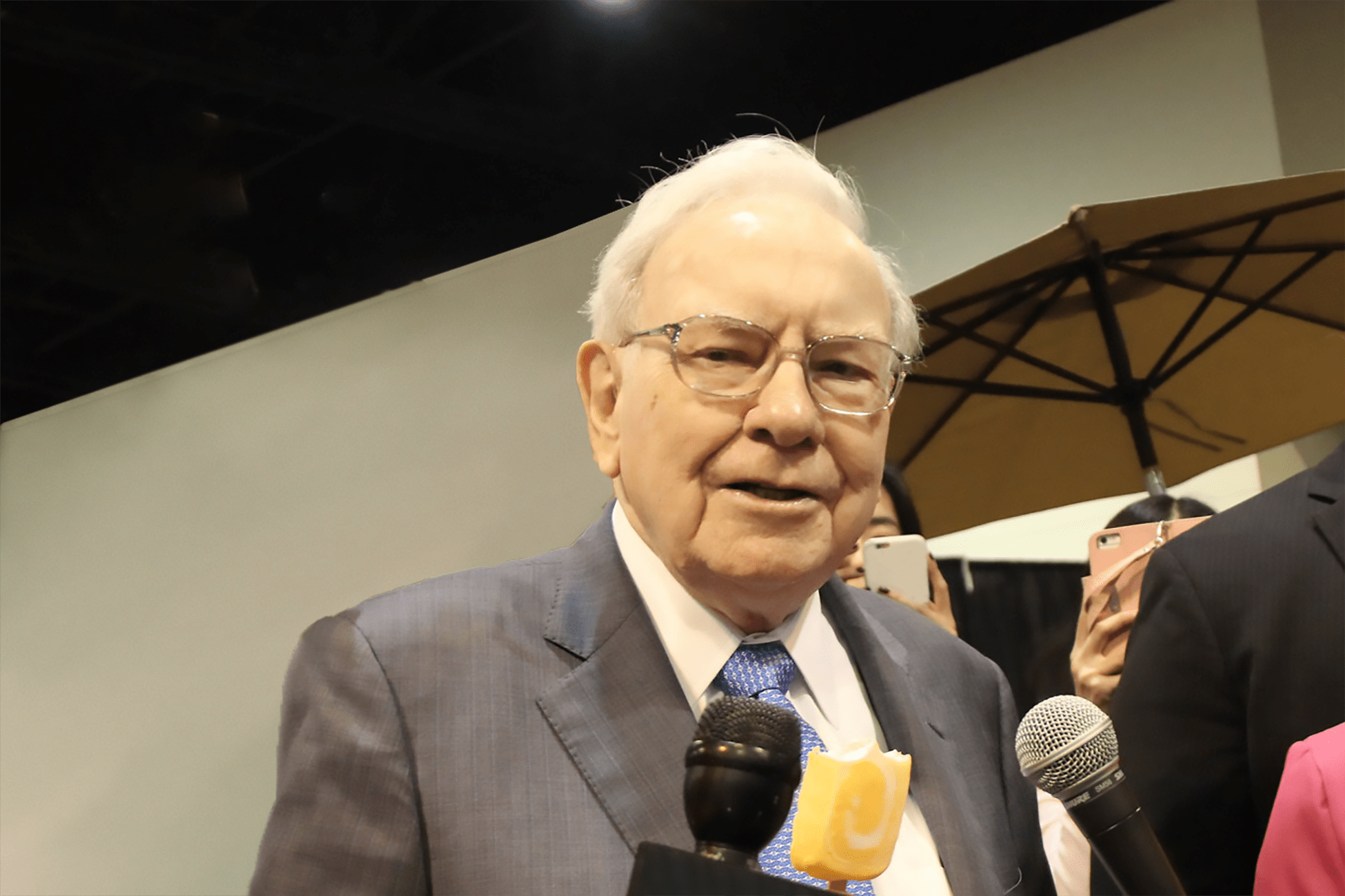

Featuring legendary investor Warren Buffett and his company Berkshire Hathaway own before Restaurant Brands International, the Oracle of Omaha is no doubt familiar with the restaurant industry. However, there is a related business that he did not directly own that certainly fits the criteria he aspires to when investing.

