Tesla Reserve has unhidden a surge within the life few weeks, in keeping with a contemporary analyst document. The document means that the rally is pushed by way of short-selling buyers overlaying their positions. The analyst additionally expects Tesla’s accumulation to keep growing as the corporate continues to innovate and enlarge into brandnew markets. The document additionally highlights that Tesla’s accumulation has outperformed the S&P 500 this week. The analyst concludes that the stream rally is a short-covering rally of “epic proportions”.

Tesla accumulation (TSLA) has exploded since its early January lows, and professionals say all of it is smart.

The electrical car maker’s accumulation has soared 100% from its Jan. 3 low to $210 on Thursday. At this level, positive factors seem to be feeding into the new FOMO (worry of lacking out) within the Tesla accumulation rally.

“The demand outlook for 2023 has surpassed even the bull-case scenario, causing short-for-eternity coverage,” Wedbush tech analyst Dan Ives instructed Yahoo Finance by the use of e mail.

The quick-covering rally seems to had been began by way of Tesla’s contemporary worth cuts.

In early January, Tesla lowered the cost of the bottom Type 3 by way of $3,000 to $43,990. The Type 3 Efficiency variant noticed a worth release from $9,000 to $53,990.

Tesla additionally diminished the cost of the Type Y Lengthy Area by way of $13,000 to $52,990, date the Efficiency type was once lowered to $56,990, about $13,000 less expensive than the former worth.

The cost cuts have resulted in renewed call for (and in all probability marketplace percentage positive factors) for Tesla, CEO Elon Musk hinted at the corporate’s contemporary convention name.

“The price cuts were a brilliant move by Musk and are paying off massively in this space,” Ives stated.

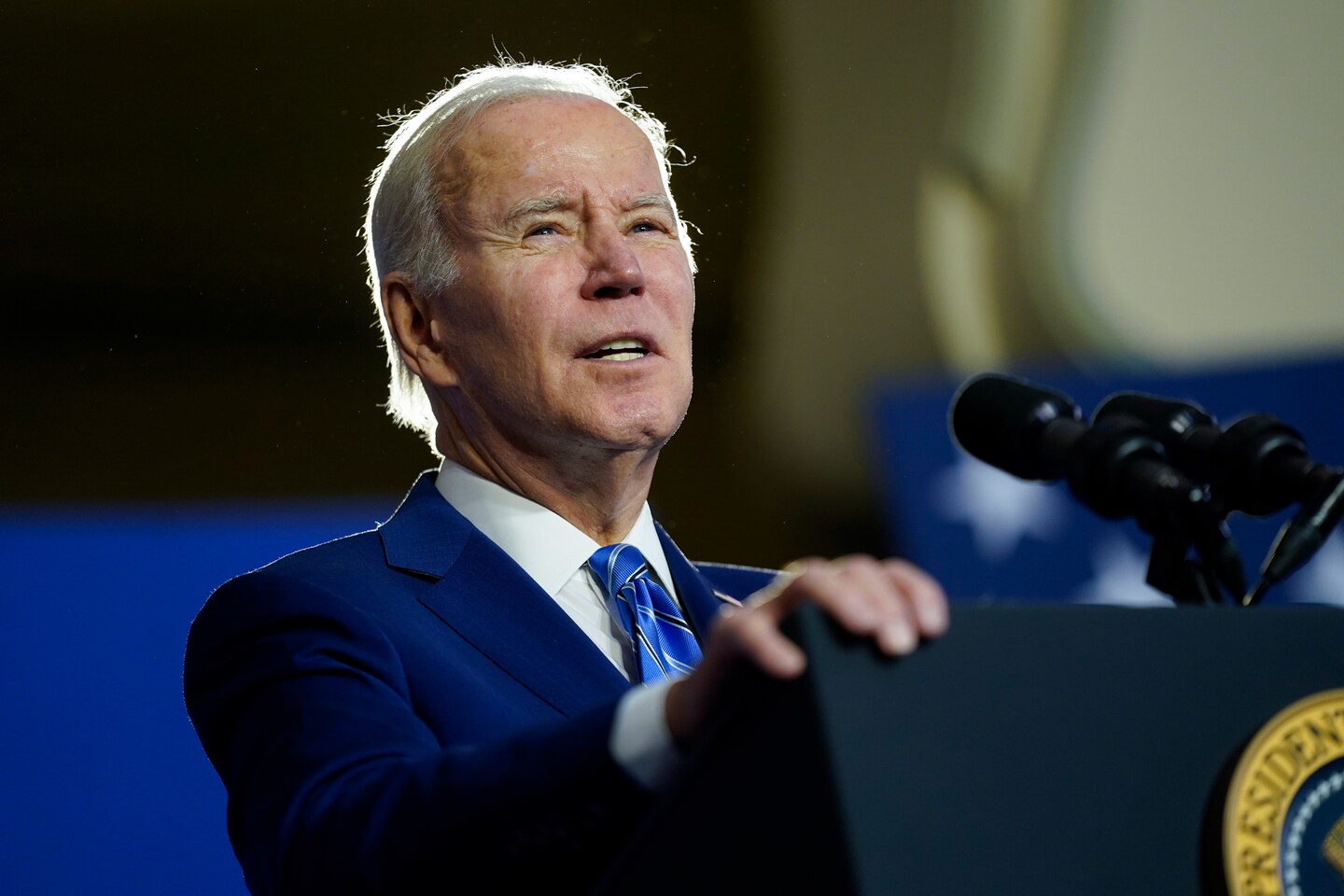

Tesla Motors CEO Elon Musk speaks on the Tesla Giga Texas Production “Cyber Rodeo” elegant opening birthday celebration on April 7, 2022 in Austin, Texas. (Photograph by way of SUZANNE CORDEIRO/AFP by the use of Getty Photographs)

Longtime Tesla bull and Ark Make investments founder Cathie Log instructed Yahoo Finance she believes the associated fee cuts are because of Tesla’s value management in battery generation. With this management place, Tesla may decrease costs additional and spice up call for even additional.

No less than, that’s a thesis that would help the accumulation’s contemporary surge.

“I think traditional automakers will struggle to keep up with the price declines that Tesla’s technology is enabling,” Log stated on Yahoo Finance Are living (video above).

Not at all everybody on Wall Boulevard stocks the bullish optimism about Tesla, even because the accumulation rips upper.

Some professionals consider worth cuts will turn out negative to the Tesla emblem over the long run, date additionally hurting benefit margins.

“Because of the statement that [Elon Musk] BofA analyst John Murphy told Yahoo Finance Live that if he said on the fourth-quarter earnings call that its demand was double its supply, it would be foolish to lower the price. “You would just eat up your profitability and not achieve incremental volume anytime soon.”

Brian Soci is a contract essayist and Anchor at Yahoo Finance. Observe Sozzi on Twitter @BrianSozzi and extra LinkedIn.

Click on right here for the untouched accumulation tickers from the Yahoo Finance platform

For the untouched accumulation marketplace information and in-depth research, together with occasions shifting shares, click on right here

Learn the untouched monetary and industry information from Yahoo Finance

Obtain the Yahoo Finance App for Apple or Android

Observe Yahoo Finance on Twitter, Fb, Instagram, flipboard, LinkedInAnd youtube

Don’t miss interesting posts on Famousbio