Disney hold surged 4.7% then the corporate reported its streaming losses had narrowed within the first quarter. The corporate reported a $473 million working loss from its streaming products and services, which is a considerably smaller loss than the $812 million it reported within the first quarter of 2020. Disney+ now has greater than 103 million subscribers, making it the biggest streaming carrier on this planet. Disney additionally reported higher-than-expected profits for the quarter and its revenues had been up 24%. The corporate additionally introduced that it was once elevating its dividend through 10%.

Disney (DIS) reported quarterly effects then the bell on Wednesday that confirmed a leap on each the upside and drawback as call for for the corporate’s theme grounds surged all the way through the peace season.

As anticipated, Disney+ subscribers fell rather within the first quarter because of the absence of the Indian Premier League cricket event at its Indian logo Disney+ Hotstar.

Streaming losses narrowed to $1.1 billion within the first quarter from a $1.5 billion loss within the fourth quarter — forward of the corporate’s previous forecasts as Disney’s ad-supported tier and up to date worth hikes helped to let go the losses.

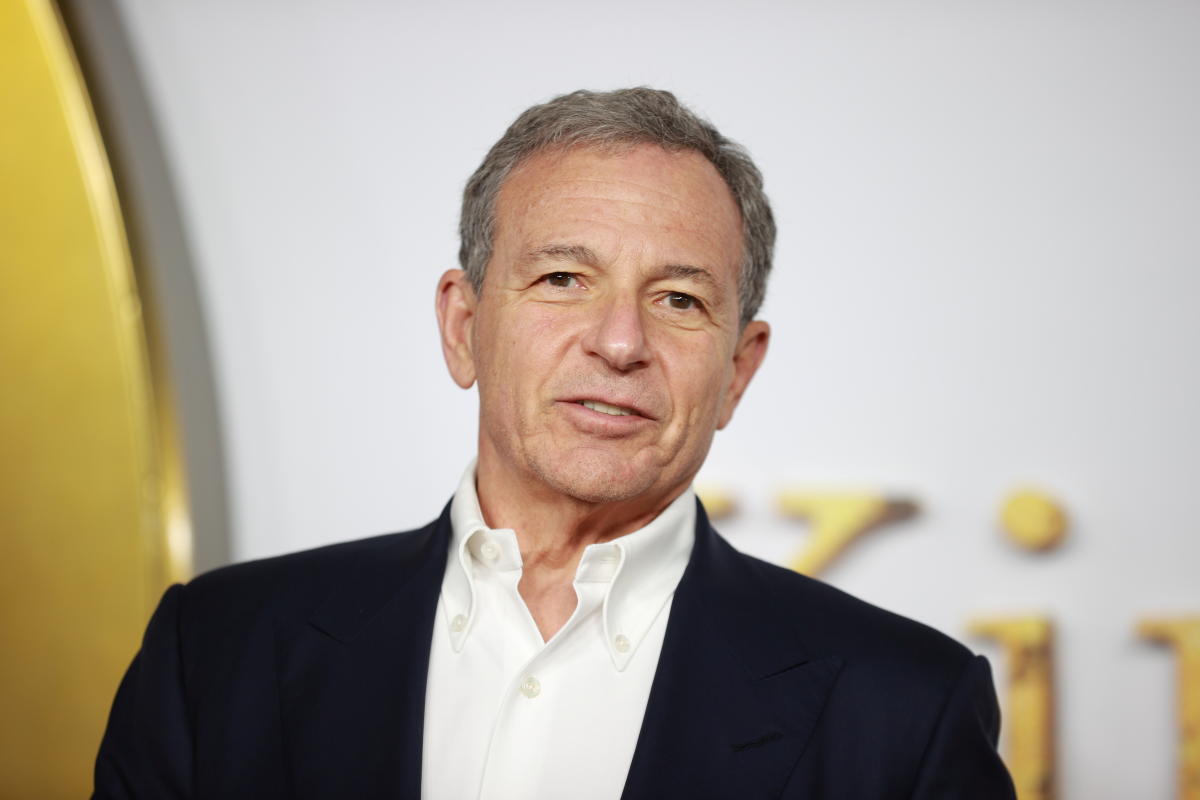

Wednesday’s upbeat effects had been the corporate’s first profits file since CEO Bob Iger returned to the corporate in November. Disney stocks rose up to 3% following the inside track.

Listed here are Disney’s Q1 effects in comparison to Wall Side road consensus estimates compiled through Bloomberg:

-

Income: $23.51 billion as opposed to $23.4 billion anticipated

-

Adj. profits in step with percentage (EPS): $0.99 as opposed to $0.75 anticipated

-

General Disney+ subscribers: 161.8 million as opposed to 164 million anticipated

-

Income from grounds, stories and client items: $8.74 billion as opposed to $8.08 billion anticipated

“After a solid first quarter, we are embarking on a meaningful transformation that will maximize the potential of our world-class creative teams and our unparalleled brands and franchises,” Disney CEO Bob Iger stated within the profits let fall.

“We consider the paintings we’re doing to reshape our industry round creativity year lowering prices will lead to sustainable enlargement and profitability for our streaming industry, higher positioning us for year disruptions and world financial demanding situations and can assemble price for our shareholders. “

Iger, who’s lately in the middle of a high-profile proxy combat with activist investor Nelson Peltz, will likely be confronted with a dimension of questions in regards to the corporate’s core values – from ESPN’s bleak year to down, at the corporate’s convention name after this afternoon to escalating subjects parking costs.

Traders may even search extra readability on Disney’s streaming technique, together with fresh experiences that the corporate plans to license extra of its motion pictures and TV sequence to third-parties because the media vast prioritizes earnings over subscribers.

Moreover, attainable updates on layoffs and the corporate’s restructuring plans usually are queried all the way through the decision, as Iger guarantees to snip prices following the streaming presence.

Bob Iger, Government Chairman of The Walt Disney Corporate arrives on the international premiere of the movie ‘The King’s Guy’ at Leicester Sq. on December 6, 2021 in London, Britain. REUTERS/Hannah McKay

At the soil facet of the industry, working source of revenue grew to $3.05 billion. The rebound comes then the ease grounds category neglected expectancies within the fourth quarter as recession fears weighed on shoppers.

Terminating era, Disney introduced long-awaited updates to its soil reservation gadget and annual passholder program then client backlash over lengthy waits and sky-high price tag costs.

Disney confronted a difficult 2022, when stocks plunged about 45%, marking the corporate’s worst annual hold efficiency since 1974. The hold is up greater than 20% year-to-date.

Alexandra is a senior leisure and media reporter at Yahoo Finance. Observe her on Twitter @alliecanal8193 and e mail her at [email protected]

Click on right here for the unedited profits experiences and research, profits whispers and expectancies, and company profits information

Learn the unedited monetary and industry information from Yahoo Finance

Obtain the Yahoo Finance App for Apple or Android

Observe Yahoo Finance on Twitter, Fb, Instagram, flipboard, LinkedInAnd youtube

Don’t miss interesting posts on Famousbio