The Inside Earnings Provider (IRS) is advising Californians to attend to report their 2019 taxes till the IRS has completed updating their tool to deal with California’s unused regulation. The regulation calls for Californians to record their gross revenue from the former life, instead than the taxable revenue, on their 2019 returns. The IRS has stated that the replace might be finished by means of mid-February, and that Californians will have to wait till later to report their taxes.

In the case of unfortunate however important duties, submitting your tax go back ranks primary with cleansing your gutters and drawing blood.

So it’s possible you’ll suppose no person would thoughts when the Inside Earnings Provider instructed taxpayers in California and several other alternative states to lengthen submitting their 2022 returns indefinitely. The cause of the lengthen? The company continues to be seeking to decide whether or not to pack taxes on California’s “middle class tax refund” and indistinguishable bills national.

However maximum taxpayers will have to thoughts. Consistent with IRS statistics, greater than three-quarters of taxpayers who filed returns in 2021 owed refunds. Despite the fact that this percentage has been rather smaller in earlier years, it’s familiar for neatly over part of taxpayers to overpay right through the life, generally by means of having remaining withheld from their paychecks.

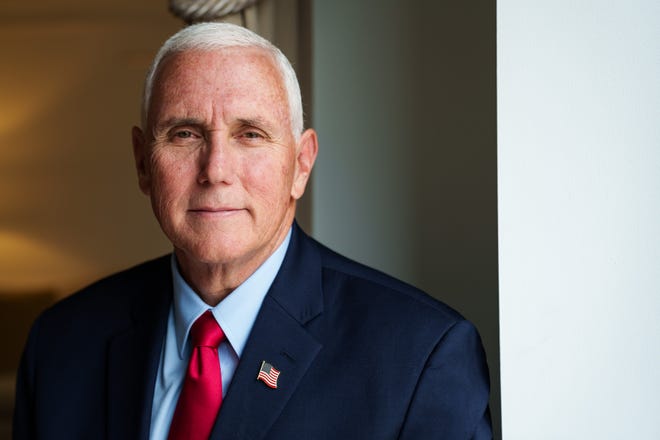

“Anytime someone else has your money and doesn’t give it to you right away, that’s a bad thing,” stated Mike Cussen, a retired accountant who volunteers as a tax aide. for AARP in Paso Robles.

“We have tons of people, especially single moms and families, filing early because they get the earned income credit and child tax credits, which can be substantial,” Cussen stated. . “Now with this [Middle Class Tax Refund] hiccups, their returns will be suspended.

According to the California Franchise Tax Board, the state issued more than $9 billion in checks or prepaid debit cards to more than 16.5 million households, most of it issued last year. If you earned $250,000 or less as a single person or $500,000 as a couple filing jointly, you were eligible for $200 to $1,050.

The tax authority has always said that the payments would not be subject to California income tax. But because the payments were not actually tax refunds, it was unclear whether the the feds would like to tax them.

Last week, the IRS said it was “working with state tax authorities as quickly as possible to provide additional information and clarification to taxpayers.” He added, “For taxpayers and tax preparers with questions, the best thing to do is wait for further clarification on state payments rather than calling the IRS. We also do not recommend amending a 2022 return that has already been filed.

Thursday morning, the agency had no additional information.

If you did not receive a payment from the state last year and you are owed a tax refund, there is no reason not to file your return. In fact, there are several reasons to file early, whether or not you have an upcoming refund.

Mark Steber, director of tax information at Jackson Hewitt, says in an online video that “advance deposit prevents someone else from using your personal information or that of your family to file a false tax return and possibly steal your tax refund”. This sentiment is shared by means of many tax advisers.

Plus, tax execs say submitting early can aid you keep away from the backlog brought about by means of a overspill of returns filed similar to the closing date, delaying your refund. And submitting your tax go back early will provide you with extra age to get to the bottom of problems that can stand, reminiscent of lacking paperwork.

Be mindful, should you underpaid throughout 2022 and owe the IRS now, you don’t must pay whilst you report your go back. You’ll be able to wait till returns are due, which for many Californians is Would possibly 15 of this life. The IRS has granted an extension to taxpayers in disciplines lined by means of the January federal extremity declaration.

Cussen stated it can be a “no harm, no fault” status if the IRS resolves the problem inside of a age, no less than so far as low-income filers are involved.

Traditionally, crowd who aim to evade tax by means of claiming irrelevant earned revenue tax credit report very early within the life, sooner than the IRS has the information it wishes from employers to ensure. their claims, Cussen stated. In reaction, the IRS is retaining returns claiming those tax credit till then Feb. 15, when employers’ W-2 methods had been filed and the claims will also be verified, he stated.

The IRS wasn’t accepting any returns till Jan. 23, so early filers who didn’t declare earned revenue tax credit are simply founding to obtain their refunds. Cussen stated her first consumer’s case used to be filed Feb. 1 and she or he won her refund Feb. 8.

Tax mavens additionally counsel submitting your go back electronically and having your refund despatched electronically for your storagefacility account to leave the chance of fraud and blunder. “EFILE and direct deposit is the only solution,” Cussen stated.

In regards to the Occasions Virtue Journalism Workforce

This text comes from The Occasions Virtue Journalism Workforce. Our project is to be very important to the lives of Southern Californians by means of publishing knowledge that solves issues, solutions questions, and aids in determination making. We lend audiences in and round Los Angeles, together with wave Occasions subscribers and diverse communities whose wishes have no longer been met by means of our protection.

How are we able to aid you and your people? E mail significance(at)latimes.com or considered one of our newshounds: Matt Ballinger, Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

Los Angeles Occasions

Don’t miss interesting posts on Famousbio