Here are three reasons Warren would love Buffett Chipotle Mexican Grill (CMG -0.22%) and a big red flag that would put him off.

A strong brand

It goes without saying that one of Chipotle’s key strengths is strong brand awareness. The company currently has 3,187 stores in its physical footprint and plans to open 255 to 285 in 2023. In fact, the executive team, led by CEO Brian Niccol, believes there may one day be 7,000 stores in North America. This type of growth potential is unheard of in the cutthroat restaurant industry.

Chipotle’s dominance, represented by sales of $8.6 billion in 2022, was fueled by the company’s adoption of the fast-casual concept. And it’s so ingrained in consumers’ minds that similar concepts are often referred to as “the Chipotle of.” [name a cuisine].”

Accordingly Piper SandlerIn the Fall 2022 Taking Stock With Teens survey, Chipotle ranked behind Chick-fil-A and as the third most popular restaurant brand Starbucks. Innovation in an otherwise dull industry has strengthened Chipotle’s brand.

Look at Berkshire’s portfolio holdings and there won’t be a shortage of companies that are of the same quality.

customer care

The brand is empowered by the simple fact that Chipotle has a relentless focus on the customer experience. By providing real ingredients, a simple menu, quick ordering process, and affordability, Chipotle has become a top choice for hungry consumers. Same-store sales increased by an average of 8.8% between 2018 and 2022.

With the launch of Chipotle’s rewards program in March 2019, management has shown it wants to improve accessibility and convenience for customers. In less than four years, the loyalty program has attracted 31.6 million members who can earn points for orders made through the mobile app or the company’s website. Plus, with the launch of Chipotlanes, the company’s drive-thru option (202 opened in 2022), it’s even easier for customers to get their favorite meals.

“Don’t just satisfy your customers, please them,” Buffett once said. I think he would certainly agree that Chipotle is doing just that.

pricing power

When it comes to inflation, Chipotle has proven it can handle rising costs successfully. The company handled higher spending on key inputs like avocados, beef and chicken — factors that would normally squeeze margins for the company — by raising menu prices multiple times over the past year. “We really haven’t seen any significant resistance to our pricing,” Niccol said on the company’s fourth-quarter 2022 earnings call.

Additionally, Chipotle’s profitability has actually improved. The company’s operating margin rose from 10.7% in 2021 to 13.4% in 2022, thanks largely to those price hikes. And walk-in customer traffic was positive in January compared to the prior-year period. It’s good to know that Chipotle can pull the price lever when needed.

Buffett believes that pricing power is the most important trait to look for when determining whether a company is of high quality. Chipotle has proven it firmly belongs in that category.

An unfavorable quality

Despite the three positive traits that Buffett would find attractive in Chipotle’s business, there’s one big red flag that would quickly piss him off about the stock — valuation. As of this writing, Chipotle shares trade at a price-to-earnings multiple of 50, which is more expensive than other popular restaurant stocks like Starbucks. Domino’s PizzaAnd MC Donalds.

To be fair, Chipotle’s growth has outpaced those other names over the past few years. And the business has performed incredibly well in 2022 despite macro headwinds. Additionally, according to management, Chipotle’s prospects still point to huge profits in the coming years. But if there’s one thing Buffett is asking for, it’s a margin of safety. And Chipotle just doesn’t offer that at its current stock price.

Nonetheless, by understanding the characteristics some of the world’s top investors look for in potential stocks to buy, readers can apply the same thoughts when considering their own portfolios.

Neil Patel has positions at Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway, Chipotle Mexican Grill, Domino’s Pizza, and Starbucks. The Motley Fool recommends Restaurant Brands International and recommends the following options: short April 2023 $100 calls at Starbucks. The Motley Fool has a disclosure policy.

Don’t miss interesting posts on Famousbio