Federal Secure officers have known as for additional charge hikes within the close past, mentioning issues over the power of the U.S. financial system. They famous that the financial system used to be rising quicker than anticipated and that inflation used to be selecting up, prompting the will for additional hikes. Officers additionally famous that the exertions marketplace used to be proceeding to improve, with unemployment nonetheless close historical lows. The Fed is predicted to proceed to watch financial statuses going ahead, and extra charge hikes may well be imaginable if the financial system continues to make bigger.

(Bloomberg) — Federal Secure officers stressed out the wish to proceed elevating rates of interest, together with the chance that borrowing prices might top at greater ranges than up to now anticipated amid ongoing worth pressures.

Maximum learn by way of Bloomberg

4 policymakers talking at diverse occasions on Wednesday delivered a indistinguishable message – welcoming a up to date slowdown in inflation hour blackmail that the fight isn’t but received.

Their hawkish feedback, following feedback by way of Chair Jerome Powell on Tuesday, come as buyers re-evaluate bets on how a lot the Fed will hike charges, with some having a bet the height may succeed in 6% following a late-breaking January jobs record. They’re these days at 4.6%.

“We need to adopt sufficiently accommodative policies,” Unused York Fed President John Williams stated at a Wall Side road Magazine reside match in Unused York. “We need to keep that going for a few more years to make sure we get inflation to 2%.”

Policymakers terminating era raised rates of interest by way of 1 / 4 of some extent to a area of four.5% to 4.75%. The smaller walk adopted a part level hike in December and 4 excess 75 foundation level hikes prior to that.

Officers in December posted a mean forecast of five.1% for rates of interest this pace, implying a couple of extra quarter-point hikes.

“That still seems like a very reasonable idea of what we need to do this year to balance supply and demand and bring down inflation,” stated Williams, who served as vice chair of the Federal Discoverable Marketplace Committee at Powells Management belongs to the workforce.

The Fed chair had stated charges wish to conserve emerging to tame inflation and hinted they may arise higher-than-expected if worth pressures proceed.

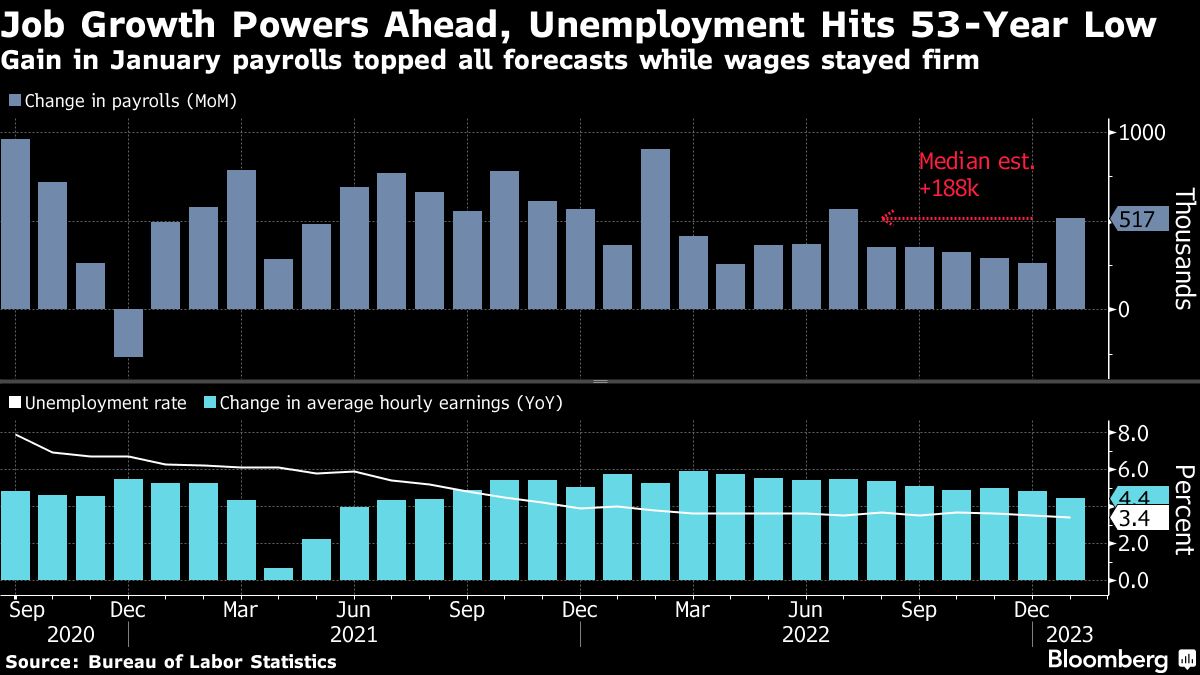

Bets on a extra competitive Fed have crispy since a far stronger-than-expected jobs record terminating era confirmed employers added greater than part 1,000,000 jobs in January as unemployment fell to a few.4%, its lowest degree since 1969.

In the meantime, inflation, measured on the Fed’s most well-liked measure, has slowed to five% within the twelve months to December, down from 7% in June, however nonetheless smartly above policymakers’ goal of two%.

“While we have made progress in reducing inflation, today I want to make it clear that the work is not done,” Gov. Christopher Waller informed an target market at Arkansas Atmosphere College in Jonesboro, Arkansas. “It could be a long battle, with interest rates higher than some currently expect.”

Buyers have higher their bets on top charges to about 5.15%, which is near to the Fed’s most up-to-date forecast, even though a number of immense bets on rates of interest of 6% have been additionally made this era.

Waller predicts enlargement will sluggish within the first quarter however stay sure, and he stated the robust exertions marketplace, hour a possibility to costs, could also be a supply of monetary assistance.

Gov. Lisa Cook dinner stated previous Wednesday officers have been dedicated to curtailing inflation and extra tightening used to be warranted, even though she advocated a phased method.

“We’re not done raising interest rates, and we need to keep interest rates sufficiently restrictive,” she stated at an match in Washington. If we walk in smaller increments, “we will have time to assess the impact of our quick actions on the economy.”

That sentiment echoed Minneapolis Fed Chairman Neel Kashkari, a FOMC voter this pace, who informed the Boston Financial Membership charges wish to hike greater to battle salary enlargement.

“I don’t think there’s a lot of evidence yet that the rate hikes we’ve done so far are having a big impact on the job market,” he stated. “We need to balance the labor market, that tells me we need to do more.”

–Assisted by way of Craig Torres.

Maximum Learn by way of Bloomberg Businessweek

©2023 Bloomberg LP

Don’t miss interesting posts on Famousbio